Overview

Sudbury, Ontario is like no other mining district in the world. The Canadian jurisdiction boasts a rich history rooted in mining and widespread mineralization that leverages advantageous positioning on the iconic Canadian Shield, land that is located right on the third-largest known impact crater on earth.

Known famously for its high-yield copper and nickel production, the mining-friendly district also hosts tremendous precious metal exploration and production across its many historic and past-producing mines. With such diverse mineralization and unique rock formations dating back millions of years, Sudbury presents investors and exploration companies with a perfect storm of discovery potential and rich historical production records.

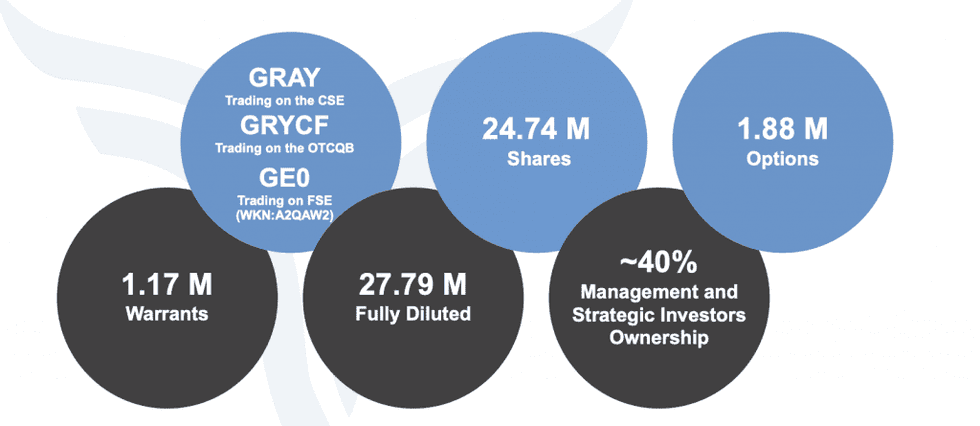

Graycliff Exploration (CSE:GRAY,FSE:GEO,OTC:GRYCF) is a Canadian-based junior exploration company exploring highly prospective gold projects in this historic gold-producing district of Ontario, Canada. The Company’s project portfolio consists of its flagship Shakespeare gold project and the newer Baldwin project.

The flagship Shakespeare project is located around the historic Shakespeare gold mine 88 kms west of Sudbury,Ontario. The 1, 025 hectare property leverages the region’s deep mining roots and high-grade mineralization in the shadow of a historic headframe. Historic and current exploration demonstrates exciting discovery opportunities and promising gold grades across multiple quartz vein and quartz vein stockwork targets.

The Baldwin project is just East of the Shakespeare property and both projects are transected by the prolific Murray Fault. Both projects are also situated in a well-known geological zone of the Canadian Shield, where the Archean, Southern and Superior geological provinces intersect. This boasts tremendous exploration opportunities for both projects

The next steps for Graycliff include continuing extensive drilling and further exploration programs for high-grade gold at Shakespeare and prospecting, sampling and geophysics at Baldwin. Historic work at Baldwin was for uranium only and historic reports suggest similar geology to Shakespeare. . The Company already initiated its Phase Three drilling program at its flagship property and remains excited uncover future gold discoveries.

Graycliff has a tight capital structure with 25 million shares outstanding with close to 40% being held by management, insiders and strategic shareholders. In April 2021, the Company announced the completion of a C$2.4 million non-brokered private placement. The net proceeds from the financing mean that Graycliff’s exploration programs at Shakespeare and Baldwin are fully funded through 2022. The Company hopes to find gold at Baldwin in 2022 and create a new Ontario gold camp

Graycliff Exploration’s management team and technical advisors bring together deep exploration experience and a pedigree across multiple major projects in Ontario. A notable technical advisor driving Graycliff’s mining operations is Bruce Durham, a significant figure credited with the discovery of several significant economic mineral deposits, including the David Bell mine, the Golden Giant mine, the Redstone Nickel mine and the Bell Creek Mine. Together, this leadership roster primes Graycliff for tremendous discovery and economic upside.

Company Highlights

- Graycliff Exploration is a Canadian junior exploration company engaged in acquiring, exploring, developing and extracting precious metals in prolific mining districts. Its property portfolio includes the Shakespeare and Baldwin gold projects located on the prolific Canadian Shield west of Sudbury, Ontario.

- The flagship Shakespeare project is located around the historic Shakespeare gold mine. Current exploration includes the third phase of drilling to identify further high-grade, near-surface gold and identifying new targets along it’s SW-NE trending mineralized horizon of over six kilometers.

- Historic reports suggest that the adjacent Baldwin project has similar geology to Shakespeare and initial field work is being carried out in 2021..

- The Company has a tight share structure with close to 40% of its shares management, insiders and strategic shareholders.

- Graycliff has an impressive management and technical advisory team with deep roots in exploration, project development and corporate finance.

Get access to more exclusive Gold Investing Stock profiles here