- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

Zinc Stocks: 5 Biggest Canadian Companies in 2025

How to Invest in Platinum Stocks, Bullion and More

Overview

Having the right team to push the development and exploration of mineral-rich assets sets a great mining company apart from the good ones. Particularly for precious metal properties, striking gold can sometimes be half the battle.

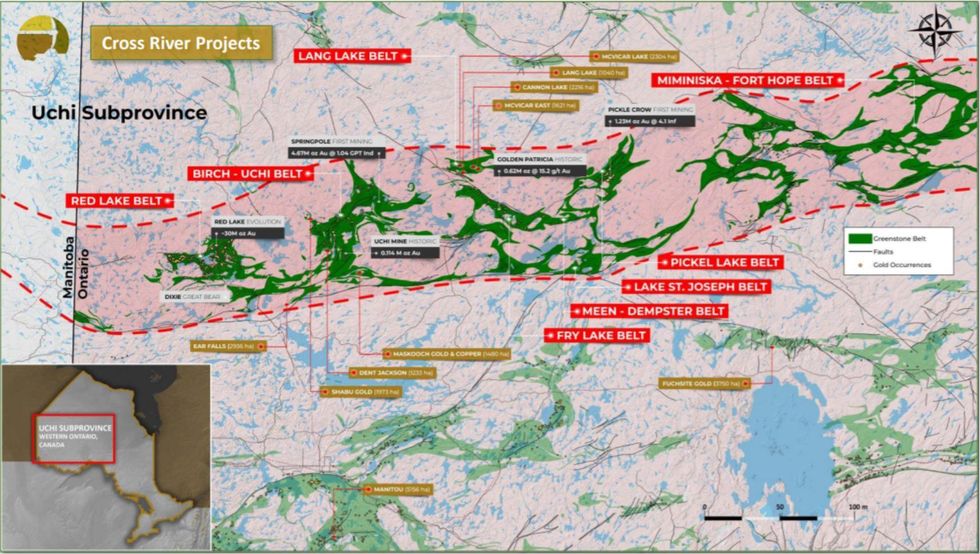

Cross River Ventures (CSE:CRVC) is a gold exploration company focused on developing high-quality exploration properties in top-tier mining districts. The company currently has a robust project portfolio in Northwest Ontario, Canada, along prolific, gold-bearing greenstone belts.

The Cross River Ventures leadership combines unparalleled expertise and technical experience across its all-star team of accomplished individuals. Dr. Rob Carpenter and Dr. Alan Wainwright, the company’s leading technical advisors, helped lead the Kaminak team to success with the multi-million-ounce discovery Coffee gold project in the Yukon.

Likewise, Cross River Ventures’ exploration manager, Lori Paslawski, has a proven history with volcanogenic massive sulfide (VMS) ore and gold districts, and she was instrumental in the target generation, delineation and expansion of Westhaven Gold (TSXV:WHN) Shovelnose gold discovery.

The company’s flagship property is the McVicar Lake gold project, which spans over 11,500 hectares in the Lang Lake Greenstone belt in Northwest Ontario. The rest of Cross River Ventures’ portfolio currently consists of the Manitou project, the Fuchsite gold project, the Tahsis copper-gold project and its four properties in the Uchi Belt, including the Dent-Jackson project.

Exploration plans for 2021 include continued compilation efforts of historical data and assessment of all projects, acquisition of remote sensing data through LIDAR imagery and airborne magnetic surveys, field work and analytical sampling. Projected drilling phases are to begin at priority projects starting at the end of the year.

Company Highlights

- Cross River Ventures is a gold exploration company focused on developing top-tier exploration properties in Ontario and British Columbia.

- Its flagship McVicar gold project is a dominant land position that spans the main structural elements of the entire Lang Lake Greenstone Belt in Northwestern Ontario. The project hosts high-grade gold mineralization with extensive gold discovery potential.

- Cross River’s project portfolio also consists of several highly prospective early-stage properties along the Uchi Greenstone Belt. This collection includes the Dent-Jackson, Shabu, Maskooch and Ear Falls properties.

- The company also operates the Dryden Area Manitou project and Fuchsite gold project in Ontario and the Tahsis copper-gold project on Vancouver Island.

- Cross River Ventures has a stellar technical team that includes big names such as Dr. Rob Carpenter, Dr. Alan Wainwright, Lori Paslawkshi and Daniel MacNeil.

Get access to more exclusive Gold Investing Stock profiles here