March 22, 2023

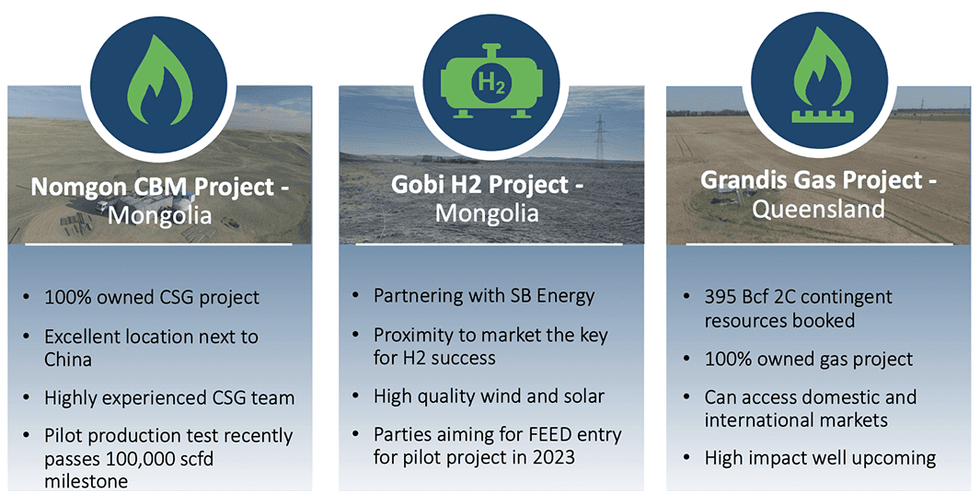

Elixir Energy (ASX:EXR) focuses on natural gas and hydrogen assets in Mongolia and in Queensland, Australia. Elixir Energy is the first company ever to flow gas in the country. The company is developing the Gobi H2 green hydrogen project in Mongolia. The project has exceptional renewable resource inputs and the potential to become a world-class hydrogen asset. The company has a maturing 50/50 partnership with Japan’s SB Energy in this project which has recently moved to the point of Term Sheet execution.

Elixir Energy’s Nomgon coal-bed methane (CBM) project is also located in the South Gobi region of Mongolia and on the Chinese/Mongolian border. The ideal location of the asset provides access to excellent infrastructure, including planned pipelines and local mines as customers. The Nomgon project includes a CBM pilot production plant, which recently passed an important milestone of 200,000 standard cubic feet per day (SCFPD).

In Queensland, Elixir Energy acquired the Grandis Gas project last year and is currently moving towards drilling the Daydream-2 appraisal well that will seek to increase contingent resources, possibly book initial reserves and confirm liquids content.

Company Highlights

- Elixir Energy is an exploration and development company with energy assets in Mongolia and Australia, targeting both renewable energy and natural gas.

- The company was the first to flow gas in Mongolia, pioneering production in the country.

- Elixir has two projects in Mongolia and an additional gas resource in Australia that cover a range of ever cleaner energy sources of the type global markets are increasingly demanding.

- The market for clean hydrogen has been steadily growing as technology has improved and carbon reduction goals have increased, allowing Elixir’s Gobi H2 project to potentially commence production just as demand skyrockets.

- The Gobi H2 project is also near China – allowing delivery by pipeline rather than boat, facilitating much lower cost deliveries. A PFS is currently underway as the company moves towards FEED entry.

- Elixir Energy’s Nomgon CBM asset’s pilot plant recently surpassed the initial milestone of 200,000 square cubic feet per day.

- The company’s Grandis Gas project in Queensland is located in an established gas and oil region and is moving towards a very high impact appraisal well later this year.

- A management team with a range of expertise in the natural resource sector leads Elixir Energy towards capitalizing on its assets.

This Elixir Energy profile is part of a paid investor education campaign.*

Click here to connect with Elixir Energy (ASX:EXR) to receive an Investor Presentation

EXR:AU

The Conversation (0)

02 May 2024

Elixir Energy

Early-mover in natural gas exploration and appraisal in Australia and Mongolia.

Early-mover in natural gas exploration and appraisal in Australia and Mongolia. Keep Reading...

Latest News

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00