May 27, 2024

Firebird Metals Limited (ASX: FRB, “Firebird” or “the Company”) is pleased to announce its subsidiary Hunan Firebird Battery Technologies has received the critical safety permit for Stage 1 of the Battery Grade Manganese Sulphate Plant in China, which will utilise third party manganese ore to produce high-purity manganese sulphate (MnSO4).

HIGHLIGHTS

- Critical safety permit received for the construction and operation of the Company’s battery grade manganese sulphate plant, which will be located in Jinshi, Hunan Province, China

- The safety permit is one of three critical permits required to commence construction, with the other two being environmental and energy

- Environmental Impact Permit Report - completed and has gone through initial Expert Panel review – Full approval expected within the June quarter

- Energy Consumption Report - completed and has been lodged with local Jinshi Government - Full approval expected within the June quarter

- Efficient receipt of the Safety Permit and advanced status of remaining key permits highlights the strong in-country support Firebird has to establish the Company as a key high-purity manganese sulphate producer

- Once all permits are obtained and following a Final Investment Decision (FID), which is anticipated to be made in H2 2024, Firebird will be ready to immediately commence construction of the sulphate plant, with completion projected to take ~12-15 months and operations expected to commence in late 2025

- The Company’s Battery Grade High-Purity Manganese Feasibility Study released in early May (ASX announcement dated 7/5/24) with projected CAPEX of US$83.5 million and OPEX of ~US$609/metric tonne (mt) for the production of battery grade manganese sulphate

Cautionary Statement

The Feasibility Study referred to in this announcement is a Technical Feasibility of the establishment of the Battery Grade Manganese Sulphate Plant Stage 1 Processing Plant in China (the Plant). Please refer to ASX announcement dated 7/5/24 for full Feasibility Study details.

The Feasibility Study is based on the material assumptions contained in the Feasibility Study document which accompanied the announcement. This announcement and the Feasibility Study include assumptions about the availability of funding. While the Company considers all the material assumptions to be based on reasonable grounds, there is no certainty that they will prove to be correct or that the range of outcomes indicated will be achieved.

Notwithstanding the Finance Update as set out in the ASX announcement dated 14/5/24, investors should note that there is no certainty that the Company will be able to raise the amount of funding to develop the Plant when needed. It is also possible that such funding may only be available on terms that may be dilutive to or otherwise affect the value of Company’s existing shares.

It is also possible that the Company could pursue other ‘value realisation’ strategies such as a sale, partial sale or joint venture of the Plant. If it does, this could materially reduce the Company’s proportionate ownership of the Plant. Given the uncertainties involved, investors should not make any investment decisions based solely on the results of the Feasibility Study.

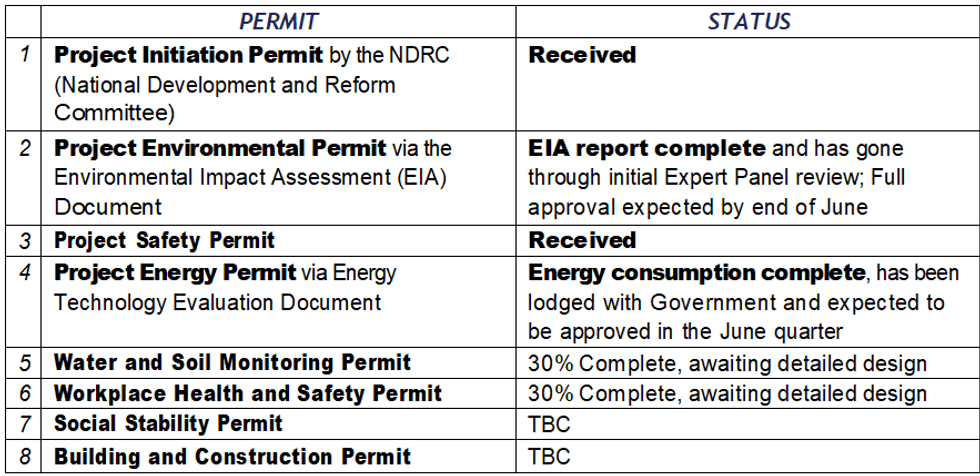

In China there are total of 8 major permits required for construction and operation, which are outlined below, along with status updates for each permit:

These permit applications can proceed concurrently with Feasibility Studies, engineering assessments, and financing endeavours, with the critical permits being environmental, safety & energy permits.

Once all key permits are obtained, with the expectation that the remaining two permits will be received before the end of the financial year and following the anticipated Final Investment Decision in the second half of 2024, Firebird will be ready to immediately begin construction on its battery-grade manganese sulphate plant.

Construction is projected to take only 12-15 months, with operations expected to commence in late 2025.

Firebird Managing Director Mr Peter Allen commented: “As we continue to efficiently advance the necessary permits for our battery grade manganese sulphate plant, I am pleased to announce that we have received the first of three critical permits, being the safety permit, and expect the remaining two permits to be received by the end of June.

“We are moving at a rapid pace on-the-ground in China and that is due to the hard work of our leading manganese team and the strong level of in-country support we have and continue to receive. Importantly, we continue to tick all the boxes in the delivery of our high-purity manganese sulphate strategy and have defined a low-cost, near-term pathway to production. We expect to make a Final Investment Decision in the second half of 2024, immediately commence construction activities and work extremely hard towards commencing operations in late 2025.”

Click here for the full ASX Release

This article includes content from Firebird Metals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

FRB:AU

The Conversation (0)

27 September 2023

Firebird Metals

Building Western Australia’s Next Major Manganese Mine for the EV Battery Market

Building Western Australia’s Next Major Manganese Mine for the EV Battery Market Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00