Critical Elements Lithium Corporation (TSX-V:CRE)(OTCQX:CRECF)(FSE:F12) ("Critical Elements" or the "Corporation") is pleased to provide a corporate update regarding its exploration, engineering, permitting and project financing activities. The Corporation is fully funded for these preparatory activities leading to a potential final investment decision for its wholly-owned Rose Lithium-Tantalum project ("Rose Project" or "Project") in the James Bay Region of Northern Québec (the "Final Investment Decision"). Critical Elements is pleased to be working closely with the Cree Nation of Eastmain, the Grand Council of the Crees (Eeyou Istchee), and the Cree Nation Government under the Pikhuutaau Agreement signed in July 2019

Exploration Update

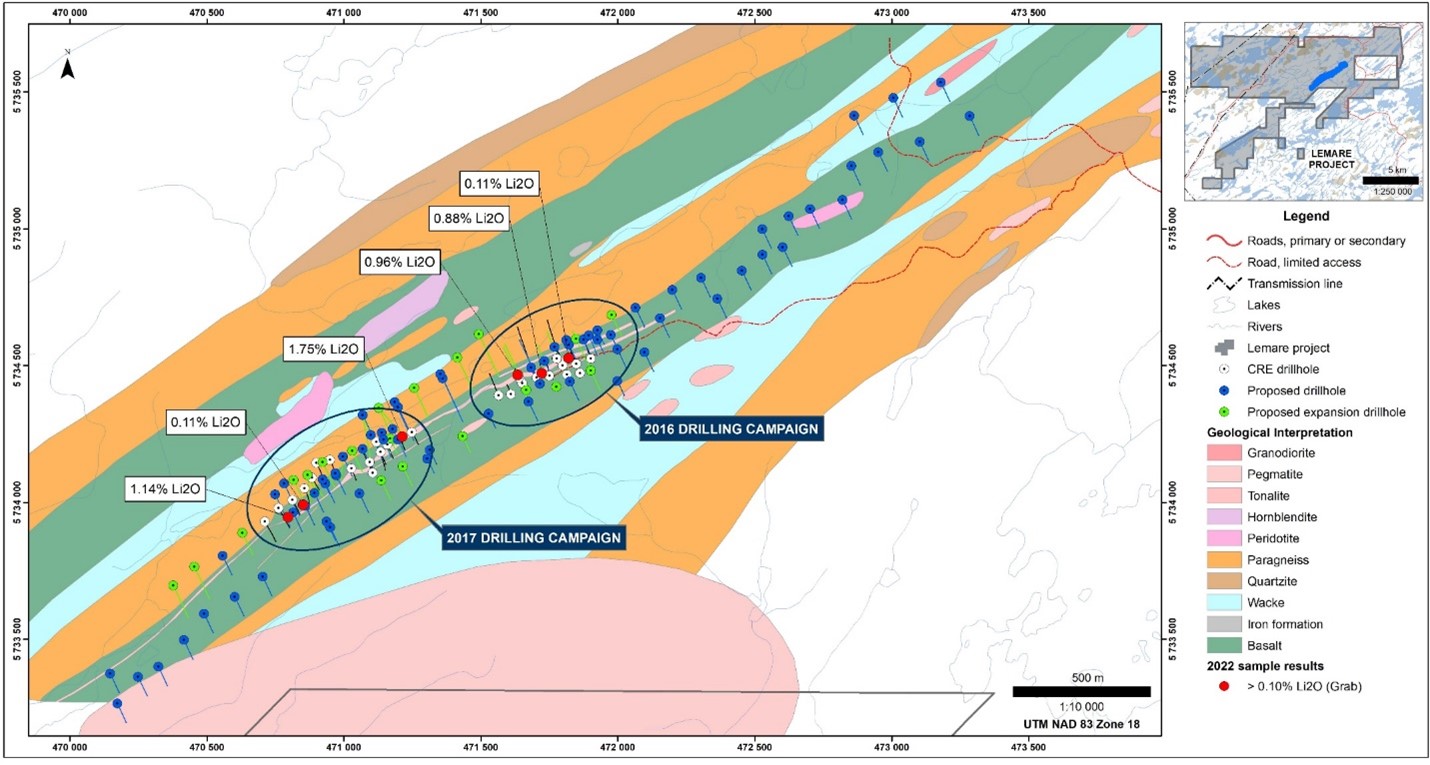

Critical Elements has commenced a drilling program on it's wholly owned Lemare Lithium project, located within a portion of the Corporation's highly prospective 1,050 km2 exploration portfolio. The objective of the drilling program is to confirm and expand the known Lemare zone identified by drilling in 2016-2017. The Corporation plans to drill approximately 7,000 meters during its winter program on Lemare with the objective of delivering an initial mineral resource estimate later this year.

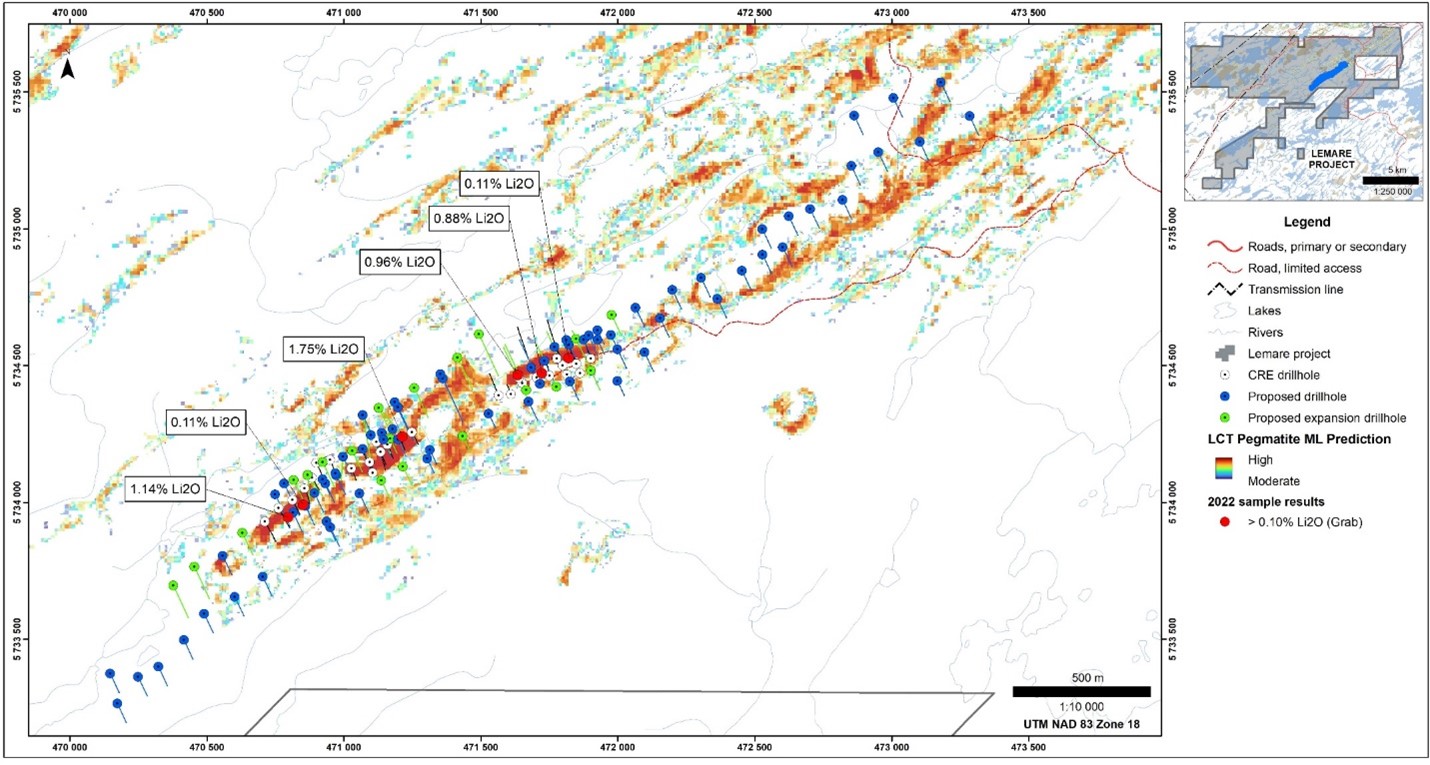

During the summer of 2022, Critical Elements conducted a prospecting program over the Lemare property and several areas of the Corporation's Nemaska belt property portfolio. Prior to the prospecting campaign, EarthLabs, through its GoldSpot Discoveries division, generated and ranked LCT pegmatite targets using its in-house "SmartTarget" methodology that combines both expert-driven and machine-learning data-driven targeting approaches. The objective of the field program was the identification of new pegmatite bodies using systematic rock geochemical sampling of all pegmatite bodies to refine the geological interpretation of the properties for further exploration work.

Sample results confirming the extension of the LCT pegmatite trend on the Lemare property had also extended the strike potential for future drilling on the Lemare property (Figure 1 and 2). The LCT pegmatite trend on the Lemare property now has a potential strike length of over 5 kilometres (See Press Release October 27th, 2022). The winter 2023 drill program will test some of this potential strike extension. Additional drilling is expected following the Lemare program, as part of the total 25,000m program announced in 2022.

Front-End Engineering Design Study

The Corporation is pleased to provide a progress update on the front-end engineering design ("FEED") studies for the process plant and related infrastructure. Bumigeme Inc. has been mandated to conduct a gap analysis on the process plant focusing on design review, optimization, and mitigation of potential risks related to the flowsheet developed during the feasibility study released by the Corporation in 2022 (the "2022 Feasibility Study"), a copy of which is available on the Corporation website and on SEDAR under its issuer profile. The gap analysis informs the FEED study to optimize and freeze the design of the process plant and produce an updated capital cost estimate. As of today, 98% of this mandate has been completed. On completion of the processing plant FEED study, a value engineering study will finalize this optimization, freeze the 3D layout for all equipment and define datasheet for long-lead equipment orders.

WSP has been conducting the FEED study for process and non-process infrastructure such as the main electrical station and 25 kV distribution, utilities, water management, final effluent facility, and mining support facilities. This infrastructure FEED study will optimize and freeze the design and produce an updated capital cost estimate. The infrastructure FEED study consists of optimizing the design and producing preliminary engineering documents to reduce some risks for the infrastructure project estimate. WSP will be responsible for consolidating all estimates from other consultants and producing the overall project estimate. As of today, more than 80% of the WSP mandate has been completed and the completion of the WSP mandate is scheduled for the end of February 2023.

Golder is now part of WSP. WSP-Golder has been mandated to complete the detailed engineering design of the stack tailings facility ("STF") for filtered mill tailings in co-disposal with a pit waste rock disposal facility ("WRF"). Engineering works include STF and WRF hazard classification, tailings laboratory testing, staging and placement, water management design, hydrogeological modelling and seepage collection, stability assessment, and an instrumented monitoring plan. As of today, more than 50% of the Golder mandate been completed and completion of this mandate is expected by the end of Q2 - 2023.

Detailed engineering is expected to follow value engineering and take 12 to 14 months. The Corporation is fully funded to complete all detailed engineering. Assuming project financing and specific construction permits are in place, tree clearing and site preparation may commence with detailed engineering being approximately 60% to 75% completed and a Final Investment Decision having been made. Based on the 2022 Feasibility Study, the construction period is expected to be approximately 20 months.

Bumigeme Inc. is a Montréal based multidisciplinary engineering firm offering various services in geotechnical, mining operations, ore processing, mechanical and electrical engineering. Bumigeme Inc. has executed several prefeasibility and feasibility studies as well as detailed engineering and construction activities on mining projects in Canada, South America and West Africa. Bumigeme Inc. conducted the original mineral processing of the 2017 Feasibility Study for the Rose Project.

As one of the world's leading professional services firms, WSP provides engineering, design, and strategic advisory services in Transportation & Infrastructure, Property & Buildings, Environment, Power & Energy, Resources and Industry sectors. WSP had previously conducted the infrastructure portion of the Corporation's original feasibility study and environmental impact assessment for the Rose Project released in 2017 (the "2017 Feasibility Study").

Golder is a global organization which offers construction, design, and consulting services in their specialist areas of earth, environment, and energy characterized by technical excellence, innovative solutions, and award-winning customer service. Their clients work in key sectors, namely mining, oil and gas, manufacturing, and the energy and infrastructure sectors.

Environmental Authorization and Permitting

The Province of Québec is considered one of the top mining jurisdictions globally by the Fraser Institute in its annual survey of mining companies. Permitting transparency is one of the key factors in the institute's considerations and certainty of land tenure is an essential driver of mining investment.

In August 2021, Critical Elements announced that the Federal Minister of Environment and Climate Change had rendered a favorable decision in respect of the proposed Rose Project. In a Decision Statement, which included the conditions to be complied with by the Corporation, the Minister confirmed that the Project is not likely to cause significant adverse environmental effects when mitigation measures are taken into account.

In May 2022, Critical Elements announced that the Québec Minister of Energy and Natural Resources has approved the rehabilitation and restoration plan concerning the Rose Project.

In November 2022, Critical Elements received the Certificate of Authorization pursuant to section 164 of Québec's Environment Quality Act from the Québec Minister of the Environment, the Fight against Climate Change, Wildlife and Parcs.

The receipt of the Certificate of Authorization pursuant to Québec's Environment Quality Act and the approval of the rehabilitation and restoration plan are a prerequisite to the granting of the mining lease and the land use lease that will be necessary to move forward with the Project.

The Corporation has been working actively to complete the application for the mining lease and land use lease. The Critical Elements team does not anticipate having any difficulty meeting the various conditions attached to the Federal and Provincial authorizations and is advancing the monitoring programs related to the Rose Project.

Project Financing Process

Critical Elements has commenced a formal process to receive and analyze multiple expressions of interest in participating in the financing and development of the project received to date. The Corporation's long-term strategy of avoiding Memorandums of Understanding for offtake arrangements leaves the Rose Project's planned production unencumbered in a tight market for spodumene concentrate, both for chemical conversion for the burgeoning EV battery market, and also for the higher margin glass and ceramics industry. The Corporation believes that the Project's location in a top mining jurisdiction with access to low cost, low carbon energy, as well as strong financial and human capital, makes the Rose Project's metallurgically attractive spodumene concentrate highly desirable. Management is actively engaged in identifying the optimal strategic partner or partners to maximize benefits for all the Corporation's stakeholders, but at this time, there can be no guarantees as to the timing and outcome of this process.

Qualified persons

Yves Perron, Eng. MBA, Vice-President Engineering, Construction and Reliability and Marc-André Pelletier, Project Geologist for the Corporation and Member in good standing with the Ordre des géologues du Québec (permit No. 2040)are the qualified persons that has reviewed and approved the technical contents of this news release on behalf of the Corporation.

About Critical Elements Lithium Corporation

Critical Elements aspires to become a large, responsible supplier of lithium to the flourishing electric vehicle and energy storage system industries. To this end, Critical Elements is advancing the wholly owned, high purity Rose lithium project in Québec, the Corporation's first lithium project to be advanced within a land portfolio of over 1,050 square kilometers. On June 13th, 2022, the Corporation announced results of a feasibility study on Rose for the production of spodumene concentrate. The after-tax internal rate of return for the Project is estimated at 82.4%, with an estimated after-tax net present value of US$1.9 B at an 8% discount rate. In the Corporation's view, Québec is strategically well-positioned for US and EU markets and boasts good infrastructure including a low-cost, low-carbon power grid featuring 93% hydroelectricity. The project has received approval from the Federal Minister of Environment and Climate Change on the recommendation of the Joint Assessment Committee, comprised of representatives from the Impact Assessment Agency of Canada and the Cree Nation Government and also received the Certificate of Authorization pursuant to section 164 of Québec's Environment Quality Act from the Québec Minister of the Environment, the Fight against Climate Change, Wildlife and Parcs.

For further information, please contact:

Patrick Laperrière

Director of Investor Relations and Corporate Development

514-817-1119

plaperriere@cecorp.ca

www.cecorp.ca

Jean-Sébastien Lavallée, P. Géo.

Chief Executive Officer

819-354-5146

jslavallee@cecorp.ca

www.cecorp.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is described in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary statement concerning forward-looking statements

This news release contains "forward-looking information" within the meaning of Canadian Securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "scheduled", "anticipates", "expects" or "does not expect", "is expected", "scheduled", "targeted", or "believes", or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". Forward-looking information contained herein include, without limitation, statements relating to the results and completion of the 2023 exploration program, the permitting process, the results and outcome of the Front-End Engineering Design Study as well as the outcome of the formal process launched by the Corporation in connection with the project financing. Forward-looking information is based on assumptions management believes to be reasonable at the time such statements are made. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information.

Although Critical Elements has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. Factors that may cause actual results to differ materially from expected results described in forward-looking information include, but are not limited to: final and complete results of the Corporation's 2023 exploration program, the final outcome of the permitting process and the Corporation's ability to meet all conditions imposed thereunder, the final results of the Front-End Engineering Design Study and its effects on the development of the Rose Project, the formal process launched in connection with the project financing not producing the anticipated and expected results, as well as those risk factors set out in the Corporation's Management Discussion and Analysis for its most recent quarter ended November 30, 2022 and other disclosure documents available under the Corporation's SEDAR profile. Forward-looking information contained herein is made as of the date of this news release and Critical Elements disclaims any obligation to update any forward-looking information, whether as a result of new information, future events or results or otherwise, except as required by applicable securities laws.

SOURCE: Critical Elements Lithium Corporation

View source version on accesswire.com:

https://www.accesswire.com/737702/Corporate-Update