December 13, 2023

43% increase in Dalgaranga Project Resource ounces, 13% uplift in grade and 27% more tonnes – all within 2km of the plant

Spartan Resources Limited (“Spartan” or “Company”) (ASX: SPR) is pleased to announce the Updated Mineral Resource Estimate (“MRE”) for its 100%-owned Dalgaranga Gold Project “DGP”, located in the Murchison region of Western Australia.

Highlights:

- Updated Mineral Resource Estimate (“MRE”) completed for the Dalgaranga Gold Project, located on granted Mining Leases and within 2km of the 2.5Mtpa processing plant:

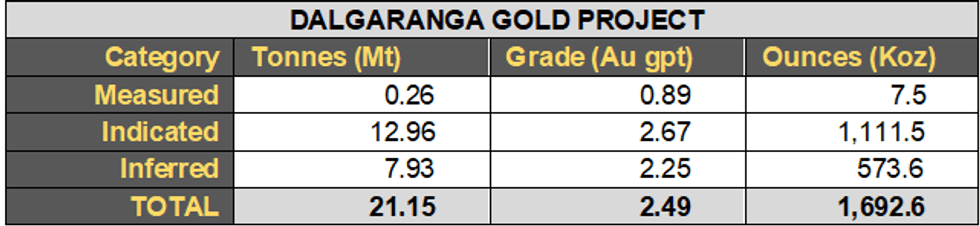

- 21.15Mt @ 2.49g/t gold for 1,692,600 ounces, comprising:

- 5.16Mt @ 5.74g/t gold for 952,900 ounces – Never Never Gold Deposit

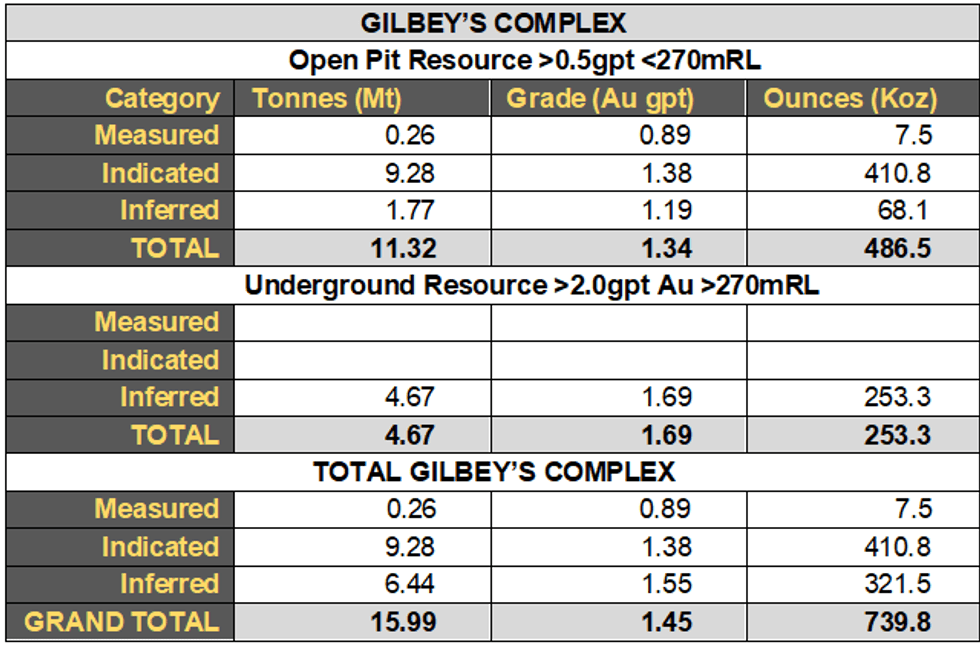

- 15.99Mt @ 1.45g/t gold for 739,800 ounces – Gilbey’s Complex

- Resource Classification breakdown for the updated Dalgaranga Gold Project MRE:

- 12.96Mt @ 2.67g/t gold for 1,119,000 ounces (66%) classified as Indicated;

- 7.93Mt @ 2.25g/t gold for 573,610 ounces (34%) classified as Inferred.

- Resource Classification breakdown for the updated Never Never Gold Deposit MRE:

- 3.67Mt @ 5.93g/t gold for 700,700 ounces (74%) classified as Indicated;

- 1.49Mt @ 5.28g/t gold for 252,100 ounces (26%) classified as Inferred.

- In-fill drilling from surface has converted circa 74% of the updated Never Never Gold Deposit MRE ounces to the higher confidence Indicated Resource classification, available for future conversion to Ore Reserves.

- The underground component of the updated Never Never MRE averages more than 1,690 ounces per vertical metre (“ozpvm”). Additionally, the apparent strike length of high-grade mineralisation at depth has increased to over 200m north-south and growing.

- Targeted in-fill drilling and updated Resource estimation of the higher grade Four Pillars and West Winds gold prospects has delivered an updated Gilbey’s Complex MRE of:

- 11.32Mt @ 1.34g/t gold for 486,500 ounces with 86% or:

- 9.28Mt @ 1.38g/t gold for 410,800 ounces classified as Indicated and constrained within a A$2,800/oz pit.

- Updated Spartan Group Mineral Resources for the Dalgaranga and Yalgoo (“Murchison”) and Glenburgh and Egerton (“Gascoyne”) Projects now stand at:

- 44.16Mt @ 1.77g/t gold for 2,512,400 ounces (69% or 1.7Moz Indicated)

This latest MRE update comprises an update for the high-grade Never Never Gold Deposit as well as an update for the Gilbey’s Complex, which comprises the higher-grade Four Pillars and West Winds Gold Prospects. The updated Mineral Resource Estimate is summarised below:

Management Comment

Spartan Managing Director and Chief Executive Officer, Simon Lawson, said: “This is an exceptional result for our shareholders which reflects the hard work of the Spartan team over the past year. To be able to post a high-grade Resource for the Never Never discovery of just under 1 million ounces at an average grade of 5.74g/t less than a year after emerging from a 10c recapitalisation is an incredible outcome and a remarkable story – one of which we are justifiably proud!

“The centrepiece of this MRE update is once again the Never Never discovery, which has grown remarkably within short order from a resource of 303,000oz at the start of 2023, through to 721,000oz in July, and now, less than 12 months later, reaching 952,900oz – 74% of which is now classified as Indicated.

“Importantly, Never Never continues to emerge as an exciting growth story at depth, with recent visible gold intercepts having been logged below the current MRE boundary and awaiting assay. The deposit remains open and appears to be shallowing and flattening slightly to the south due to the flexure zone mentioned in Tuesday’s announcement. This presents as a tantalising target for a fan of directional drilling from a parent hole that we plan to drill early in the New Year to systematically understand the potential of Never Never Deeps.

“I would also like to highlight the importance of the recognition and structural re-interpretation of the high- grade Four Pillars and West Winds gold prospects, part of the larger Gilbey’s Complex MRE presented here. We believe these high-grade structures within and beneath the current Gilbey’s open pit, when combined with the incredible high-grade endowment of the Never Never Gold Deposit, are a key part of any longer-term future mine plan.

“We now have 739,800 ounces at an average grade of 1.45g/t in resource at Gilbey’s as a starting point for the future. That grade is more than 50 per cent above the average resource grade at which the Company was mining last year. The identification and focus on the higher-grade aspects of the Gilbey’s sequence bodes extremely well for the potential to add bulk tonnage open pit ore feed at very attractive grades into the high-grade ore feed that we expect will come from the Never Never underground mining complex. The Company’s mining strategy for these deposits located within the floor of the current Gilbey’s open pit is likely to be somewhat different from what was contemplated and mined before, albeit we are very excited about the possibilities here.

“Another key takeaway for investors is that while this is just an interim update in what is a rapidly unfolding growth story at Dalgaranga, the Company has more drill assays to come and many more high-grade targets sitting along-strike from Never Never, Four Pillars and West Winds. We have a full target set and we have shown what our team is capable of with our drilling strategies. We are well positioned and set to continue to deliver more high-grade ounces at very attractive gold grades.

“We are all looking forward to another massive year in 2024. If we can repeat anything like the success we have enjoyed in 2023 in terms of continued growth in high-grade resource ounces within a 2km radius of the Dalgaranga plant, then Spartan is set for a very exciting future!

“Upon reflecting on 2023, this has been a huge team effort, and I would especially like to thank our Exploration and Drill Management team on site, our Resource team and our incredible Finance team for their diligent stewardship of our exploration programs and prudent management of our finances.

“I would also like to thank and wish all of our loyal shareholders a very safe and festive summer season and we look forward to presenting more high-grade drill results, more rapid resource growth, and as a consequence an exciting mine plan and Ore Reserves in 2024.”

Click here for the full ASX Release

This article includes content from Spartan Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

SPR:AU

The Conversation (0)

03 April 2024

Spartan Resources

Focused on Growing High-grade Gold Ounces in front of established infrastructure in Prolific Western Australia

Focused on Growing High-grade Gold Ounces in front of established infrastructure in Prolific Western Australia Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00