August 18, 2025

Fathom Nickel Inc. (CSE: FNI) (FSE: 6Q5) (OTCQB: FNICF) (the "Company" or "Fathom") is pleased to announce the completion of the summer field exploration program at the Gochager Lake Project.

The Gochager Lake Project Summer Field Program (the "Program") Highlights:

- 2,926 B-horizon soil samples were collected from 3,183 designated sites.

- 337 rock samples, consisting of both chip samples and grab samples were collected from various outcrop locations.

- All 337 samples were analysed on-site by pXRF for nickel-copper-cobalt-sulphur and key mafic-ultramafic rock pathfinder elements (chrome and magnesium).

- Multiple well-mineralized samples have been submitted for multi-element assay along with a select number of samples for whole rock geochemical analysis.

- Unfortunately, due to a lightning-induced wildfire in the Gochager Lake area, the field crew was evacuated, and the Program was cut short by three days. Despite the truncated program, the crew was able to complete approximately 90% of the intended soil geochemistry sampling coverage.

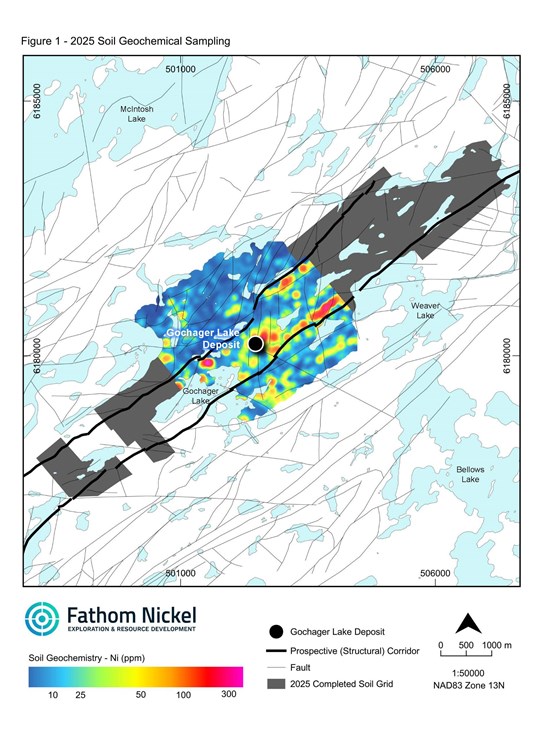

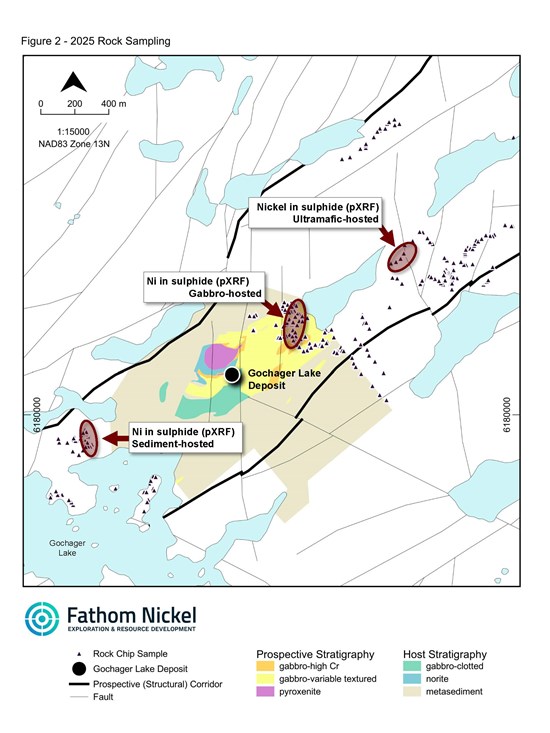

The Program summary is presented in Figures 1 & 2.

- Figure 1 illustrates the extension of the soil geochemistry along strike to the northeast and southwest of the area where the 2024 soil geochemistry survey was performed.

- The 2025 program has added approximately 3.5km of coverage to the northeast and approximately 2.5km of coverage to the southwest.

- Note: the areas to the southwest that are not highlighted in grey, are the areas where crews were unable to complete their work due to the encroaching wildfire.

- The area now covered by B-horizon soil geochemistry (from 2024 and 2025) totals approximately 9km in strike and 1-3km in width. To date, the soil geochemistry coverage has been focused within the interpreted structural corridor highlighted in Figures 1 and 2.

- Figure 2 illustrates chip sample locations and 3 notable polygons where pXRF analysis detected anomalous to very anomalous nickel in sulphide mineralization within metasedimentary, gabbroic and ultramafic rock.

- Nickel (Ni) in disseminated sulphide mineralization in an ultramafic host was detected approximately 1,200m along strike of the historic Gochager Lake deposit.

- Multiple locations of Ni in disseminated sulphide mineralization, in gabbroic rock was detected approximately 400-500m along strike of the historic Gochager Lake deposit.

- Note variable texture gabbro with Ni occurring in disseminated sulphide mineralization is the host rock at the historic Gochager Lake deposit. Furthermore, Fathom recognizes Ni in disseminated sulphide mineralization in ultramafic rock (pyroxenite) occurring immediately north of the historic Gochager Lake deposit.

- Elevated Ni in disseminated to semi-massive sulphide mineralization within a metasediment host was detected approximately 800m west-southwest of the historic Gochager Lake deposit. It is within this area that the highest Ni-in soil sample was collected (Fathom Press Release July 21, 2025).

- The historic Gochager Lake deposit area geology map will be updated once all analyses have been received and interpreted.

- We anticipate the receipt of all soil and rock geochemistry results by mid-September.

In acknowledging the efforts of the team in response to the wildfires, Ian Fraser, Fathom CEO and VP Exploration stated, "Firstly, I would like to thank the crew at TerraLogic Exploration Inc. for an excellent job done under extremely challenging circumstances. I must also acknowledge the leadership teams at both TerraLogic and Osprey Wings Ltd. for their swift action in ensuring a safe and complete evacuation of the Gochager Lake camp. I must also thank the team at JP Enterprises Inc. for their efforts in manning the pumps and sprinkler system at our camp. It has been a very challenging exploration season due to wildfires burning in our project area and we are very grateful that the crew was extracted safely and further commend the efforts of those individuals who remained in camp and ultimately saved our newly constructed 20-25 person all season camp."

He went on to comment on the exploration program and the future plans at Gochager Lake, "We look forward to interpreting the results of the soil and rock geochemistry program once assays are in hand in September. It is obvious from preliminary rock geochemistry that mineralized gabbro continues for a minimum of 500m along strike of the historic Gochager Lake deposit. We were delighted and very encouraged with the discovery of a mineralized ultramafic outcrop further along strike and on the other side of the lake from the known mineralized gabbro occurrences. We look forward to completing a geophysical survey to determine the conductivity associated with the newly discovered mineralized gabbro and ultramafic rock and to specifically determine if there is a conductor(s) below the small lake. Once we have all results in hand we will be in a better position to discuss the robust multi-element in-soil anomalies that flank the boundaries of the interpreted structural corridor and to determine the next exploration steps as we further define this burgeoning nickel camp in north central Saskatchewan."

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7843/262842_f6728b8674c48b15_002full.jpg

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7843/262842_f6728b8674c48b15_003full.jpg

Quality Assurance / Quality Control (QA/QC) Disclosure Statement

The Company contracted the services of TerraLogic Exploration Inc. ("TerraLogic") to conduct its soil and rock geochemistry program within the historic Gochager Lake deposit area. Soil samples were collected using either a hand auger or a geotool at pre-determined sites utilizing a 50m x 50m sample spacing configuration. B-horizon soil samples were collected at each site, placed in kraft soil sample bags and all metadata associated with each sample location was recorded. Once sorted and logged, samples were shipped to ALS Canada Ltd. ("ALS") in North Vancouver, British Columbia for multi-element analyses. All rock samples collected for analyses, once logged and sorted, were also sent to ALS for multi-element analyses.

As part of its ongoing exploration activities, Fathom is utilizing a portable Vanta™ XRF Analyzer ("pXRF") to provide real-time lithogeochemical, multi-element data on surface rock chip samples and rock grab samples collected in the field. The Vanta™ XRF Analyzer is a hand-held device, held in position for a total 120 seconds - beam 1 (30 seconds), beam 2 (60 seconds) and beam 3 (30 seconds) to allow for an effective reading of elements occurring at that specific point, and at that specific surface of a rock sample. All elements detected at that specific point; nickel, copper, cobalt plus key pathfinder elements, chrome and magnesium, are recorded. The reader is cautioned that pXRF data should be treated only as an indication of elements, as the accuracy of the beam position on a particular element is variable.

Qualified Person and Data Verification

Ian Fraser, P.Geo., CEO, VP Exploration and a Director of the Company and the "qualified person" as such term is defined by National Instrument 43-101, has verified the data disclosed in this news release, and has otherwise reviewed and approved the technical information in this news release on behalf of the Company.

About Fathom Nickel Inc.

Fathom is an exploration company that is targeting magmatic nickel sulphide discoveries to secure the supply of North American Critical Minerals and to support the global green energy transition.

The Company now has a portfolio of three high-quality exploration projects located in the prolific Trans Hudson Corridor in Saskatchewan: 1) The Albert Lake Project, a 90,000+ hectare project that hosts the historic Rottenstone Mine1. Fathom exploration to date at the Albert Lake project confirms: the Rottenstone deposit mineralization (Ni-Cu+Pd-Pt+Au ) extends to the south a minimum 40m and remains open, and the potential for a footwall offset of the Rottenstone deposit; a new Rottenstone-like (similar host rock and similar mineralization) discovery by drilling 500-550m W-NW of the historic mine; and similar Rottenstone-like host rock and mineralization intersected by drilling approximately 1.5km S-SW of the historic mine. 2) The 34,000+ hectare Gochager Lake Project that hosts the historic Gochager Lake deposit2. Fathom exploration to date at the Gochager Lake project confirms: the vertical extension of Ni-Cu-Co mineralization a minimum of 150m below the interpreted historic deposit boundary, and very good potential remains open for expansion in all directions; and multiple high-grade zones / chutes of vertically oriented Ni-Cu-Co sulphide breccia mineralization occur within the historic deposit and remain open for further expansion and delineation; and surface mapping and soil / rock geochemistry has confirmed the Gochager Lake deposit host rock and mineralization style; the footprint, extends a minimum 1,200m to the northeast and remains open for expansion along strike. 3) The 10,000+ hectare Friesen Lake Project located 40km southwest of the historic Rottenstone Mine and 30km northwest of the historic Gochager Lake deposit. The Friesen Lake property hosts the Olsen Cu-Ni-Pt Showing also referred to as the Friesen Lake Cu-Ni-Pt showing and is described as an ultramafic dyke that historic trenching and drilling demonstrates Cu-Ni-Pt-Pd and Au mineralization within the ultramafic dyke (Saskatchewan Mineral Deposit Index (SMID) #0928a). To date Fathom has not performed any exploration at the Friesen Lake Project.

1 - The Rottenstone Mine; a small open-pit mining / milling operation in production 1965-1969. Milling commenced September 5, 1965, operated through November 7, 1965, and 5,500 short tons were mined and milled, the average production grade being 3.23% Ni, 1.83% Cu, 0.14 oz/ton Pt, 0.10 oz/ton Pd, 0.03 oz/ton Au (9.26 g/t* 3E) and 0.20 oz/ton Ag for this period. Initial milling operations in 1965 produced 1,070 dry short tons of concentrates, the average grade being: 10.835% Ni, 5.74% Cu, 0.33 oz/ton Pt, 0.53oz/ton Pd, 0.10 oz/ ton Au (32.91 g/t* 3E) and 1.25 oz/ton Ag. (Richards, B.R. and Robinson, B.G.W. 1966), Mining and milling a small ore deposit …. Rottenstone Mining Limited: The Canadian Mining and Metallurgical Bulleting for December 1966. The Saskatchewan Mineral Deposit Index (SMDI) #0958 reports final mine production in 1969 of 28,724 tons with an average grade of 3.28% Ni, 1.83% Cu and 9.63 g/t 3E (Pd-Pt+Au) and that approximately 9,000 tons of concentrate were sold to the International Nickel Company of Canada Limited. * A factor of 34.286 g/tonne was used to convert 1 oz/ton to g/tonne (g/t).

2 - The Gochager Lake property is host to the historic Gochager Lake Ni-Cu deposit. There is no source or available Technical Reports to verify the historic resource estimate for the Gochager Lake deposit; hence, Fathom will treat the Gochager Lake deposit historic estimate as an Exploration Target. Available records in the SMDI and Saskatchewan Mineral Assessment Database (SMAD) suggest an Exploration Target of 4-5 million tons grading 0.3% Ni - 0.4% Ni and 0.08% Cu - 0.09% Cu, containing a higher-grade core of 1.5-2 million tons grading 0.6% NiEq - 0.7% NiEq (note NiEq is based on Ni-Cu only). The ranges of tons and grade are conceptual as there is insufficient historic data to verify the historical resource estimate(s) for the Gochager Lake deposit, and the higher-grade core. At present, Fathom has drilled 16 drillholes (5,549m) into the historic Gochager Lake deposit and has confirmed Ni-Cu grades comparable to and higher than the historical grades reported, thus confirming that a deposit of Ni-Cu+Co metal accumulation does exist at the historic Gochager Lake deposit / property. Furthermore, insufficient drilling has been done by the Company to define a current mineral resource, and again at this time, it is uncertain if further drilling will result in the Exploration Target being delineated as a mineral resource. The disclosed potential quantity and grade has been determined by historic records notably; the Saskatchewan Mineral Deposit Index (SMDI #0880) reports delineation drilling outlined a deposit at the historic Gochager Lake Deposit; Steel, J.S. (1990)(SMAD 73P15-0091) : Report on a Diamond Drilling Program on the Gallagher (Gochager) Lake Property of McNickel Inc., reported that Scurry-Rainbow Oil Ltd. constructed vertical sections and a longitudinal section from drill data collected 1966-1968, and an orebody with reasonably well-defined limits was interpreted. Ore reserves were then calculated for the Zone A. As stated above the historic estimate is not well documented and there are no available Technical Reports to support the historic resource estimate(s).

ON BEHALF OF THE BOARD

"Ian Fraser"

CEO, VP Exploration, Director

For further information, please contact:

Ian Fraser, CEO, VP Exploration

1-403-650-9760

ifraser@fathomnickel.com

Or

Doug Porter, President and CFO

1-403-870-4349

dporter@fathomnickel.com

Forward Looking Statements:

This news release contains "forward-looking statements" that are based on expectations, estimates, projections and interpretations as at the date of this news release. Forward-looking statements are frequently characterized by words such as "plan", "expect", "project", "seek", "intend", "believe", "anticipate", "estimate", "suggest", "indicate" and other similar words or statements that certain events or conditions "may" or "will" occur, and include, without limitation, statements regarding payment of terms under the Option Agreement, permitting for the Property, receipt of an exploration permit, timing of the exploration program on the Property and the Company achieving the earn-in thresholds under the Option Agreement. Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be "forward-looking statements." Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation: risks related to failure to obtain adequate financing on a timely basis and on acceptable terms; risks related to the outcome of legal proceedings; political and regulatory risks associated with mining and exploration; risks related to the maintenance of stock exchange listings; risks related to environmental regulation and liability; the potential for delays in exploration or development activities or the completion of feasibility studies; the uncertainty of profitability; risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; results of prefeasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Company's expectations; risks related to commodity price fluctuations; and other risks and uncertainties related to the Company's prospects, properties and business detailed elsewhere in the Company's disclosure record. Such forward looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. These forward-looking statements are made as of the date hereof and the Company does not assume any obligation to update or revise them to reflect new events or circumstances except in accordance with applicable securities laws. Actual events or results could differ materially from the Company's expectations or projections.

FNI:CC

The Conversation (0)

25 February

Oregon: America’s Premier Domestic Nickel Opportunity

The global race for critical minerals has begun. As the US stares down a future of massive industrial shifts, the strategy is clear: secure the supply chain or get left behind. Demand for nickel is hitting overdrive, fueled by its role in electric vehicle (EV) batteries, high-strength stainless... Keep Reading...

24 February

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to begin... Keep Reading...

24 February

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI,OTC:FNICF) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to... Keep Reading...

23 February

Ni-Co Energy Inc. Files Preliminary Prospectus for Proposed Initial Public Offering

Ni-Co Energy Inc. (“Ni-Co Energy” or the “Company”) is pleased to announce that it has filed a preliminary prospectus (the “Preliminary Prospectus”) with the securities regulatory authorities in the provinces of Québec, Ontario, Alberta, and British Columbia in connection with its proposed... Keep Reading...

12 February

Bahia Metals Corp. Completes Initial Public Offering of $5,750,000, with Full Exercise of Over-Allotment Option

Bahia Metals Corp. (CSE: BMT) ("Bahia" or the "Company") is pleased to announce that it has successfully completed its initial public offering (the "IPO") of 11,500,000 units of the Company (the "Units") at a price of $0.50 per Unit, inclusive of the full exercise of the 15% over-allotment... Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00