November 28, 2023

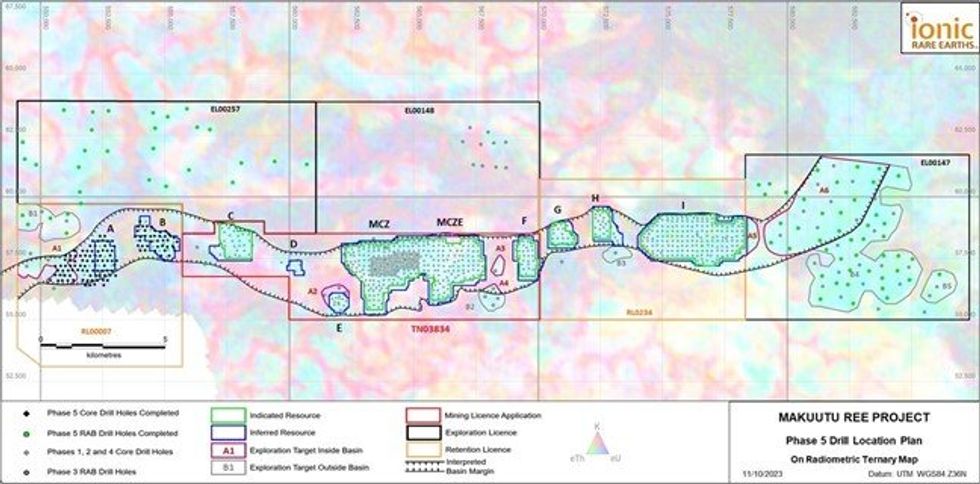

Ionic Rare Earths Limited (“IonicRE” or “the Company”) (ASX: IXR) is pleased to provide a further update on progress in securing land access agreements and the verification process for the Mining Licence Application (MLA) for the Stage One development of the Makuutu Rare Earths Project (“Makuutu”) over Retention Licence (RL) 1693 (application TN03834), through local Ugandan operating entity Rwenzori Rare Metals Limited (“RRM”).

- Ugandan Government representatives from the Directorate of Geological Survey and Mines (DGSM) have completed the on-site verification processes noting strong local support from stakeholders providing positive social licence to operate;

- Land access agreements now secured for over 95% of the full 44km2 Mining Licence Application (MLA) for the Stage One development of the Makuutu Project over Retention Licence (RL) 1693 (application TN03834);

- Final administrative stages of the Mining Licence approval process underway; and

- Makuutu’s basket contains 71% magnet and heavy rare earths content, and is one of the most advanced heavy rare earth projects globally available as a source for new supply chains emerging across Europe, the US, and Asia.

The Ugandan government approved RRM’s proposed process to secure land access agreements on 15th September 2023. Land access agreements have now been secured for 95% of the MLA.

As noted in earlier announcements, the Makuutu Heavy Rare Earths Project has the Government’s full support and is set to become Uganda’s flagship mine (refer also to IXR ASX release on the 11th of September 2023 for more detail).

Last week, RRM hosted a delegation from the Directorate of Geological Survey and Mines (DGSM) to conduct physical verification and stakeholder engagement activities. The Delegation undertook a three-day process on behalf of the Permanent Secretary of the Ministry of Energy and Mineral Development (MEMD) to verify the process undertaken and results achieved by RRM in securing Land Access agreements as part of the Mining Licence application process.

Key observations of the visit by the DGSM conveyed to the Company indicated that across the three districts, local stakeholders confirmed satisfaction with project engagement and emphasised that RRM should be granted a mining licence.

On conclusion, the DGSM lead confirmed that an excellent land acquisition and community engagement process had been undertaken. The DGSM also noted that RRM has a social licence to operate in the project area based on the goodwill noted over the three days and the continued support for the Project by the community.

The company is now engaging with the DGSM and MEMD on the formal award, and the gazetting of the formal award of the Stage 1 mining license over TN03834.

Click here for the full ASX Release

This article includes content from Ionic Rare Earths, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

IXR:AU

The Conversation (0)

14 September 2023

Ionic Rare Earths

Low Capital Operations With the Potential for High Margins

Low Capital Operations With the Potential for High Margins Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00