Saga Metals Corp. (" TSXV: SAGA ") (" SAGA " or the " Company "), a North American exploration company focused on critical mineral discovery in Canada, is pleased to announce the successful closing of its initial public offering (IPO) and provide updates on its major projects. SAGA shares began trading on the TSX Venture Exchange (TSXV) under the symbol "SAGA" on September 24, 2024.

A Strategic Focus on Critical Minerals in North America

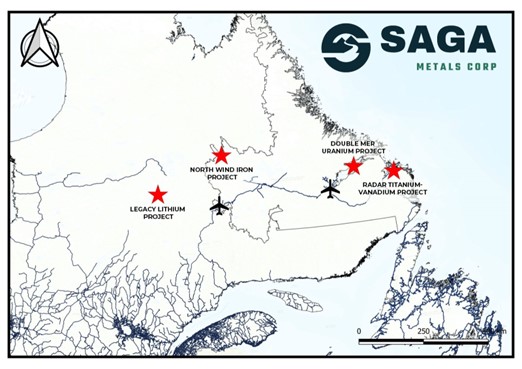

SAGA is dedicated to advancing North America's critical mineral supply for the global green energy transition. The company owns four 100%-owned properties in Canada targeting high-demand minerals, including uranium , lithium , titanium , vanadium , and iron ore . These minerals are essential for renewable energy technologies, and SAGA's diverse portfolio places the company at the forefront of critical mineral exploration.

Map of Saga Metals Projects

SAGA's Key Critical Mineral Projects Driving Shareholder Value:

Regional map of the Double Mer Uranium Project in Labrador, Canada

1. Double Mer Uranium Project (Labrador, Canada)

- Strategically Located: The property sits within the northeastern part of the Grenville Structural Province and contains similarly linked geology to the Central Mineral Belt located just north of the property boundary and host to other notable Uranium projects including Atha Energy and Paladin Energy as shown in the map above.

- Significant Potential: Over 1,024 claims covering 25,600 hectares, with historic exploration identifying highly prospective uranium oxide (U3O8) grades.

- Ongoing Exploration: A 14 km zone of prospective uranium samples (up to 4,280 ppm) with extensive radiometric results including up to 22,000 counts per second (cps) from the scintillometer. The Uranium radiometrics highlight an 18 km east-west linear trend averaging approximately 500 meters in width.

- What's Next: Ongoing sampling and mapping at the Double Mer Uranium project are paving the way for focused drilling efforts to expand key uranium trends. Since early August, SAGA's team has been on-site, setting up the camp to support both summer and winter exploration programs. This includes preparations for future drilling, outcrop sampling, mapping, and channel sampling of identified uranium targets.

SAGA has also launched a detailed channel sampling program at four key uranium zones on the property. These samples will help define the size, shape, and concentration of the uranium deposits. High-resolution drone imagery is being used to support this work, which will play a crucial role in planning the upcoming drilling program.

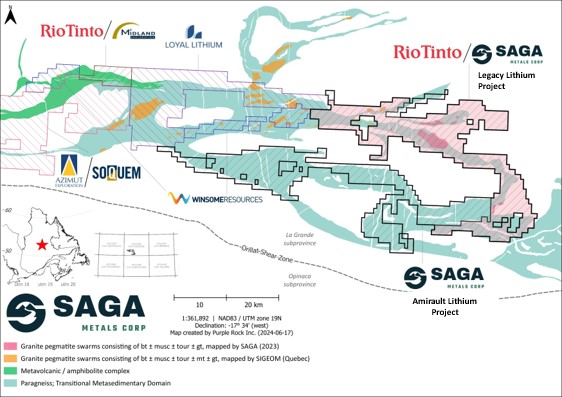

A map of the "Lithium Neighborhood" at the Legacy Lithium Project in Quebec

2. Legacy Lithium Project (James Bay, Quebec)

- Rio Tinto Partnership: Under the Option Agreement, Rio Tinto Exploration Canada (RTEC) has the option to acquire a 51% interest in SAGA's Legacy Lithium Project over four years if it meets the following conditions:

- C$410,190 cash payment to SAGA (received by SAGA in August 2024).

- C$9.57 million in exploration spending, with at least C$1.71 million committed within the first 20 months.

- Annual cash payments of C$68,365 (totaling C$273,460 ) and additional payments of C$225,000 for claim acquisitions owed by SAGA to the original property vendors.

Once RTEC earns the initial 51% interest, it has the option to increase its stake to 75% over five more years by spending an additional C$34.18 million on exploration. RTEC will oversee the project during both the first and second option periods, and a joint technical committee will plan the exploration programs.

- Prime Location: Situated in a region known for significant lithium discoveries, including Winsome Resources Adina Project, Loyal Lithium's Trieste Project, and Rio Tinto's Galinee Project as shown in the map above.

- Exploration in Motion: Fieldwork conducted by Rio Tinto Exploration Canada is ongoing, with a focus on pegmatite mapping and geophysical surveys. The option agreement with Rio Tinto is a major growth driver for SAGA.

- Expanded Land Holdings: SAGA has also acquired the Amirault Lithium Project , expanding its total land holdings to 1,274 claims covering 65,849 hectares and creating two project opportunities. This acquisition makes SAGA the largest contiguous landholder in the eastern region of James Bay, as shown in the map above.

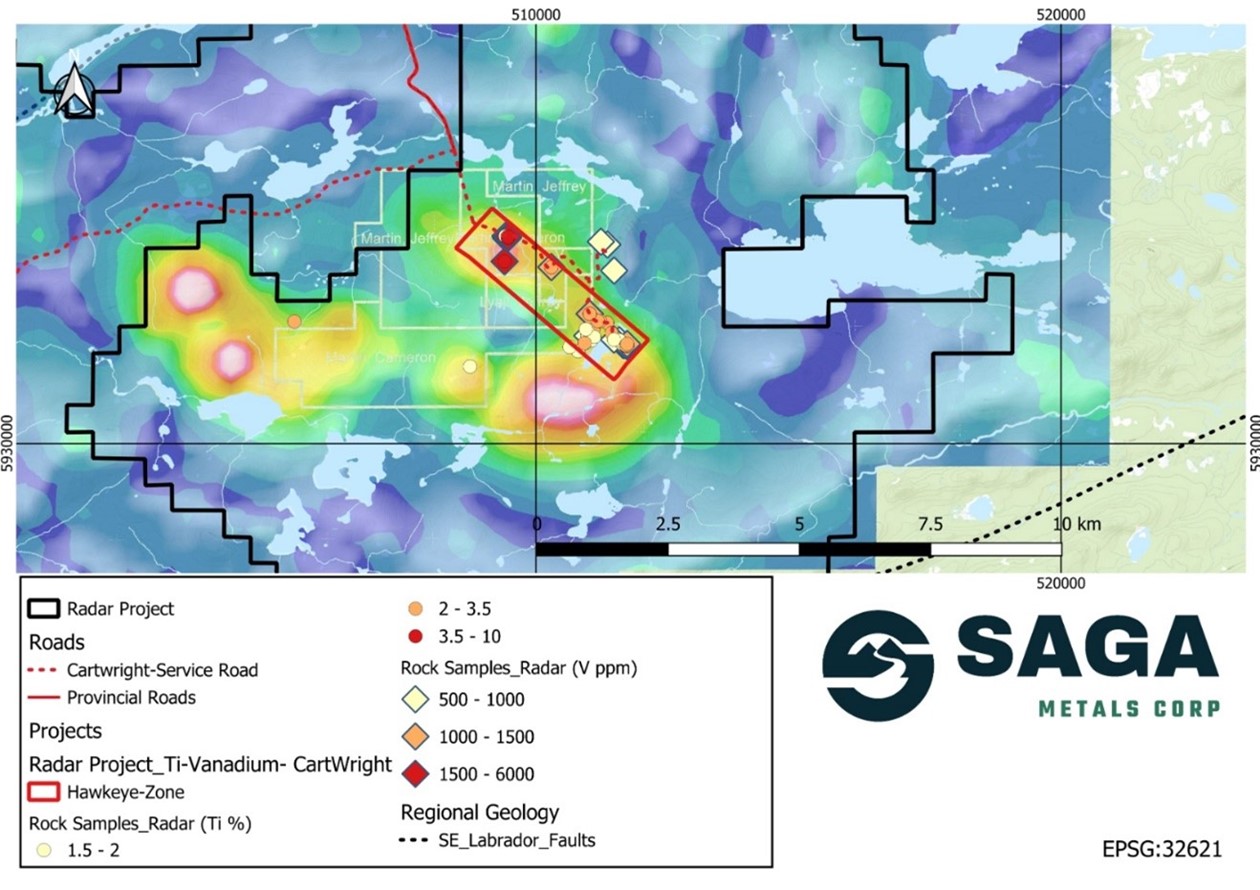

Radar Project Hawkeye zone and corresponding geophysics cutline program overview

3. Radar Titanium-Vanadium Project (Labrador, Canada)

- Promising Discovery: A 3.5 km zone highly prospective for titanium (up to 6.63%) and vanadium (up to 3,670 ppm) as shown in the map above.

- 2024 Exploration Program Complete: The recent field program at SAGA's Radar Titanium-Vanadium (Ti-V) Project focused on surface geochemistry in areas with geophysical anomalies uncovered through historical data. Two major northwest (NW) striking trends were identified:

- Hawkeye Zone: Previously sampled by SAGA in July 2023, providing the first promising results for titanium and vanadium targets.

- Trapper Zone: Newly discovered in 2024, named after local Cartwright residents who helped cut over 16 km of access trails. These anomalies were so strongly magnetized that the team's compasses couldn't function during the snow-covered months.

Guided by geophysics, the team accurately targeted both zones, which run parallel to each other and may have a shared geological origin. Further exploration will focus on confirming the geochemical connection between these zones. See map below:

Hawkeye and Trapper Zone with Corresponding Geophysics post 2024 Field Program

The Hawkeye Zone revealed several significant surface outcrops, including an impressive 4-meter outcrop containing 16 individual magnetite layers ranging in size from centimeters to 0.3 meters wide within a Gabbro-Norite/Leuco-Gabbronorite host. Several new outcrops with massive magnetite layers were also discovered, showing a rich distribution of magnetite within the host rock.

During the two-week field program, 211 rock samples and 557 soil samples were collected across the property. Soil grids were placed over the northern half of the Hawkeye Zone and the entire Trapper Zone. Rock samples from both zones, as well as additional targets across the property, revealed magnetite-bearing samples at all sites. Some samples from the Hawkeye Zone contained up to 80% visually estimated magnetite .

The near future exploration at the Radar Ti-V Project will likely focus on follow-up prospecting, mapping, back pack drilling, and channel saw sampling to better define the surface width and extent of the magnetite zones discovered in 2024.

Regional map of the North Wind Iron Ore Project in Labrador, Canada

4. North Wind Iron Ore Project (Labrador, Canada)

- Historic Data: This project includes previous drill data with iron ore grades averaging 20.74% Fe with the highest graded stratigraphy being LRGC at 24.74% FE over 277m. SAGA will be reviewing the historical data and plan further exploration to capitalize on global iron demand.

Looking Ahead to Q4 2024:

SAGA anticipates an exciting year ahead with plans for drilling, sampling, and continued exploration on all its properties. Key updates on assay results from the summer 2024 programs and plans for winter drill programs will be announced soon.

Mike Stier, CEO & Director of Saga Metals Corp. states, "Saga is committed to delivering quality projects. With the IPO now closed, we can fully concentrate on advancing our initiatives through the vital stages of exploration and development."

Michael Garagan, CGO & Director of Saga Metals Corp. states, "Starting in July and stretching through to the fall, our exploration team has been running full tilt towards a successful field season. Hard work is paying off, as the samples and observations in the field having been encouraging thus far. We look forward to bringing our ground programs to a close as the weather turns, with assay results expected in October from the Double Mer Uranium project."

With strong partnerships, an expansive portfolio of critical minerals, and a strategic focus on supporting the global energy transition, Saga Metals Corp. is poised for growth in the mining sector.

About Saga Metals Corp.

Saga Metals Corp. is a North American mining company focused on the exploration and discovery of critical minerals that support the global transition to green energy. The company's flagship asset, the Double Mer Uranium Project, is located in Labrador, Canada, covering 25,600 hectares. This project features uranium radiometrics that highlight an 18-kilometer east-west trend, with a confirmed 14-kilometer section producing samples as high as 4,281 ppm U3O8 and spectrometer readings of 22,000 cps.

In addition to its uranium focus, SAGA owns the Legacy Lithium Property in Quebec's Eeyou Istchee James Bay region. This project, developed in partnership with Rio Tinto, has been expanded through the acquisition of the Amirault Lithium Project. Together, these properties cover 65,849 hectares and share significant geological continuity with other major players in the area, including Rio Tinto, Winsome Resources, Azimut Exploration, and Loyal Lithium.

SAGA also holds secondary exploration assets in Labrador, where the company is focused on the discovery of titanium, vanadium, and iron ore. With a portfolio that spans key minerals crucial to the green energy transition, SAGA is strategically positioned to play an essential role in the clean energy future.

For more information, contact:

Saga Metals Corp.

Investor Relations

Tel: +1 (778) 930-1321

Email: info@sagametals.com

www.sagametals.com

Qualified Persons

Michael Cullen, P. Geo., Rochelle Collins, P. Geo., and Peter Webster, P. Geo., of Mercator Geological Services Limited are each a "qualified person" as defined under National Instrument 43-101 – Standards of Disclosure for Mineral Projects (" NI 43-101 ") and have reviewed and approved the scientific and technical content of this news release regarding the Double Mer Uranium Property, Radar Titanium-Vanadium Property and North Wind Iron Ore Property.

Kamil Khobzi, P. Eng., MBA, of Kamil Khobzi & Associates Inc. is a "qualified person" as defined under NI 43-101 and has reviewed and approved the scientific and technical content of this news release regarding the Legacy Lithium Property

The TSX Venture Exchange has not reviewed and does not accept responsibility for the accuracy or adequacy of this release. Neither the TSX Venture Exchange nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Disclaimer

This news release contains forward-looking statements within the meaning of applicable securities laws that are not historical facts. Forward-looking statements are often identified by terms such as "will", "may", "should", "anticipates", "expects", "believes", and similar expressions or the negative of these words or other comparable terminology. All statements other than statements of historical fact, included in this release are forward-looking statements that involve risks and uncertainties. In particular, this news release contains forward-looking information pertaining to plans with respect to its mineral exploration properties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's expectations include, but are not limited to, changes in the state of equity and debt markets, fluctuations in commodity prices, delays in obtaining required regulatory or governmental approvals, environmental risks, limitations on insurance coverage, failure to satisfy closing conditions in respect of the Offering, risks and uncertainties involved in the mineral exploration and development industry, and the risks detailed in the Prospectus and available under the Company's profile at www.sedarplus.ca, and in the continuous disclosure filings made by the Company with securities regulations from time to time. The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of the Company. The reader is cautioned not to place undue reliance on any forward-looking information. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements contained in this news release are made as of the date of this news release and the Company will update or revise publicly any of the included forward-looking statements only as expressly required by applicable law.