September 06, 2023

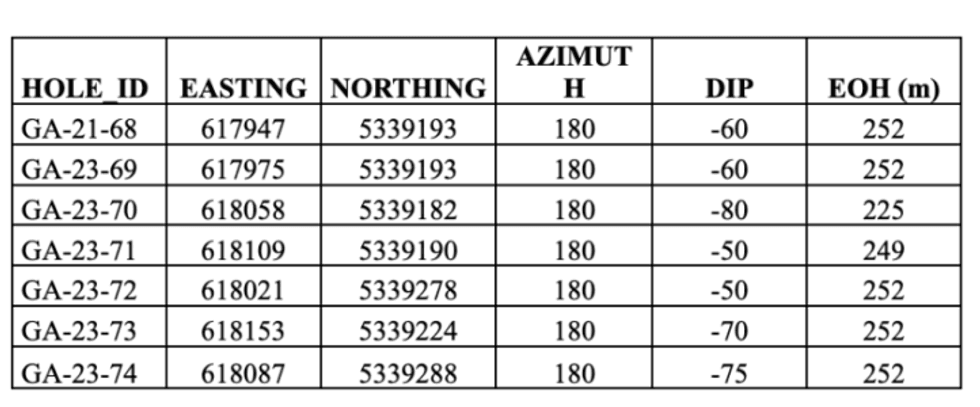

Fokus Mining Corporation (“Fokus” or the “Company”) (TSXV-FKM) (OTCQB: FKMCF) (FSE: F7E1) is pleased to announce assay results from its 4th exploration drilling campaign, held during the summer of 2023, aimed at furthering its knowledge of the RB Zone where it had previously drilled twelve (12) holes (see press release dated March 28, 2023). Fokus has drilled seven (7) holes for 1,735 metres, intersecting gold in all of them.

Highlights

- Fokus completed seven (7) holes for 1,735 metres on RB zone (July 2023)

- Fokus intersected gold in each one

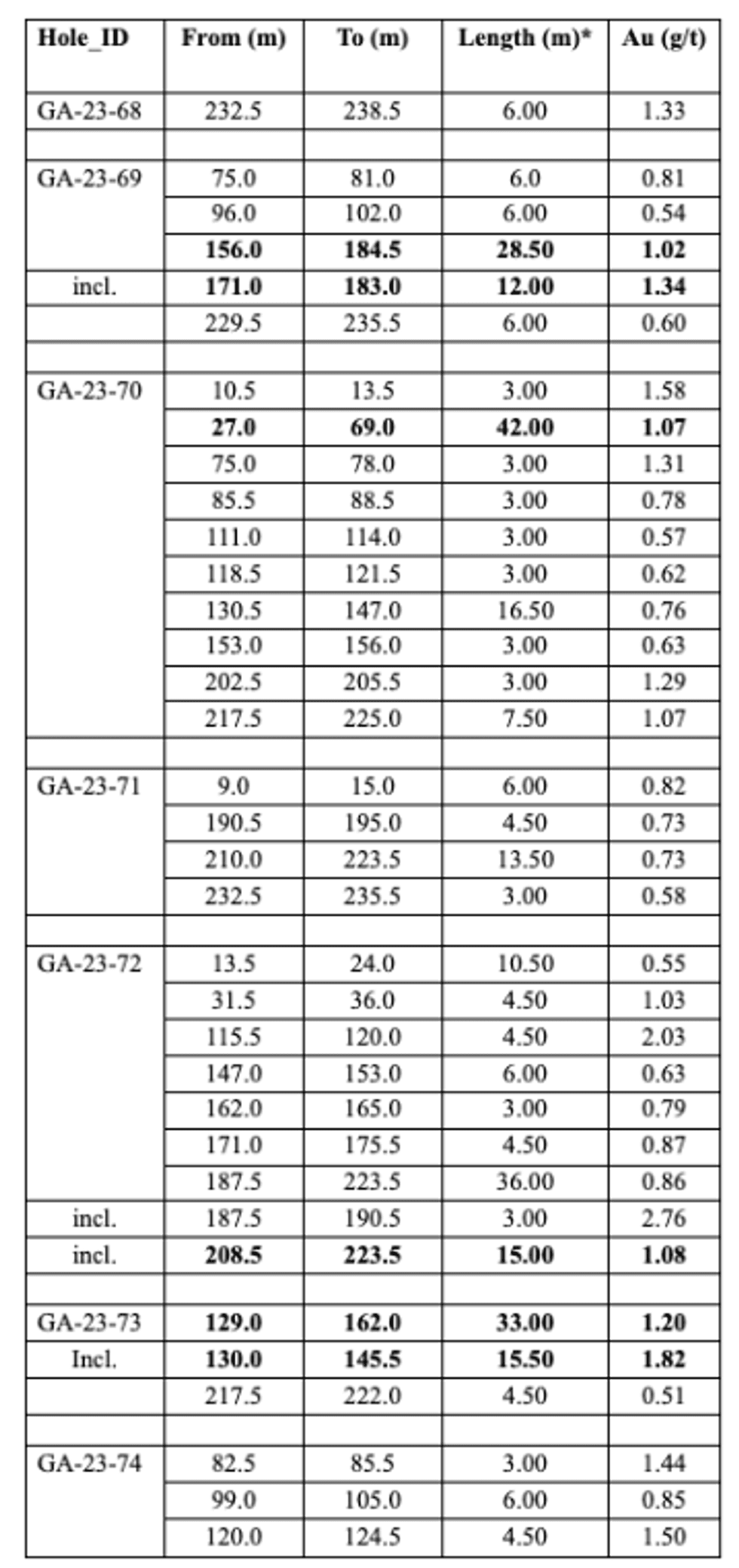

- GA-23-73 cut 1,20 g/t Au on 33 metres

- GA-23-70 cut 1,07 g/t Au on 42 metres

- GA-23-69 cut 1,02 g/t Au on 28,5 metres

- Fokus is planning new exploration drilling for autumn 2023.

This is the Company’s fourth small drill program since 2021 on the RB Zone, which is one of two major new gold targets detected by the high-resolution airborne magnetic survey in the Renault Bay intrusion area of the Galloway property. It is located to the east of the GP gold zone (1,445,000 mt at 0,98 g/t Au – 43-101 report 2023). It forms part of what the Company considers to be an AU-CU porphyry system mineralisation in this part of Galloway, which also includes the Hendrick Zone (37,989,000 mt at 1,06 g/t Au – 43-101 report 2023).

Jean Rainville, President and CEO of Fokus stated: “This recent program reinforces our view that the mineralised system could form a large mushroom typical of porphyry systems with the entire system tilted to the west: Hendrick would form the head (cap) and RB areas, the stipe (tube). We now need to define the direction of the reel and the plunge of this gold-bearing tube.”

Following on from these results, and as part of its ongoing activities, the Company’s management is evaluating the possibility of completing a financing to enable it to undertake another drilling campaign in autumn 2023 to continue its work on the north-eastern extension of the RB zone.

The Company also plans to validate a possible NS gold system in the Moriss deposit area, for which the latest report NI-43-101 – 2023 gives 514,000 mt inferred at 2.74 g/t Au at surface. Several holes drilled in this direction have previously intersected high gold values such as 18.9 g/t Au over 5.5m and 14.38 g/t Au over 6m in hole VPE-10-11 and 59.51 g/t Au over 6.20m and 5.09 g/t Au over 5.05m in hole VPE-12-50.

Some other interception values in SW and WWS directions on Moriss:

- VPE-10-19: 23.72 g/t Au over 3.75m

- VPE-11-24: 46.96 g/t Au over 2.80m

- VPE-10-10 : 11.48 g/t Au over 5.35m.

The Company believes that it is possible to delineate, by drilling, several north-south trending tension zones in this gold-bearing environment. In this sense, the Company’s management anticipates that a short drilling programme in this area during the autumn will clearly identify the gold potential that this EW orientation system could offer.

Jean Rainville, President and CEO is very pleased by these recent assays and said: “Our results are increasingly in line with our assumptions about the structure of the deposit. These four, albeit modest, campaigns on RB confirm our understanding of the deposit’s structure.” He added: “The work planned for this autumn in both the RB and Moriss zones will focus on better defining the model, for which we have more and more knowledge and convincing results. It is with this in mind that we are planning to raise appropriate funding for the situation.”

Detailed information and results of the summer 2023 exploration campaign on the RB zone

*Lengths are measured along the holes. True widths are believed to be 65-90% of the core length.

Qualified Person

The scientific and technical disclosure for Fokus included in this news release have been reviewed and approved by Gilles Laverdière, P. Geo. Mr. Laverdière is a geologist and a qualified person under National Instrument 43-101 Standards of Disclosure of Mineral Projects (“NI 43-101”) and a director of the Company.

ABOUT FOKUS MINING

Fokus Mining Corporation is a mineral resource company actively acquiring and exploring precious metal deposits located in the province of Quebec, Canada. In implementing this major undertaking within the Canadian mining industry, we are determined to unlock the secret of the Galloway gold project.

The Galloway project covers an area of 2,865.54 hectares and is located just north of the Cadillac-Larder Lake deformation which extends laterally for more than 100 km. Numerous gold deposits are related to that structure and its extensions. The current work focuses on a small western portion of the mineral claims where several mineral occurrences have been identified. For more information, visit our website: fokusmining.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this release.

For further information:

Jean Rainville, President & Chief Executive Officer

Tel.: (514) 918-3125, Fax: (819) 762-0097

Email: jrainville@fokusmining.com

Related Links

Forward-Looking Statements

Certain statements contained in this press release may constitute forward-looking information or statements. Forward-looking information is often, but not always, identified using words such as “anticipate”, “plan”, “estimate”, “expect”, “may”, “will”, “will have”, “should”, and other similar expressions. Forward-looking information involves known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking information. The Company’s actual results could differ materially from those anticipated in this forward-looking information due to regulatory decisions, competitive factors in the industries in which the Company operates, prevailing economic conditions, changes in the Company’s strategic growth plans and other factors, many of which are beyond the Company’s control. The Company believes that the expectations reflected in the forward-looking information are reasonable, but no assurance can be given that these expectations will prove to be correct and, accordingly, such forward-looking information should not be relied upon as such. All forward-looking information contained in this press release represents the Company’s expectations as of the date hereof and is subject to change after such date. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by applicable securities legislation.

FKM:CC

The Conversation (0)

23h

Flow Metals to Acquire the Monster IOCG Project in Yukon

Flow Metals Corp. (CSE: FWM) ("Flow Metals" or the "Company") is pleased to report that it has entered into an option agreement dated February 9, 2026 (the "Option Agreement") with Go Metals Corp. ("Go Metals") to acquire the Monster IOCG project (the "Monster Project"), located approximately 90... Keep Reading...

09 February

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

09 February

Dr. Adam Trexler: Physical Gold Market Broken, Crisis Unfolding Now

Dr. Adam Trexler, founder and president of Valaurum, shares his thoughts on gold, identifying a key issue he sees developing in the physical market. "There's a crisis in the physical gold market," he said, explaining that sector participants need to figure out how to serve investors who want to... Keep Reading...

09 February

Trevor Hall: Bull Markets Don’t Always Mean Big Returns

Clear Commodity Network CEO and Mining Stock Daily host Trevor Hall opened his talk at the Vancouver Resource Investment Conference (VRIC) with a strong message: It is still possible to go broke in a bull market.“I want to start with the simple but uncomfortable truth: most investors don't lose... Keep Reading...

09 February

How Near-term Production is Changing the Junior Gold Exploration Model

Junior gold companies have traditionally been defined by exploration: identifying prospective ground, drilling to delineate a resource and, ideally, monetising that discovery through a sale or joint venture with a larger producer. While this model has delivered success in the past, changing... Keep Reading...

09 February

Gold Exploration in Guinea: An Emerging Opportunity in West Africa

While much of West Africa’s gold exploration spotlight has historically fallen on countries like Ghana and Mali, Guinea is increasingly emerging as a quiet outlier — a country with proven gold endowment, expansive underexplored terrain and a growing number of active exploration programs. Despite... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00