(TheNewswire)

December 10, 2025 Rockport, Ontario TheNewswire - New Age Metals Inc. (TSX.V: NAM | OTCQB: NMTLF | FSE: P7J) ("NAM" or the "Company") is pleased to announce that effective December 8 th 2025 it has entered into an option agreement, after completing its due diligence, with an arms-length third parties - Mr. Troy Gallik (75%) and Shaun Holmes (25%), local Kenora Gold District prospectors.

The Lavender Property consists of 64 mining claims and 1 patented mining claim totalling 1,335 ha (3,299 acres). The adjacent Gibi Property consists of 186 mining claims, totalling 3,881 ha (9,590 acres). These two Properties are located ~25 km southeast of Kenora in northwestern Ontario. The Company has the option to acquire a 100% of the Properties subject to a 2% net smelter return (NSR) royalty, which the Company has an option to buy down the royalty to 1% for $1 million.

With the completion of this acquisition, alongside the recently announced Magnet Lake Property, NAM continues to consolidate its position within the Bonanza Ridge Gold and Critical Metals Project area ( see news release dated October 27, 2025: New Age Metals Receives Exchange Approval for Bonanza Gold Project, Kenora Gold District, Ontario ). The combined land position now forms a ~8,500 ha, strategically located exploration portfolio within the Kenora Gold District, an emerging Ontario jurisdiction for both precious and critical metals.

Highlights

- Multiple possible mineralized structural targets across both properties, with known Au and Cu mineral occurrences (Table 1 below).

- Excellent year-round access and infrastructure, including nearby highways, boat access, logging roads, and proximal 240 kV provincial power transmission lines.

- Strategic location ~25 km southeast of Kenora, providing direct access to mining services, skilled labour, and logistical support in a longstanding exploration district.

- Historic and recent surface sampling confirms mineralization at surface, including copper and gold values requiring follow-up (grab samples are selective and not representative of the overall mineralized system – see table 1 below)

- Occurs along the same structural corridor that hosts multiple verified gold occurrences within NAM's expanding Bonanza Ridge Gold and Critical Metals Project see news release dated October 27, 2025: New Age Metals Receives Exchange Approval for Bonanza Gold Project, Kenora Gold District, Ontario

- Minimal modern exploration, leaving the majority of high-priority targets untested for drilling or detailed geophysics.

- Eric Sprott is NAM's largest shareholder

Harry Barr, Chairman and CEO, commented: "We are pleased to further expand our project portfolio in the mining-friendly Kenora Gold and Critical Metals District. This acquisition creates substantial new opportunities for both base-metal and precious-metal exploration in an area that remains under-explored. NAM remains a well-financed critical and precious metals exploration and development company, actively growing a diversified portfolio across gold, antimony, lithium, platinum group metals, and copper. NAM's corporate objective has been to acquire and develop mineral properties capable of generating projects attractive to mid-tier and major producers."

"This new project further strengthens our critical and precious metals portfolio and supports our long-term commitment to creating value for our shareholders."

Due Diligence Site Visit and Sampling Results

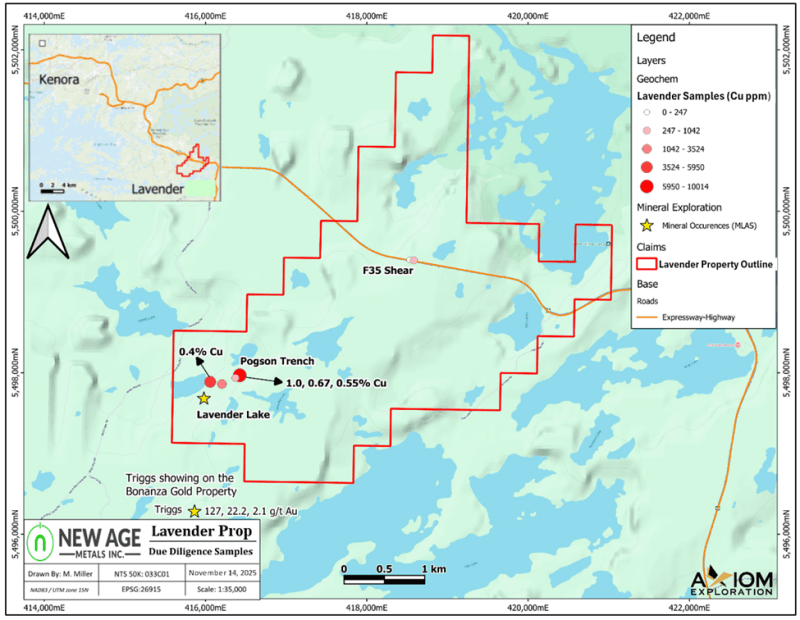

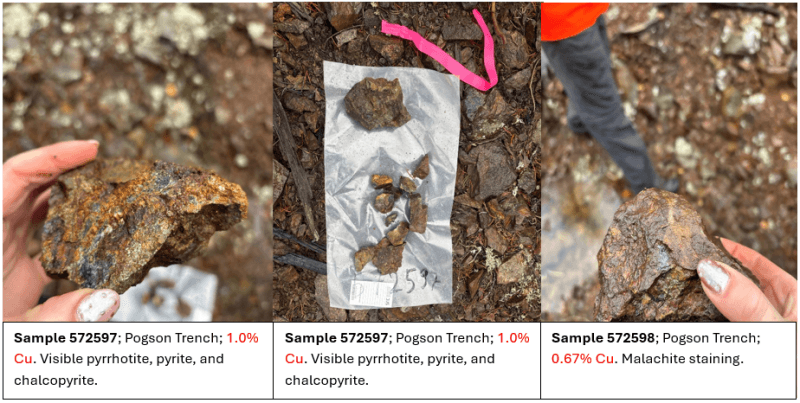

A due diligence site visit and verification sampling program was successfully executed in mid-October 2025. Eight grab samples were taken from quartz veins, basalt, gabbro, and sulphide zones at two prospects distributed throughout the Lavender Property. The mineralization occurs in mafic volcanic to mafic and ultramafic rocks that host visible chalcopyrite, pyrrhotite, pyrite, and localized malachite. The rocks are cut by a regional high-strain zone and related property-scale and smaller-scale structures spatially associated with hydrothermal mineralization in greenschist facies metamorphosed rocks. Due to time constraints, the site visit and sampling efforts focused on the Lavender Property; the Gibi Property, south and east adjacent to Lavender, was not visited.

The mineral occurrences sampled, and RUSH multi-element assay results are shown in Figure 1 and listed in Table 1. Photographs of selected samples are shown in Figure 2. The due diligence program successfully confirmed the presence of copper mineralization on the property. Particularly at the Pogson Trench prospect and defined elevated copper contents in newly sampled areas along the Pogson Trench trend on the Lavender Property.

Figure 1. Grab Sample Assay results for Due Diligence Verification on the Lavender Property. Also highlights Triggs Showing with previous Due Diligence samples referenced here: see news release dated October 27, 2025: New Age Metals Receives Exchange Approval for Bonanza Gold Project, Kenora Gold District, Ontario

Table 1. Due Diligence Sample Assays for the Lavender Property

Sample ID | Prospect | Easting (NAD 83) | Northing (NAD 83) | Au (ppb) | Cu (ppm) | Ni (ppm) | Description |

572595 | Pogson Trench | 416202 | 5497860 | 14 | 1,620 | 35 | Strong alteration, moderate sulphides. Small trench on trend with Pogson Trench |

572596 | Pogson Trench | 416425 | 5497962 | 28 | 5,454 | 91 | Strong alteration, moderate sulphides such as pyrite, pyrrhotite, and chalcopyrite. South end of Pogson Trench |

572597 | Pogson Trench | 416424 | 5497970 | 172 | 10,014 | 99 | Strong alteration, moderate pyrite, pyrrhotite, and chalcopyrite and trace malachite. North end of Pogson Trench |

572598 | Pogson Trench | 416423 | 5497967 | 108 | 6,695 | 123 | Mineralized quartz stringers with trace malachite. Float from the Pogson Trench |

572599 | Pogson Trench | 416370 | 5497935 | 11 | 897 | 521 | Small 2 x 3 m size trench on trend with the Pogson Trench. Semi-massive pyrite and pyrrhotite |

572600 | Pogson Trench | 416057 | 5497887 | 70 | 4,000 | 177 | Newly discovered outcrop with moderate sulphides on trend with the Pogson Trench |

572601 | F35 Shear | 418528 | 5499400 | <5 | 49 | <10 | Strong alteration in quartz vein. Moderate sulphides |

572602 | F35 Shear | 418582 | 5499392 | <5 | 379 | <10 | Moderate sulphides in rusty quartz vn |

Cautionary Note : Grab rock (outcrop and boulder) samples are selective by nature and are unlikely to represent average grades on the Magnet Lake Property. These results are preliminary in nature and not conclusive evidence of the likelihood of the occurrence of a mineral deposit. However, these samples demonstrate significant copper (and gold) mineralization potential on parts of the Property.

Figure 2. Photographs of Selected Due Diligence Samples Collected by NAM Technical Representatives.

The Bonanza Ridge Gold and Critical Metals Project and Kenora Gold District

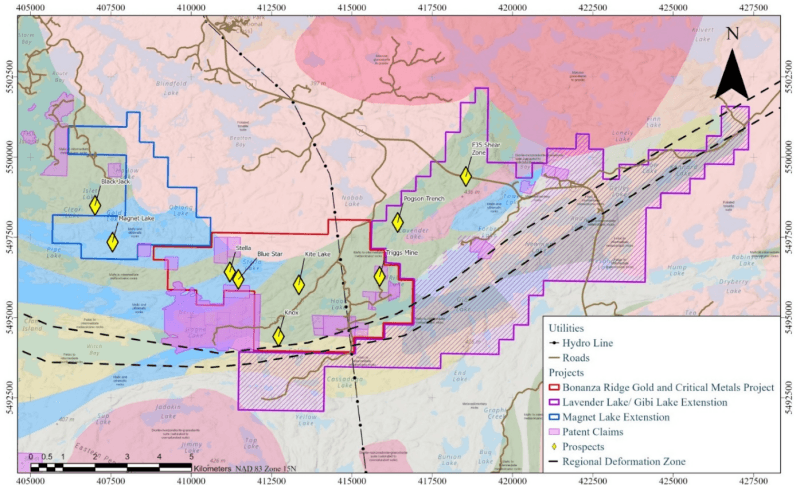

The acquisition of the Lavender Lake and South Gibi Lake Properties marks a further expansion of NAM's emerging district-scale Bonanza Ridge Gold and Critical Metals Project in the highly prospective Kenora Gold District. Located along a favourable regional structural trend and directly adjacent to NAM's flagship Bonanza Gold Property, the new ground meaningfully increases the Company's exploration footprint over one of the most prospective greenstone belts in Northwestern Ontario.

These properties provide large areas of untested geology with multiple mapped mineralized trends and historical occurrences, highlighting potential for both gold systems and critical metals shown in Figure 3. Their position along the Witch Bay–Gibi Lake High Strain Zone enhances the potential for structurally hosted sulphide-rich mineralization similar to that targeted at NAM's adjoining claims.

Figure 3. Ontario Geological Survey regional geology map with key property acquisitions that comprise the Bonanza Ridge Gold and Critical Metals Project. Lavender Lake and Gibi Properties (hashed purple area) shown as one Property. Known mineralized prospects shown in yellow diamonds. Regional deformation zone outlined by dashed lines.

With infrastructure, road access, and powerline proximity already in place, NAM is now positioned to advance a broader, more integrated exploration strategy across the consolidated land package. As work progresses, the Company intends to prioritize new target generation, structural modelling, and field verification to support a future discovery-driven drill campaign.

The Kenora Gold District is a historic gold-producing region known since the late 1800s for its Archean lode-gold deposits and continues to see renewed investment from major and mid-tier mining companies. Supported by year-round access, skilled labour, and expanding development activity, the region remains one of Ontario's most attractive opportunities for new gold and critical-metal discoveries.

Terms of the Option Agreement

To exercise the Option, NAM's agreement calls for a series of cash payments and share issuances to the Prospectors, exploration expenditures on the Project. Any share payments that become issuable under the terms of the agreement will be based on a 10-day trading average prior to the date of issuance, subject to a minimum deemed issue price of $0.255 per share. NAM has the ability to terminate the agreement any time after the first year's commitments have been completed. There are no finder's fees payable in connection with this transaction.

Lavender Lake Property

Date / Milestone | Cash Payment | NAM Common Shares | |

Within 10 days of Regulatory Approval | $15,000 | $15,000 in shares | |

Year 1 (from regulatory approval) | $30,000 | $30,000 in shares | |

Year 2 (from regulatory approval) | $37,500 | $37,500 in shares | |

Year 3 (from regulatory approval) | $70,000 | $70,000 in shares |

Gibi Lake South Property

Date / Milestone | Cash Payment | NAM Common Shares | |

Within 10 days of Regulatory Approval | $7,500 | $7,500 in shares | |

Year 1 (from regulatory approval) | $12,500 | $12,500 in shares | |

Year 2 (from regulatory approval) | $15,000 | $15,000 in shares | |

Year 3 (from regulatory approval) | $15,000 | $15,000 in shares |

The transaction and any securities issued in connection with the agreement are subject to TSX Venture Exchange approval and a four-month plus one day hold period in accordance with applicable Securities Laws.

Analytical Methods, Chain of Custody, and Quality Assurance/Quality Control

NAM maintained a rigorous QA/QC protocol for all the verification rock samples collected for due diligence purposes. Two certified reference materials (CRMs) were inserted into the sample batch. The CRMs were sourced from industry-certified providers and selected to match, as closely as possible, the expected mineralization style and grade ranges of the due diligence samples.

All samples were individually sealed in heavy-duty plastic bags, labelled with unique sample numbers, and placed into rice bags for transport. Continuous possession of the samples was maintained until they were dropped off at a courier service in Saskatoon for express delivery to SGS Canada Minerals laboratory facilities in Burnaby, British Columbia. At this facility, the samples were weighed and prepared into pulps in accordance with SGS's standard procedures before being analysed on a RUSH basis for gold and multi-element analysis.

The analytical work included:

- Gold: Au exploration grade 50 g Fire Assay with Atomic Absorption Spectrometry ("AAS") (reporting limits 5 to 10,000 ppb) ( GE_FAA50V5

- Gold: Au over limit analysis "ore" grade 50 g Fire Assay with Gravimetric Finish (reporting limits 0.5 to 10,000 ppm) (GO_FAG50V)

- Silver: Ag over limit analysis "ore" grade 30 g Fire Assay with Gravimetric Finish (reporting limits 50 to 10,000 ppm) (GO_FAG37V);

- Multi-element: 55 element analysis – sodium peroxide fusion, ICP-AES/ICP-MS, (GE_ICM90A50)

- Multi-element: Cu, Co, Ni, Pb, Zn over limit analysis "ore" grade sodium peroxide fusion, ICP-AES (GO_ICP90Q100)

Internal laboratory QA/QC procedures at SGS included the insertion and analysis of certified reference materials (standards), analytical blanks and sample duplicates with the submitted samples to monitor analytical accuracy and precision.

Qualified Person

Dr. William Stone, P.Geo. and an independent Qualified Person for the purposes of National Instrument 43-101 Standards of Disclosure for Mineral Projects and a geoscience consultant to NAM, has reviewed and approved the scientific and technical data disclosure in this press release.

The Qualified Person has not completed sufficient work to verify the historical information on the neighbouring and other properties in the Kenora region. Nevertheless, the Qualified Person considers that historical drilling and analytical results were completed to industry standard practices. The reader is cautioned that mineral occurrences, prospects and deposits on neighbouring properties are not necessarily indicative of mineralization on the Company's properties. This information may provide an indication of the exploration potential of the Properties, but might not be representative of exploration results.

About NAM

New Age Metals is a junior mineral exploration and development company focused on the discovery, exploration, and development of critical green metal projects in North America. The Company has three divisions: a Platinum Group Element division, a Lithium/Rare Element division, and an Antimony-Gold Division, and an investment in MetalQuest Mining's (TSXV:MQM | OTC:MQMIF) high purity Lac Otelnuk Iron Project.

The PGE Division includes the 100% owned, district-scale River Valley Project, one of North America's largest undeveloped Platinum Group Element Projects, situated 100 km by road east of Sudbury, Ontario. In addition to River Valley, NAM owns 100% of the Genesis PGE-Cu-Ni Project in Alaska.

The Company's Lithium Division is one of the largest mineral claim holders in the Winnipeg River Pegmatite Field, where the Company is exploring hard rock lithium and various rare elements such as tantalum, rubidium, and cesium. NAM is developing its lithium division in conjunction with its Farm-in/Joint Venture agreement with Mineral Resources Ltd. ("MinRes"), one of the world's largest lithium producers. A minimum budget to maintain the Projects has been approved by Mineral Resources Ltd for May 2025 to April 2026. The Companies agreed to the minimum budget due to current lithium pricing and forest fire dangers in the immediate area

In April 2024, a $1.5M NSERC Alliance grant was awarded to a collaboration led by the University of Manitoba (Drs. Fayek and Camacho), with academic partners from Lakehead University (Dr. Hollings) and industry partners including New Age Metals and Grid Metals. This research is focused on advancing Canada's critical metals sector, with New Age Metals' portion targeting its Bird River lithium properties. Approximately $107,000 of work is planned on New Age's properties in 2025. The early work will include core sampling and field visits starting this summer. The project will likely extend beyond the original 3-year term, due to its delayed start.

New Age Metals Inc. is supporting a successful $180K Mitacs research grant, awarded in 2023, through its $90K contribution (already accounted for and paid under the Mineral Resources joint venture). This academic partnership with the University of New Brunswick and the University of British Columbia is focused on understanding the origin and controls of lithium pegmatite mineralization in the Cat Lake–Winnipeg River field. Fieldwork for the MSc. thesis has been completed, while the post-doctoral phase is ongoing at UNB. This collaboration provides access to top-tier scientific expertise and equipment, significantly reducing analysis costs and adding long-term value to the project.

NAM's Antimony-Gold division is in Newfoundland and spans over 19,800 hectares consisting of 11 non-contiguous properties. Six of these properties are in St. Alban's area, along Canstar's Swanger and Little River mineralized trends. The remaining 5 properties are strategically located along the same geological trend as the past-producing Beaver Brook Antimony Mine and in proximity to New Found Gold's Queensway South Gold Project. Management has completed Phase 1 exploration. Phase 2 exploration has been initiated and further news will follow. On July 30 th , the Company was pleased to announce that it has received formal approval under Newfoundland and Labrador's Junior Exploration Assistance (JEA) Program , including eligibility for the Critical Minerals Assistance (CMA) and Provincial Critical Mineral Assistance (PCMA) streams. The potential rebate total for eligible exploration activities is $71,975.

The Company is actively seeking an option/joint venture partner for our and its road-accessible Genesis PGE-Cu-Ni Project in Alaska and results from our Summer/Fall Program are expected by the end of the year.

On August 6, 2025, New Age Metals announced an additional investment in a 4 th critical metal. NAM currently owns approximately 12.79% and holds warrants that, if exercised with today's issued and outstanding shares of MQM, would bring NAM to a 19.05% interest in MetalQuest Mining inc.

MetalQuest Mining inc. is developing one of North Americas largest iron projects, where approximately $120 million has been spent on the project. For more information, please visit MetalQuestMining.com . High-purity iron became a critical metal Federally in Canada and in the Provinces of Québec and Newfoundland and Labrador in 2024. In the summer of 2025, MQM has contracted AtkinsRealis, an international engineering company, to complete a GAP Analysis on the Lac Otelnuk Project and its 2015 Feasibility Study. Results are expected by mid-October 2025.

Management is currently aggressively seeking new mineral acquisition opportunities on an international scale . Our philosophy is to be a project generator with the objective of optioning our projects with major and junior mining companies through to production

Investors are invited to visit the New Age Metals website at www.newagemetals.com where they can review the company and its corporate activities. Any questions or comments can be directed to info@newagemetals.com or Harry Barr at Hbarr@newagemetals.com or Farid Mammadov at faridm@newagemetals.com or call 613 659 2773.

Opt-in List

If you have not done so already, we encourage you to sign up on our website ( www.newagemetals.com ) to receive our updated news.

On behalf of the Board of Directors

"Harry Barr"

Harry G. Barr

Chairman and CEO

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward Looking Statements: This release contains forward-looking statements that involve risks and uncertainties. These statements may differ materially from actual future events or results and are based on current expectations or beliefs. For this purpose, statements of historical fact may be deemed to be forward-looking statements. In addition, forward-looking statements include statements in which the Company uses words such as "continue", "efforts", "expect", "believe", "anticipate", "confident", "intend", "strategy", "plan", "will", "estimate", "project", "goal", "target", "prospects", "optimistic" or similar expressions. These statements by their nature involve risks and uncertainties, and actual results may differ materially depending on a variety of important factors, including, among others, the Company's ability and continuation of efforts to timely and completely make available adequate current public information, additional or different regulatory and legal requirements and restrictions that may be imposed, and other factors as may be discussed in the documents filed by the Company on SEDAR (www.sedar.com), including the most recent reports that identify important risk factors that could cause actual results to differ from those contained in the forward-looking statements. The Company does not undertake any obligation to review or confirm analysts' expectations or estimates or to release publicly any revisions to any forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Investors should not place undue reliance on forward-looking statements.

Copyright (c) 2025 TheNewswire - All rights reserved.