Correction of all tables in the Summary of Financial Results

Forward Water Technologies Corp. (TSXV:FWTC) (the "Company") is pleased to announce that it has filed its condensed consolidated audited financial statements and related management's discussion and analysis for the three and six months ended September 30, 2023. Copies of these financial statements and related management's discussion and analysis can be found on the Company's issuer profile at www.sedar.com. All financial information in this news release is reported in Canadian dollars, unless otherwise indicated

Operating Highlights and Recent Corporate Developments

- On July 4, 2023, the Company issued a total of 410,909 common shares in settlement of compensation to AGORA for certain advertising services provided to the Company.

- On July 25, 2023, the Company announced that it had signed a Heads of Agreement for the potential lease- to-own of the Forward Osmosis ("FO") equipment with a leading developer of battery grade lithium sourced from aquifers using direct lithium extraction (DLE) technology.

- On August 31, 2023, the Company announced that it has entered into a non-binding Letter of Intent with Alborg CSP to access their flat panel and parabolic solar thermal solution offerings for integration into the Company's FO technology systems, specific to direct lithium extraction applications and where the use of solar thermal integration provides beneficial use to the client.

- On October 5, 2023, the Company issued a total of 452,000 common shares in the amount of $22,600 in settlement of compensation to AGORA Internet Relations Corp., for certain advertising services provided to the Company.

- On October 23, 2023, the Company completed a non-brokered private placement of 9,240,000 units at a price of $0.05 per unit for gross proceeds of $462,000. Each unit consisted of one common share of the Company and one common share purchase warrant. Each common share purchase warrant entitles the holder thereof to acquire one common share of the Company at a price of $0.075 per share at any time on or before October 20, 2026.

- On October 31, 2023, the Company announced a brokered private placement (the "Offering") of a minimum of 20,000,000 units ("Units") and a maximum of 40,000,000 Units, on a commercially reasonable efforts agency basis, at a price of $0.05 per Unit (the "Issue Price") for gross proceeds of between $1 million to $2 million. The Offering may consist of up to 26,525,774 units issued pursuant to the listed issuer financing exemption available under Part 5A of National Instrument 45-106 - Prospectus Exemptions ("NI 45-106") for maximum gross proceeds of $1,326,288.70 (the "LIFE Offering").

- In addition, the Company is proposing to complete, concurrent with the LIFE Offering, a brokered private placement of up to 40,000,000 Units on the same terms as the LIFE Offering, for gross proceeds of up to $2,000,000 (the "Concurrent Private Placement"). The Units sold under the Concurrent Private Placement will be sold pursuant to applicable exemptions under NI 45-106 other than the listed issuer financing exemption.

- In no case will the aggregate amount raised under the LIFE Offering and Concurrent Private Placement be more than $2,000,000 and no more than $1,326,288.70 will be raised though the sale of Units under the LIFE Offering. The closing of the LIFE Offering is conditional upon the raising of at least $1,000,000 in gross proceeds under the LIFE Offering and Concurrent Private Placement.

- Each Unit will consist of one common share of the Company (each, a "Share") and one Share purchase warrant of the Company (a "Warrant"). Each Warrant will entitle the holder to purchase one Share (each, a "Warrant Share") at a price of $0.075 per Warrant Share at any time on or before the date which is 36 months after the issuance of the Warrant, subject to adjustment in certain events.

- In December 2021, the Company began the building of a mobile demonstration unit which can be placed on a customer's site to allow for a longer term (6-8 month) performance of the FO technology at industrial throughput that is not achievable in a laboratory setting. This revenue-generating unit was completed in November, 2023 and is now available to be used by our customers.

Management Commentary

"We are pleased with the strong commercial groundwork that has been accomplished in the last quarter and by using this foundation, FWTC expects to complete several of the commercial opportunities it has developed."

Summary of Financial Results

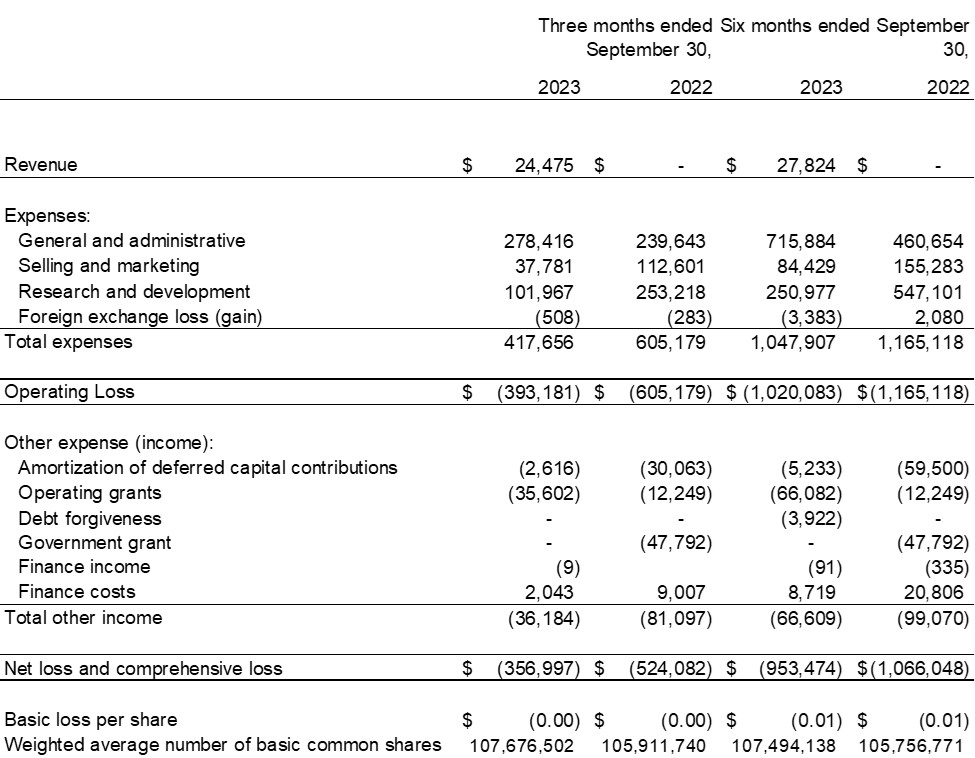

Income Statement

Balance Sheet

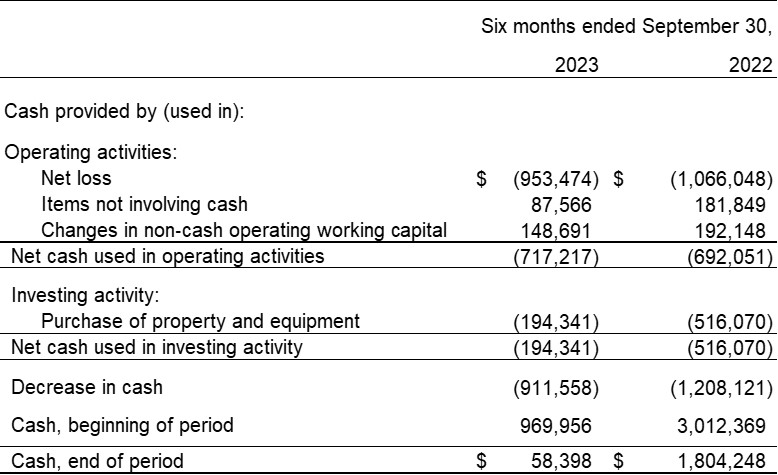

Statement of Cash Flows

About Forward Water Technologies Corp.

Forward Water Technologies Corp. is a publicly traded Canadian company dedicated to saving the earth's water supply using its patented Forward Osmosis technology. The Company was founded by GreenCentre Canada, a leading technology innovation centre supported by the government of Canada. The Company's technology allows for the reduction of challenging waste streams simultaneously returning fresh water for re-use or surface release. The Company's mandate is to focus on the large-scale implementation of its technology in multiple sectors, including industrial wastewater, oil and gas, mining, agriculture and ultimately municipal water supply and re-use market sectors. In addition, the Company has initiated early stage R&D for the treatment of food and beverage process streams.

For more information, please visit www.forwardwater.com.

Contact Information

For more information or interview requests, please contact:

C. Howie Honeyman - Chief Executive Officer

howie.honeyman@forwardwater.com

416-451-8155

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Forward-Looking Statements

Certain statements contained in this news release constitute "forward-looking information" as such term is used in applicable Canadian securities laws including statements regarding expansion and uptake of the Company's technology and the ability for the Company to achieve its growth strategy and business plan. Forward-looking information is based on plans, expectations and estimates of management at the date the information is provided and is subject to certain factors and assumptions, including, the ability to scale the technology and the adoption of the technology by potential customers.

Forward-looking information is subject to a variety of risks and uncertainties and other factors that could cause plans, estimates and actual results to vary materially from those projected in such forward-looking information. Some of the risks and other factors that could cause results to differ materially from those expressed in the forward-looking statements include, but are not limited to: the impacts from the coronavirus or other epidemics, general economic conditions in Canada, the United States and globally; unanticipated operating events; the availability of capital on acceptable terms; the need to obtain required approvals from regulatory authorities; stock market volatility as well as the other risks and uncertainties applicable to the Company as set forth in the Company's continuous disclosure filings filed under the Company's profile at www.sedar.com. The Company undertakes no obligation to update these forward-looking statements, other than as required by applicable law.

Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information.

SOURCE: Forward Water Technologies Corp.

View source version on accesswire.com:

https://www.accesswire.com/811088/correction-forward-water-technologies-announces-fiscal-year-2023-financial-results