July 16, 2023

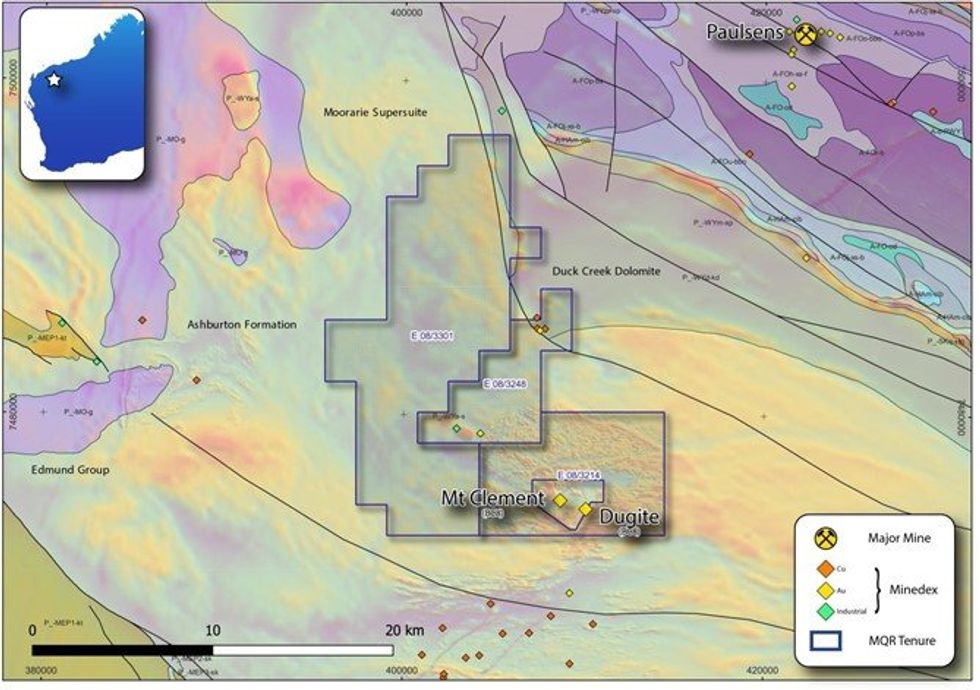

Marquee Resources Limited (“Marquee” or “the Company”) (ASX:MQR) is pleased to report that it has signed a Tenement Sale & Purchase Agreement (TSPA) with Pure Mining Pty Ltd (Pure Mining), wholly owned subsidiary of Australasian Metals Limited (ASX:A8G), to purchase a 100% interest in E08/3248 (Project) (Figure 1). The Project adjoins Marquee’s Mount Clement Project (E08/3214 and E08/3301) and further solidifies Marquee’s land position in the region.

Marquee’s Mt Clement Gold-Antimony Project is located in the northern Capricorn Orogen of Western Australia (exploration licenses E08/3214, E08/3301 and, upon completion of the TSPA, E08/3248). The Mt Clement Project will consist of 398km2 of tenure prospective for syngenetic gold-antimony mineralisation, a poorly understood and underexplored mineralisation style in the Ashburton Basin. The Mt Clement Project represents a genuine greenfields opportunity in one of Australia’s most underexplored regions.

Transaction terms

The key commercial terms of the TSPA with Pure Mining are as follows:

- As consideration for the acquisition of the Project, Marquee will issue to Pure Mining (or its nominees):

- 6,500,000 Marquee fully paid ordinary shares (Consideration Shares); and

- 6,000,000 Marquee options with an exercise price of $0.05, expiring 3 years from the date of issue, (Consideration Options), (together, the Consideration Securities).

- The Consideration Securities will be subject to 6-months voluntary escrow from date of issue.

- Completion of the TSPA is subject to and conditional upon satisfaction (or waiver) of the following conditions:

- completion of due diligence investigations to the satisfaction of Marquee;

- the parties obtaining all necessary shareholder, regulatory or third-party approvals required to issue the Consideration Securities and transfer the Project; and

- Pure Mining (or its nominees) entering a voluntary escrow deed.

Completion of the TSPA is expected to occur on the date that is 5 business days following the satisfaction (or waiver) of the conditions, or such other date agreed between the parties.

The TSPA otherwise contains terms, such as representations and warranties, typical for an agreement of this nature.

Executive Chairman Comment:

Marquee Executive Chairman, Mr Charles Thomas, commented:

“The Ashburton Basin is one of the most underexplored regions in WA and this purchase of a further 38km2 of ground gives us dominant and contiguous land holding in the area. Our geologists have been completing mapping and sampling programs over the Mt Clement Project with this work enhancing the prospectivity of the Project and driving the acquisition of the additional tenure. We look forward to sharing more details of the works programs when our team returns from the field. After receiving the final results of the mapping program, the Company will update the market with future exploration works likely to consists of detailed magnetics, geochemical sampling and drilling.”

The Mt Clement Project

The Mt Clement Project is located 30km SW of Black Cats (ASX:BC8) Paulsens gold mine, at the western end of the Ashburton Basin in the northern Capricorn Orogen. There has been debate over the mineralisation style observed at the Mt Clement deposit, however a recent study suggests Mt Clement is most likely a syngenetic exhalative-style deposit, similar to the Eskay Creek Au-Ag deposit in British Columbia and was deposited broadly coeval with the deposition of the Ashburton Basin (Guilliamse, JN 2020).

Other than orogenic and Carlin-type gold, most deposits in the Ashburton Basin are associated with localized volcanism and intrusion of the Moorarie Supersuite granitic rocks. Granitic plutons at depth are interpreted to have been the driver of mineralisation at the Mt Clement deposit and as such further exploration for syngenetic deposits would be best focused proximal to volcanic centres and plutons.

Click here for the full ASX Release

This article includes content from Marquee Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

MQR:AU

The Conversation (0)

12 July 2022

Marquee Resources

Capitalizing on the Electric Revolution with a Diverse Battery Metal Portfolio

Capitalizing on the Electric Revolution with a Diverse Battery Metal Portfolio Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00