February 08, 2024

Fathom Nickel Inc. (CSE: FNI) (FSE: 6Q5) (OTCQB: FNICF) (the "Company" or "Fathom") is pleased to announce that drilling has begun at the Company's 100% owned Albert Lake Project. Mobilization of drilling equipment was scheduled to commence February 2nd but due to harsh weather conditions mobilization did not commence until February 4th. The Company is pleased to report weather conditions have normalized and the drilling of the first hole has commenced.

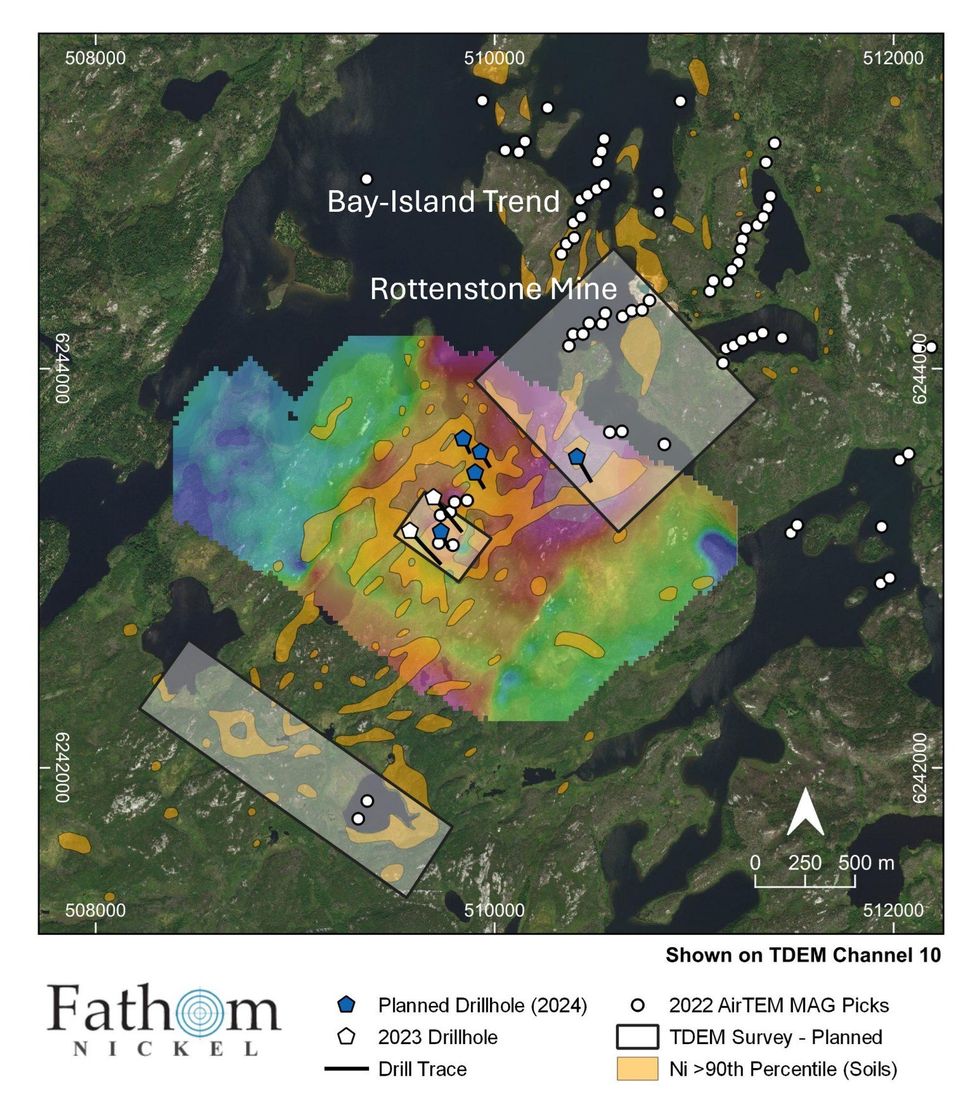

The attached Figure 1 illustrates the location of proposed drillholes. The initial hole is targeting the very strong, very prominent conductor dominating the northeastern section of the figure. This very strong time domain electromagnetic (TDEM) conductor is modeled to be >350 meters below surface, a minimum strike length of 450 meters, and occurring coincident with a gravity anomaly (see Press Release January 16, 2024). Additional exploration details for this current campaign and illustrated in Figure 1 include:

- Outline of the anomalous to very anomalous, robust Ni-in-soil anomaly occurring within the Rottenstone-Tremblay-Olson corridor as defined by >90th percentile (>15.6ppm and up to 743ppm Ni-in-soil; see Press Release January 17, 2023). Several additional drillholes are designed to test positive metals-in-soil anomalies within the Tremblay-Olson Claims area. These holes are testing coincident soil, and rock geochemistry with coincident geology and geophysical features.

- Channel 10 TDEM responses derived from the summer 2023 TDEM survey performed at the Tremblay-Olson Claims area. Red - magenta colouring defines areas of greatest, concentrated conductivity.

- Three (3) TDEM surface grids have been designed to further define TDEM conductors derived from surveys performed in 2022 and 2023.

- The "Middle" grid is further detailing a strong isolated conductor detected in 2023 coinciding with off-hole and above-hole BHEM conductors detected in the two holes drilled in March 2023 (see Press Release May 5, 2023).

- The "North" grid is a detailed follow-up to two separate grids completed in 2022 that defined conductivity in this area. The detected conductivity also aligns with, and appears to coincide with, MAG picks emanating from, and trending southwest of the historic Rottenstone Mine. The third, "South" grid, is designed to test coincident conductivity with an interpreted fold-nose as defined by surface geochemistry and airborne MAG surveys.

- The Company anticipates additional drill targets resulting from the "Middle" and "North" TDEM grids. Any drill targets resulting from the "South" grid will be tested in future drill programs.

- Note: the MAG Picks (areas of magnetic intensity) are derived from the 2022 Heli-borne AirTEM survey performed at the Albert Lake project.

Figure - 1 Rottenstone-Tremblay Olson Corridor Q-1 2024 Update Map

The Company is planning approximately 2,000 meters of drilling (5-7 drillholes) to further test, and potentially, determine the source of the very robust, multi-element soil geochemical anomaly occurring at the Tremblay-Olson Claims area. Additional drill targets will be derived from the 2024 TDEM surveys.

A similar-sized campaign is planned for the Gochager Lake project immediately following the completion of the Albert Lake program.

Ian Fraser, CEO and VP Exploration stated, "To experience fog and +8° C weather conditions at Rottenstone Lake during the last week of January is very unusual. Now that things have normalized, our crews have worked very hard to make up for lost time and have now initiated the first drillhole. We eagerly anticipate results of the first two EM grids. We are very encouraged that the AirTEM survey flown in 2022 recognizes elevated magnetic intensity directly associated with the Bay-Island Trend discovery (300+ meters of continuous ultramafic hosted Ni-Cu-Co + 3PE mineralization) occurring ~500 meters northwest of the historic Rottenstone Mine. We now recognize a similar MAG signature trending immediately southwest of the Rottenstone Mine. Once the EM data has been collected and interpreted over this area and at the Middle grid, we anticipate additional drill targets developing. We are pleased that drilling has commenced and we very much look forward to the results from this very interesting drill campaign."

Qualified Person and Data Verification

Ian Fraser, P.Geo., CEO, VP Exploration, and a Director of the Company and the "qualified person" as such term is defined by National Instrument 43-101, has verified the data disclosed in this news release, and has otherwise reviewed and approved the technical information in this news release on behalf of the Company.

About Fathom Nickel Inc.

Fathom is an exploration company that is targeting magmatic nickel sulphide discoveries to support the rapidly growing global electric vehicle market.

The Company now has a portfolio of two high-quality exploration projects located in the prolific Trans Hudson Corridor in Saskatchewan: 1) the Albert Lake Project, a 90,000+ hectare project that was host to the historic and past producing Rottenstone deposit (produced high-grade Ni-Cu+PGE, 1965-1969), and 2) the 22,000+ hectare Gochager Lake Project that is host to a historic, NI43-101 non-compliant open pit resource consisting of 4.3M tons at 0.295% Ni and 0.081% Cu2.

1 - The Saskatchewan Mineral Deposit Index (SMID#0950) Tremblay-Olson Ni-Cu Deposit or Showing.

2 - The Saskatchewan Mineral Deposit Index (SMID#0880) reports drill indicated reserves at the historic Gochager Lake Deposit of 4,262,400 tons grading 0.295% Ni and 0.081% Cu mineable by open pit. Fathom cannot confirm the resource estimate, nor the parameters and methods used to prepare the reserve estimate. The estimate is not considered NI43-101 compliant and further work is required to verify this historical drill indicated reserve.

ON BEHALF OF THE BOARD

Ian Fraser, Chief Executive Officer and Vice-President, Exploration

1-403-650-9760

Email: ifraser@fathomnickel.com

or

Doug Porter, President & CFO

+1-403-870-4349

Email: dporter@fathomnickel.com

Forward-Looking Statements:

This news release contains "forward-looking statements" that are based on expectations, estimates, projections and interpretations as at the date of this news release. Forward-Looking statements are frequently characterized by words such as "plan", "expect", "project", "seek", "intend", "believe", "anticipate", "estimate", "suggest", "indicate" and other similar words or statements that certain events or conditions "may" or "will" occur, and include, without limitation, statements regarding intended future exploration work, including drilling, and the timing of such activities. Forward-Looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be "forward-looking statements." Forward-Looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation: risks related to failure to obtain adequate financing on a timely basis and on acceptable terms; risks related to the outcome of legal proceedings; political and regulatory risks associated with mining and exploration; risks related to the maintenance of stock exchange listings; risks related to environmental regulation and liability; the potential for delays in exploration or development activities or the completion of feasibility studies; the uncertainty of profitability; risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; results of prefeasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Company's expectations; risks related to commodity price fluctuations; and other risks and uncertainties related to the Company's prospects, properties and business detailed elsewhere in the Company's disclosure record. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. These forward-looking statements are made as of the date hereof and the Company does not assume any obligation to update or revise them to reflect new events or circumstances except in accordance with applicable securities laws. Actual events or results could differ materially from the Company's expectations or projections.

FNI:CNX

The Conversation (0)

25 February

Oregon: America’s Premier Domestic Nickel Opportunity

The global race for critical minerals has begun. As the US stares down a future of massive industrial shifts, the strategy is clear: secure the supply chain or get left behind. Demand for nickel is hitting overdrive, fueled by its role in electric vehicle (EV) batteries, high-strength stainless... Keep Reading...

24 February

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to begin... Keep Reading...

24 February

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI,OTC:FNICF) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to... Keep Reading...

23 February

Ni-Co Energy Inc. Files Preliminary Prospectus for Proposed Initial Public Offering

Ni-Co Energy Inc. (“Ni-Co Energy” or the “Company”) is pleased to announce that it has filed a preliminary prospectus (the “Preliminary Prospectus”) with the securities regulatory authorities in the provinces of Québec, Ontario, Alberta, and British Columbia in connection with its proposed... Keep Reading...

12 February

Bahia Metals Corp. Completes Initial Public Offering of $5,750,000, with Full Exercise of Over-Allotment Option

Bahia Metals Corp. (CSE: BMT) ("Bahia" or the "Company") is pleased to announce that it has successfully completed its initial public offering (the "IPO") of 11,500,000 units of the Company (the "Units") at a price of $0.50 per Unit, inclusive of the full exercise of the 15% over-allotment... Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00