(TheNewswire)

TSX-V:KIP) (the " Company " or " Kiplin ") would like to provide its outlook on the significant price increase observed in the uranium market. The spot price of U3O8 uranium has surged more than 120% since the beginning of 2020.

The Company acknowledges the positive impact of this price upturn, which reflects the growing global demand for clean and sustainable energy sources. As the international community focuses on transitioning towards a low-carbon future, nuclear energy remains pivotal in meeting the world's increasing energy needs while reducing greenhouse gas emissions. This renewed interest in nuclear power has spurred a strong demand for uranium.

Kiplin believes that the recent surge in uranium prices indicates favourable market conditions and affirms the potential and importance of the uranium sector. As a company specializing in uranium exploration, this trend bolsters our confidence and highlights the attractiveness of our Cluff Lake Road (CLR) uranium project in Saskatchewan.

The Company's exploration efforts in the Athabasca Basin have been guided by the understanding that uranium is vital to the world's clean energy future. The recent price surge reinforces our conviction in the long-term prospects of the uranium market and strengthens our commitment to advancing our Cluff Lake Road and delivering value to our shareholders.

Dr. Peter Born, Director of Kiplin , commented, "The substantial increase in the price of uranium demonstrates the growing recognition of nuclear power as a key solution for achieving sustainable energy goals. At Kiplin , we are well-positioned to capitalize on this positive market sentiment. We will continue our diligent exploration efforts, leveraging the rising uranium price to maximize the value of our assets and contribute to the global clean energy transition."

Kiplin remains focused on advancing the Cluff Lake Road project and is committed to responsible exploration and development practices. The Company is committed to upholding the highest environmental and social standards as it contributes to the growth and sustainability of the uranium industry.

About Kiplin Metals Inc.

Kiplin Metals Inc. is a mineral exploration company. We create value for our shareholders by identifying and developing highly prospective mineral exploration opportunities. Our strategy is to advance our projects from discovery o production, allowing Kiplin to achieve exceptional shareholder value through the entire life-cycle of mining.

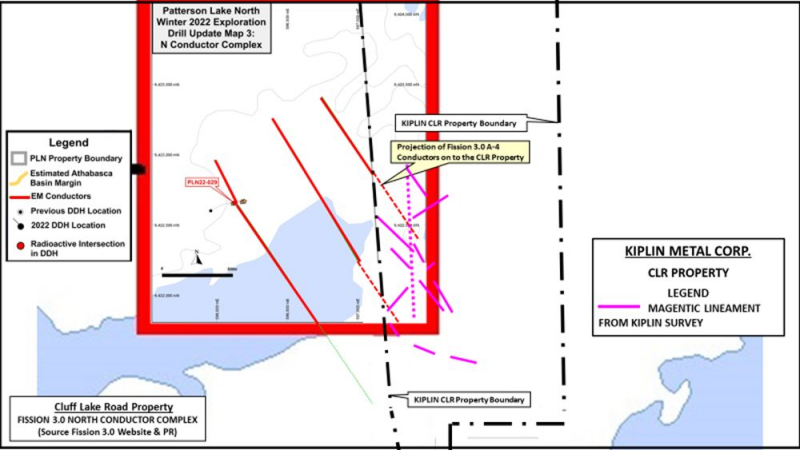

Cluff Lake Road Uranium Project. Kiplin has the right to earn a one-hundred percent interest in the Cluff Lake Road Uranium Project (the "CLR Project") . The CLR Project covers ~531 ha in the southwestern Athabasca Basin in northern Saskatchewan, where several new discoveries have been made, including the Arrow and Triple R Uranium deposits. The CLR Project is 5 km east of the Cluff Lake Road (Hwy 955), which leads to the historic Cluff Lake Mine, which historically produced approximately 62,000,000 lbs of yellowcake uranium.

For further information, contact the Company at info@kiplinmetals.com or 604-622-1199 or visit the Company's website at www.kiplinmetals.com .

On behalf of the Board,

"Peter Born"

Director

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may include forward-looking statements that are subject to risks and uncertainties. All statements within, other than statements of historical fact, are to be considered forward looking. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in forward-looking statements. There can be no assurances that such statements will prove accurate and, therefore, readers are advised to rely on their own evaluation of such uncertainties. We do not assume any obligation to update any forward-looking statements except as required under the applicable laws.

Contact Data

CONTACT:

Alex Zertuche

alexz@mrkt360.com

For E.S.T Office Hours, Call 1 416-477-0587

Copyright (c) 2023 TheNewswire - All rights reserved.