August 29, 2024

Hydration solutions company The Hydration Pharmaceuticals Company Limited (ASX: HPC) (“Hydralyte North America” or “the Company”) is pleased to provide the following update on the six-month period ended 30 June 2024 (the “half year” or “H1 FY2024”) and the Company’s Appendix 4D.

KEY HIGHLIGHTS

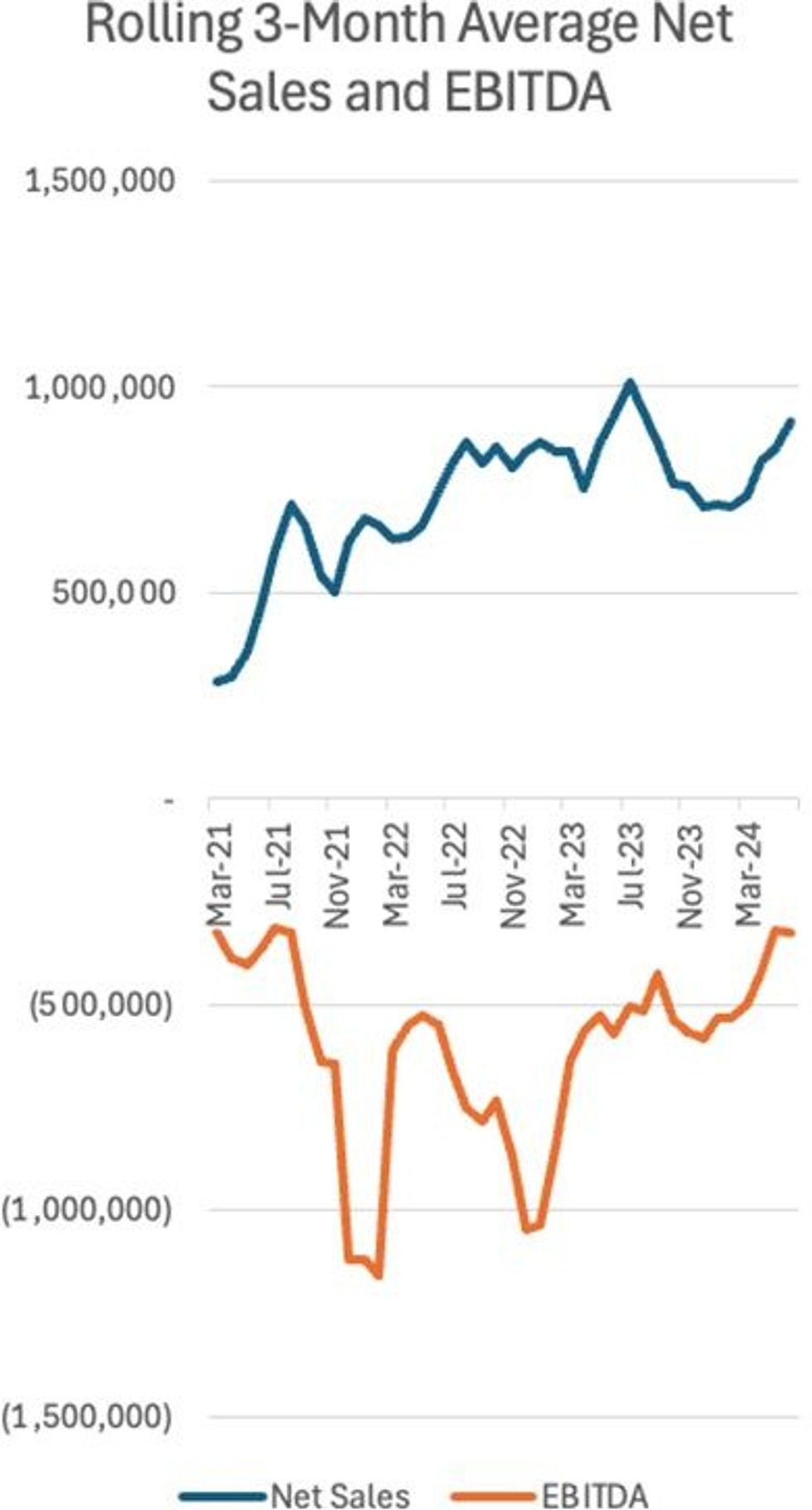

- 34% reduction in EBITDA loss to $2.4m (H1 2023: $3.6m) through stated strategy to reduce expenditure and drive cost efficiencies

- 29% or $0.8m previous corresponding period (“PCP”) reduction in net cash used in operating activities to $2.1m with continuing improvements being implemented

- Gross margin increase of 4ppt from PCP to 53% (1H 2023: 49%), a result of multiple margin improvement strategies coming to fruition

- Net sales of $5.0m with increases expected to be realised during H2 2024

- 52% ($0.4m) growth in Canadian ecommerce revenue from the PCP to $1.1m (H1 2023: $0.7m) driven by strong demand for the product in the ecommerce channel combined with effective and efficient marketing and advertising spend

- Launch of new consolidated Amazon packaging during the period expected to save 4ppt in margin on Amazon sales in US and Canada

- Advanced negotiations in progress for either the sale of the Company or a strategic divesture of assets

Financial overview:

With a continued focus on profitability and cash preservation, the Company achieved its lowest half-year expenditure since listing. This was highlighted by a 34% year-on-year (“YoY”) reduction in EBITDA loss to $2.4m (H1 2023: $3.6m), marking strong execution of the Company’s stated strategy to reduce expenditure and push towards profitability.

Gross margin as a percentage of net sales increased by 4ppt YoY to 53% (H1 2023: 49%). This was despite the negative impact of stock keeping unit (“SKU”) reductions resulting in a cost of goods increase of $0.4m during the period. SKU reductions are part of the continued effort to improve cash flow and profitability by eliminating the lowest performing products.

The Company’s ongoing review of marketing expenditure was another key aspect in the improved cash flow and reduction in losses. As a percentage of net sales, YoY marketing spend decreased by 11ppt to $1.5m. This equated or 31% of net sales (1H 2023 marketing spend: 42% of net sales or $2.2m).

During the period, the Company implemented additional reductions in marketing spend and margin improvements and anticipates that these combined efforts will be realised in the coming months.

Appendix 4D and FY24 Half Year Financial Report

Click here for the full ASX Release

This article includes content from The Hydration Pharmaceuticals Company Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

HPC:AU

The Conversation (0)

30 May 2024

Hydralyte International

Leveraging a Rapidly Expanding Hydration Market in North America

Leveraging a Rapidly Expanding Hydration Market in North America Keep Reading...

28 February 2025

FY24 Appendix 4E

Hydralyte International (HPC:AU) has announced FY24 Appendix 4EDownload the PDF here. Keep Reading...

31 January 2025

Q4 FY24 Quarterly Activities Report (App 4C)

Hydralyte International (HPC:AU) has announced Q4 FY24 Quarterly Activities Report (App 4C)Download the PDF here. Keep Reading...

28 November 2024

US Operations Update

Hydralyte International (HPC:AU) has announced US Operations UpdateDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00