- WORLD EDITIONAustraliaNorth AmericaWorld

September 17, 2023

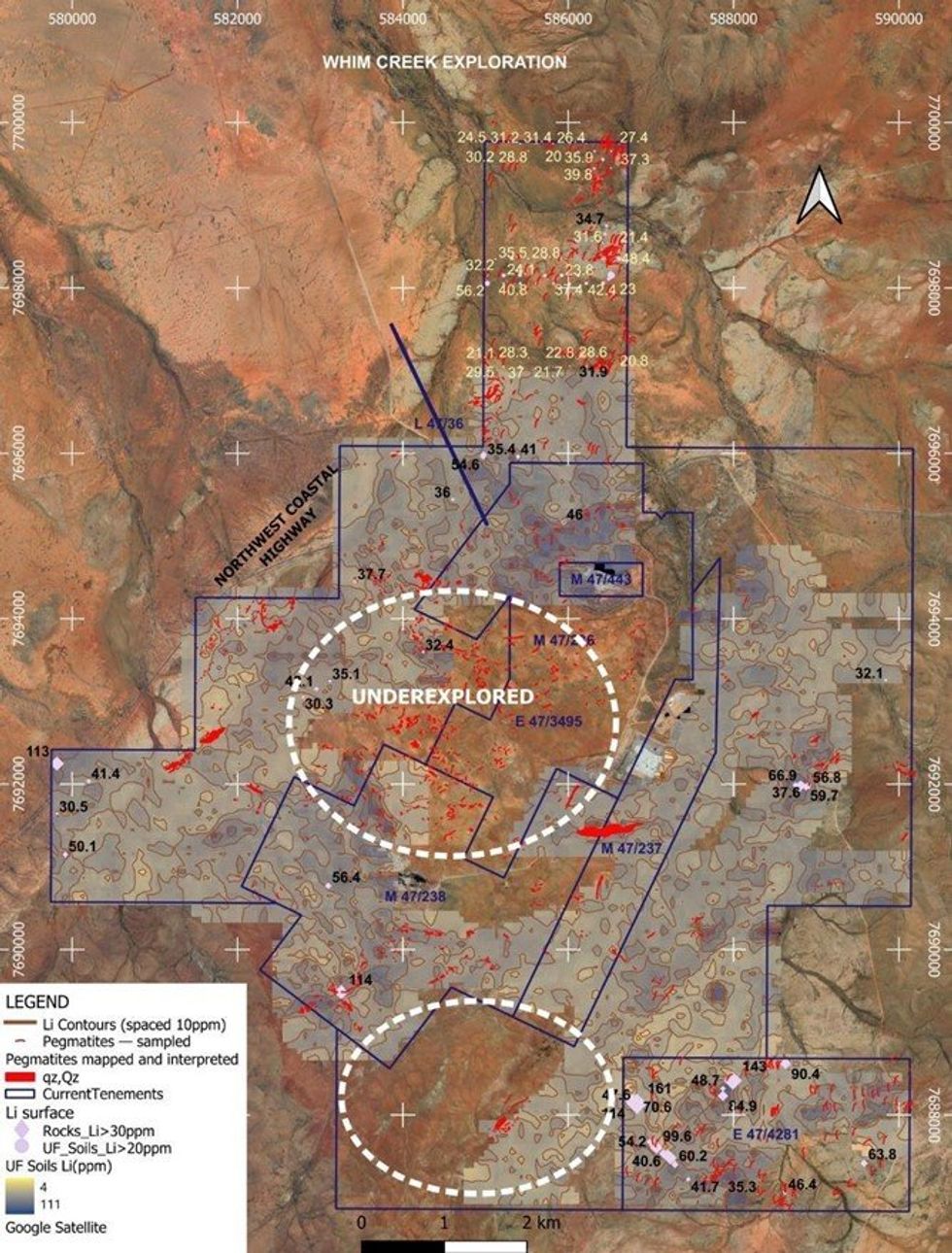

Anax Metals Limited (ASX: ANX, Anax, or the Company) is pleased to report that it has received partial lab results from recent rock chip and soil sampling which define cohesive in-situ lithium anomalies at Whim Maar (Li up to 72ppm in soils) and Loudens Patch Prospects (Li up to 161ppm in rocks). Whim Maar is the northernmost prospect of the Whim Creek Project, 80% owned and operated by Anax, under a joint venture with Develop Global Limited (ASX:DVP). Loudens Patch is 100% Anax owned and is adjacent to the east of Whim Creek Project (see Figures 1, 3 and 4).

- Results received from soil and rock chip sampling at Whim Maar and Loudens Patch have defined cohesive lithium zones

- Drill targets outlined for heritage clearance

- Lithium pegmatite potential extended across the Whim Creek Project

Geoff Laing, Managing Director of Anax Metals Limited (ASX: ANX) (“Anax” or “the Company”), commented on exploration progress:

“Soil and rock chip lithium anomalies from Whim Maar and Loudens Patch are cohesive and confirm the presence of lithium. Drill targets have been prioritised ready for heritage clearance ahead of drilling.

“Anax is broadening the search for lithium across the Whim Creek Project. Large areas remain under- explored due to lack of copper potential which has historically been the target for all exploration at Whim Creek. High-resolution satellite imagery shows extensive outcropping pegmatite swarms, now awaiting on-site verification. Anax is preparing a field programme to begin shortly, with mapping, soil and rock chip sampling at Whim Creek Dome to investigate the potential of these newly identified pegmatites.”

Following the recent discovery of pegmatites with lithium potential at Whim Maar and Loudens Patch1, and the world class lithium discovery by Azure Minerals (ASX: AZS) (~$1.17bn market cap) at the nearby Andover Project, Anax has now extended its lithium exploration further across the Whim Creek Project. UltraFine+™ soil sampling results, reported in 2021, 2022 and 20233,4,6, included lithium and associated elements (such as niobium, rubidium, strontium, caesium, tantalum, tin, etc). Contouring of lithium in soils (values up to 111ppm, contours spaced 10ppm - see Figure 1) has highlighted areas of lithium anomalism across the project as well as defining underexplored areas for further investigation.

Interpretation of high-resolution satellite imagery has defined new pegmatite outcrops (patches shown in red, Figure 1) for on-site verification, some of which coincide with lithium soil anomalies.

Anax’s 3D structural model of Whim Creek, commissioned in 20215, illustrates a dome feature at the centre of the Whim Creek Project between the Whim Creek and Mons Cupri Copper-Zinc Resources. The dome is represented by bedding planes coloured blue for older units and red for younger units in Figure 2, below. This area is underexplored as the Rushall Shale (illustrated in light grey in Figure 2) and Cistern Formation metasediments, both known to host VMS copper-zinc mineralisation, have been eroded across the dome to expose the older Mons Cupri Dacite and Red Hill Volcanic units. Structural domes are usually evidence of folding and/or subsurface intrusions, such as granites. Granites are the likely source of pegmatites which can be seen outcropping across the underexplored dome feature (see Figure 2, above) and for this reason the Whim Creek Dome is prospective for lithium.

Click here for the full ASX Release

This article includes content from Anax Metals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00