Ayr Strategies Confirms Share Buyback, Raises 2019 Forecast

Ayr Strategies informed investors it will perform a buyback for 5 percent of its outstanding subordinate voting shares, amounting to 725,892 shares.

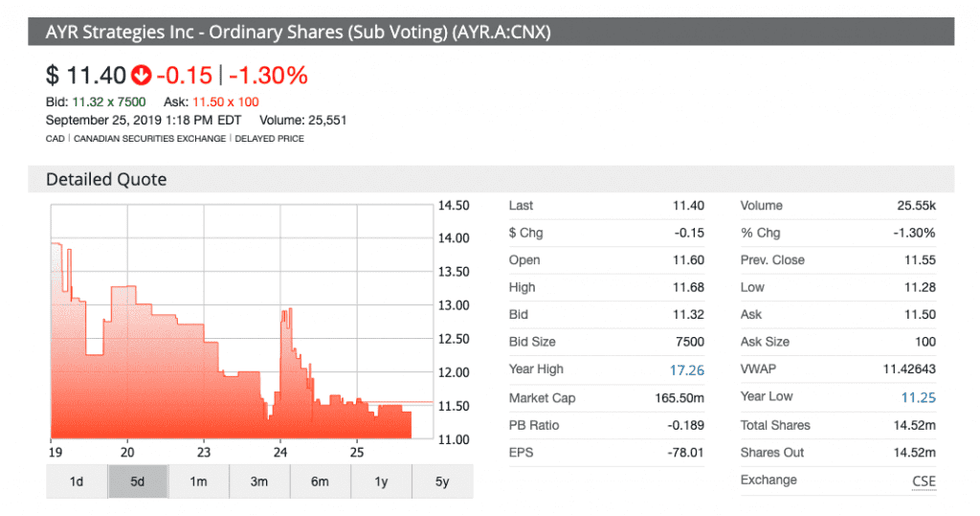

Cannabis firm Ayr Strategies (CSE:AYR.A,OTCQX:AYRSF) is looking to improve its standing in the industry through a share repurchase program.

On Tuesday (September 24), the multi-state operator (MSO) confirmed it will be authorizing a stock buyback of 5 percent, the maximum amount allowed by the Canadian Securities Exchange (CSE), where it is listed, over a 12 month period.

Starting on October 1, Ayr will begin buying a total of 725,892 subordinate voting shares. According to the firm, this action will be funded by cash flow generated from operations, which the MSO now projects to reach approximately US$1.7 million per month this year.

A share repurchase is a strategy companies use to buy back some or all of their outstanding shares with extra cash. Since it leaves fewer shares in the market, the stake of each investor increases in value.

Jonathan Sandelman, CEO of Ayr, said in a press release that the recent increase in cash flow for the company will give it the chance to “opportunistically repurchase” its stock for a worthwhile price, since the firm argues it is currently not valued appropriately.

Ayr’s chief operating officer, Jennifer Drake, told the Investing News Network (INN) that the current slump facing the industry has affected Ayr — forcing its share price down about 12 percent year-to-date — but it’s made the timing of this repurchase all the better for the company, since it can buy back its own shares at a reduced cost.

“We think … (Ayr) should be trading at a much higher multiple relative to the comparables, and so given the price action, we think this is a great time to be buying back what we think is one of the cheapest stocks in the sector,” the executive told INN.

Matthew Pallotta, equity research analyst at Echelon Wealth Partners, previously told INN that MSOs are facing a gap in valuations relative to the Canadian leaders of the public stock market.

“I think the discount is probably going to close regardless once people start seeing the revenue numbers these businesses are putting up,” Pallotta told INN.

Drake said Ayr’s investors will benefit from the increased value as a result of the repurchase.

According to Sandelman, the influx of cash for Ayr came during a run up in operations during the third quarter of 2019, giving the company the flexibility to buy back its shares.

The executive said the management of Ayr would have supported a repurchase of 10 percent worth of its shares, as is typical on other exchanges, but given the limitations from the CSE, 5 percent is all the company can buy back at this time.

“We believe repurchasing our shares represents one of the most attractive buying opportunities in the cannabis sector today, and this announcement reinforces our commitment to driving shareholder value.”

Sandelman added that the buying action will not affect the development path of the company.

Drake said Ayr is cash flow positive, a relative rarity in the cannabis space as companies in the nascent industry attempt to establish themselves under the weight of investor expectations. She added that Ayr plans on expanding its footprint across the US via consolidation strategies.

As part of its repurchase plan announcement, Ayr also adjusted its financial forecast for 2019.

Based on its results from Q3, the company increased the midpoint of its 2019 revenues and released an adjusted earnings before interest, tax, depreciation and amortization (EBITDA) estimate.

Ayr’s previous revenue projections were between US$110 million and US$130 million, but gains from the firm’s most recent quarter have shortened that range to US$120 million to US$130 million.

Ayr’s EBITDA for the fiscal 2019 year was altered to between US$35 million and US$40 million, from a previous range of US$30 million to US$40 million.

Ayr’s revenue in August was US$11.5 million, an 8.5 percent increase from July’s revenue of US$10.6 million and a 30.7 percent increase from the US$8.8 million in revenue reported in June.

In Ayr’s most recent financial results, the company reported it would be expanding production capacity at its Massachusetts facility due to increased demand. The MSO is also working on the vertical integration of its Nevada facility.

Don’t forget to follow us @INN_Cannabis for real-time news updates!

Securities Disclosure: I, Danielle Edwards, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.