Overview

Lithium plays a pivotal role in our transition to a clean, electric future. It is one of the 31 minerals identified by the Government of Canada as critical for the sustainable economic success of both the country and its allies. These minerals, as laid out in the Canadian minerals and Metals Plan (CMMP) are also crucial to establishing the country as a global leader in the energy transition.

Beyond economic security, socially and environmentally sustainable development practices are also crucial in the country's transition to a low-carbon economy. As the world grapples with the ongoing climate crisis, electrification presents a compelling solution. Renewable energy is poised to replace fossil fuels as sales of electric vehicles continue to surge. Meanwhile, battery-powered sensors and smart devices are quickly becoming the backbone of a connected world, offering us convenience, productivity and more.

This evolution could be derailed by a simple problem. In its current state, lithium production cannot keep pace with global demand. One analyst even suggests that the imbalance, if left unaddressed, could act as a hard cap for lithium demand as early as 2027.

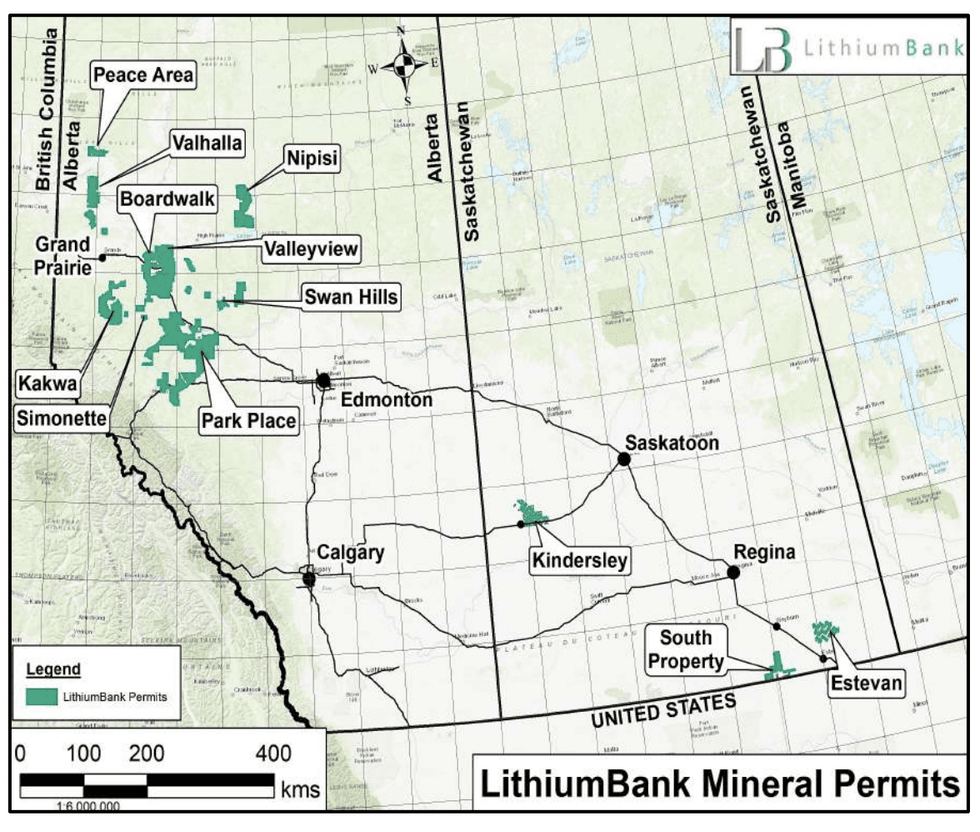

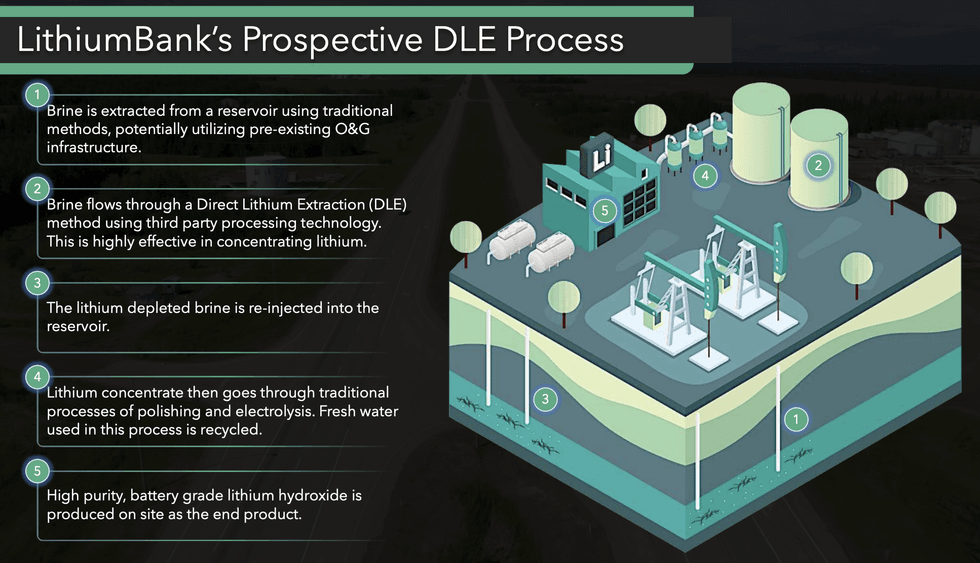

LithiumBank Resources (TSXV:LBNK, OTCQX: LBNKF) is an exploration and development company based in Western Canada that holds over 3.76 million acres of mineral titles across Alberta (3.44 million) and Saskatchewan (326,000). The company's lithium-enriched brine projects leverage direct lithium extraction (DLE) which has the potential to offer greater efficiency, lower cost and a lower environmental footprint than existing production methods.

The company is led by a qualified and well-recognized management team comprising professionals from across the energy, geological science, commodity, investment and mining sectors. The team has already cooperated extensively with oil and gas operators and established relationships with leading extraction process technology companies. As it develops its existing claims, it plans to continue acquiring and consolidating high-quality lithium exploration projects.

LithiumBank's current claims are situated in known lithium-bearing hotspots; which, between them, host more than 1,100 existing oil wells. The oil and gas sector has spent decades establishing infrastructure in these areas. Many of these wells and sites are further positioned in reservoirs which could offer the perfect conditions for the application of DLE technology.

Alberta is also home to a large and under-utilized workforce with considerable expertise in mineral extraction while the province's long history in extractive industries ensures strong social support. On the regulatory side, the mature framework established by oil and gas lends itself well to lithium brine production, as does the province's ongoing push for economic diversification. Finally, extensive geologic data provides a strong foundation and further enables low-cost resource delineation.

"It's a significant advantage that Alberta has been focused largely on extractive resources since its inception as a province in 1905," explained LithiumBank Chairman & CEO Rob Shewchuk. “We're laying the groundwork for what has the potential to become a large-scale, carbon-neutral, battery-grade lithium production opportunity that could add meaningful lithium supply to the battery supply chain in North America.”

LithiumBank's flagship project, Boardwalk, covers a total area of 794,509 acres and has the potential to hold the most contiguous elemental tonnes of lithium of any lithium brine project in North America.

Company Highlights

- LithiumBank Resources is a Canadian exploration and development company. specialized in lithium-enriched brine projects and low-impact direct lithium extraction (DLE) technology.

- The company holds 3.44million acres of mineral titles in Alberta and 326,000 acres of mineral titles in Saskatchewan.

- It has over 3.76 million acres of potential DLE-amenable assets.

- There are currently more than 1,100 wells on LithiumBank's existing claims

- DLE technology has the potential to be a cost-effective, efficient and environmentally-friendly alternative to existing high-impact and high-cost production methods.

- The company's leadership team combines decades of experience across mining, investment, geology, and oil & gas.

- The flagship Boardwalk Lithium Brine project in Alberta consists of 40 Alberta metallic and industrial mineral contiguous permits covering an area of 794,509 acres, within a LithiumBank total land package of approximately 3.44 million acres

- LithiumBank intends to continue practicing strategic acquisition and consolidation of high-quality lithium assets.

- LithiumBank increases lithium-brine land position by over 530,000 acres in Alberta and Saskatchewan.

Get access to more exclusive Lithium Investing Stock profiles here