Overview

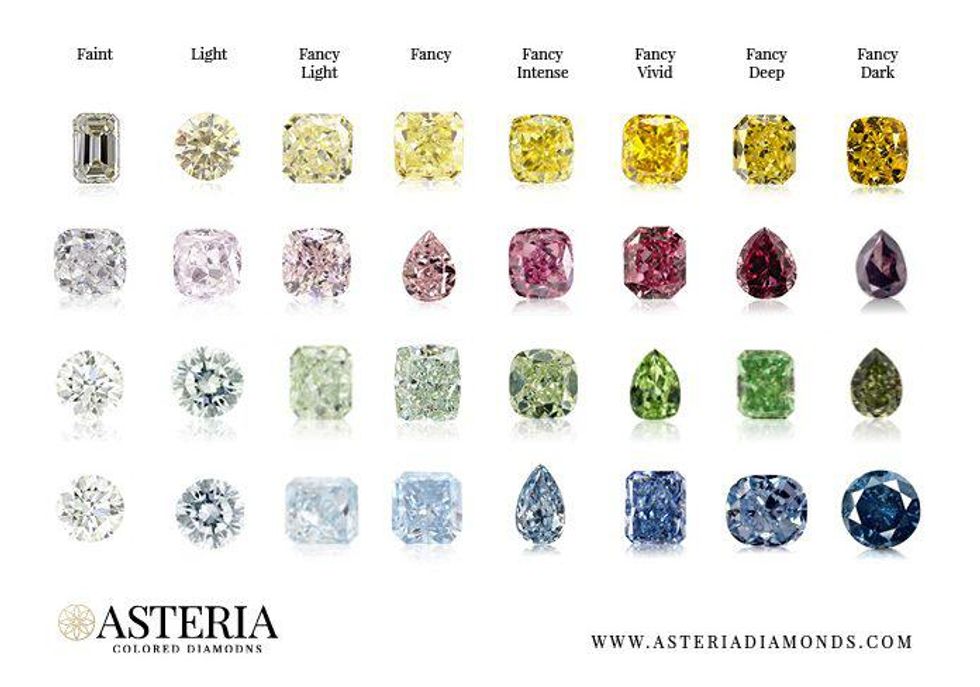

Asteria Diamonds is a family-run Israeli diamond and jewelry manufacturer that procures rough fancy colored diamonds from mines worldwide and produces in its base in Israel and branches spread around the world. After manufacturing these beautiful polished diamonds, they are then marketed and sold to jewellery stores and traders worldwide.

Early on in his career, in Israel, Eliyahu Bashari founded a company in his name that conducted diamond polishing and sales. Following the expansion of his first business into China, Bashari and his partner Ishai Bettan, later founded Asteria Diamonds in 2008. The reason of founding this establishment was to “Sell unique fancy colored diamonds and jewellery not readily available in most market places at wholesale prices”.

Today, Asteria Diamonds remains focused on supplying polished diamonds and jewelry for customers, investors and retailers across the world. “Asteria Diamonds has become a leading supplier of fancy colored diamonds by upholding our original principles of incomparable quality and services to our customers,” said Bashari.

Asteria Diamonds Highlights

- Over 40 years of reputation in the diamond industry

- Operations conducted in a very stable colored diamond market

- Certified by multiple diamond bourses across the world

- Compliance with the Kimberley process in assuring that all diamonds sold are conflict-free

- Vast network of global jewelers available for resale purposes if required

- Keen customer focus and available educational investment materials

- Agressively marketed web and social media platform assisting in sales directly to consumers.

- Variety of investment options including purchase of stones and partnerships on resale value of the diamonds