Japan Gold Corp. (TSXV: JG,OTC:JGLDF) (OTCQB: JGLDF) ("Japan Gold" or the "Company") is pleased to announce the commencement of the next phase of diamond drilling at the 100% held Mizobe Project ("Mizobe") located in the Hokusatsu district on the southern island of Kyushu, one of Japan's most prospective epithermal gold areas. The drill program consists of a total of 4 holes for approximately 1,600m.

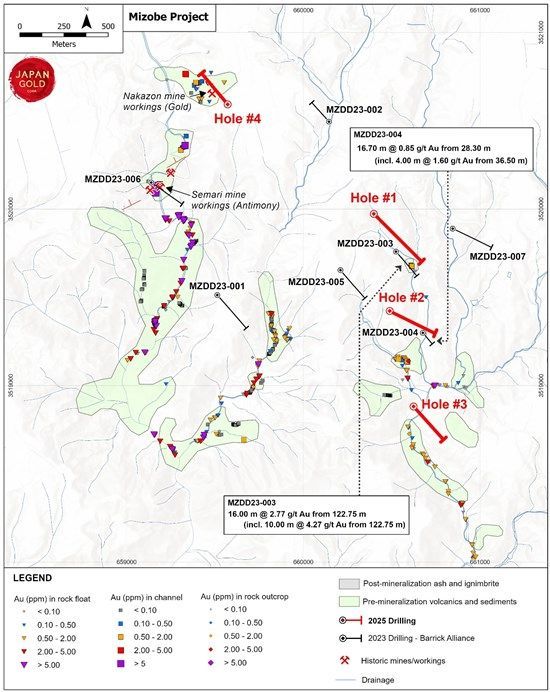

Previous drilling at Mizobe (completed through the Barrick Alliance, see news release dated February 29, 2024), confirmed the presence of gold mineralization underneath post mineralization. Best intercepts include: 10.0m @ 4.27g/t Au from 122.75m (MZDD23-003) and 4.0m @ 1.60g/t Au from 36.5m (MZDD23-004). Mineralization is associated with localised zones of silification, clay-pyrite alteration, narrow zones of hydrothermal brecciation and anomalous arsenic and antimony. This style of alteration and geochemical association is interpreted to represent the upper or peripheral parts of an epithermal system.

The 2025 Mizobe drill program is designed to test for higher grade mineralization below these intercepts, as well as testing resistivity and chargeability defined from the 2023 Induced Polarization survey.

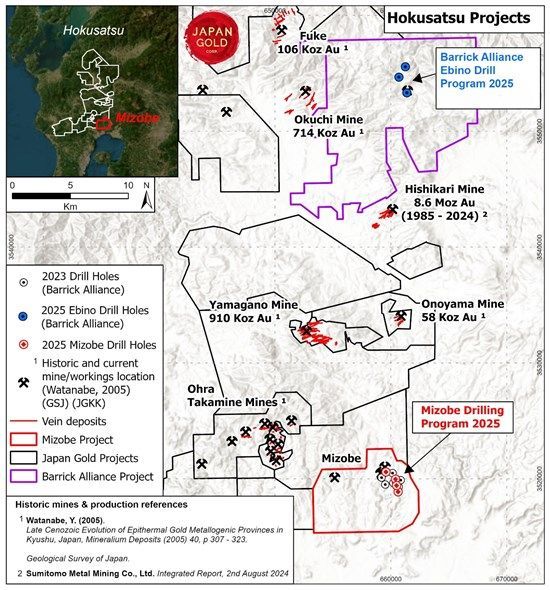

Jason Letto, VP Exploration, said, "This phase of drilling is designed to build on the encouraging results from the 2023 campaign, leverage historical data, geophysics, geochemistry, and structural interpretation to refine targeting and to increase our understanding of the mineralized system at Mizobe. We are systematically testing an area within proximity of the 14 million ounce[1] Hishikari gold mine and look forward to advancing Mizobe and other prospects in the Hokusatsu district."

The Mizobe Project

The Mizobe Project is located in the Hokusatsu district of southern Kyushu in a similar geological setting to the Sumitomo Metal Mining Co., Ltd. Hishikari Mine, located 23 kilometres to the north. Hishikari is one of the world's highest-grade gold mines and currently Japan's only active large-scale producing gold mine. The Hokusatsu district has produced more than 13 million ounces[2] of gold from several mines and remains one of the most prospective regions in Japan.

Marketing and Advertising Services

The Company entered into a Services Agreement dated August 26, 2025 (the "CanaCom Agreement") with 2686362 Ontario Corporation dba CanaCom Group ("CanaCom Group") pursuant to which CanaCom Group has agreed to provide digital content, marketing and media distribution services to the Company. Pursuant to the terms of the CanaCom Agreement, such marketing services are to be provided over a 12-month period, for a fee of C$100,000 plus applicable taxes. CanaCom Group is a full-service marketing agency based in Oakville, Ontario and is headed by Jordan Lutz. CanaCom Group provides digital marketing awareness via advertising through its fully owned platform theDeepDive.ca, which includes both video and written content coverage of Canadian small-cap stories.

Qualified Person

The technical information in this news release has been reviewed and approved by Japan Gold's Senior Technical Advisor, Fraser MacCorquodale, BAppSc, MAIG, MSEG, who is a Qualified Person as defined by National Instrument 43-101.

Figure 1 - Mizobe 2025 Drilling Program

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5665/265650_babea0fdf47bf9a4_001full.jpg

Figure 2 - Mizobe Geology with Planned Drilling

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5665/265650_babea0fdf47bf9a4_002full.jpg

About Japan Gold Corp.

Japan Gold Corp. is a Canadian mineral company focused on the exploration and discovery of high-grade epithermal gold deposits across the main islands of Japan. The Company holds a significant portfolio of tenements covering areas with known gold occurrences, history of mining and prospective for high-grade epithermal gold mineralization in one of the most stable and under explored countries in the world. The Japan Gold leadership and operational team of geologists, drillers and technical advisors have extensive experience exploring and operating in Japan and have a track record of discoveries world-wide. Japan Gold has an alliance with Barrick Mining Corporation to jointly explore, develop and mine certain gold mineral properties and mining projects with the potential to host Tier 1 or Tier 2 gold ore bodies in Japan. Significant shareholders include Equinox Partners Investment Management LLC and Newmont Corporation.

On behalf of the Board of Japan Gold Corp.

John Proust

Chairman & CEO

For further information, please contact:

Alexia Helgason

Vice President, Corporate Communications

Phone: +1(604) 417-1265

Email: ahelgason@japangold.com

Cautionary Note

Neither the TSX Venture Exchange nor its Regulation Services Provider (as such term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release contains forward-looking statements relating to expected or anticipated future events and anticipated results related to future partnerships and the Company's 2025 gold exploration program. These statements are forward-looking in nature and, as a result, are subject to certain risks and uncertainties that include, but are not limited to, the timing and granting of prospecting rights; the Company's ability to convert prospecting rights into digging rights within the timeframe prescribed by the Mining Act; general economic, market and business conditions; competition for qualified staff; the regulatory process and actions; technical issues; new legislation; potential delays or changes in plans; working in a new political jurisdiction; results of exploration; the Company's ability to execute and implement future plans, arrange or conclude a joint venture or partnership; and the occurrence of unexpected events. Actual results achieved may differ from the information provided herein and, consequently, readers are advised not to place undue reliance on forward-looking information. The forward-looking information contained herein speaks only as of the date of this News Release. The Company disclaims any intention or obligation to update or revise forward‐looking information or to explain any material difference between such and subsequent actual events, except as required by applicable laws.

1Sumitomo Metal Mining Co., Ltd. Integrated Report, August 2024

2 Garwin, S. L., Hall, R., & Watanabe, Y. (2005). Tectonic setting, geology, and gold and copper mineralization in Cenozoic magmatic arcs of Southeast Asia and the West Pacific.

The Mining and Materials Processing Institute of Japan (1989, March). Journal of Japanese gold mines, Vol. 1: Kyushu, Japan

Izawa, E., & Zeng, N. (2001).

Kushikino gold mineralization in a Pliocene volcanic region, Kyushu, Japan. In Society of Economic Geologists (Ed.), Guidebook Series (Vol. 34, pp. 53-60). Society of Economic Geologists.

Murakami, H., and Freebey, C., (2001) Geology and Geophysical Expression of the Yamagano low sulfidation epithermal Au-Ag deposit, southwest Kyushu In Society of Economic Geologists (Ed.), Guidebook Series.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/265650