Overview

Constantine Metal Resources Ltd. (TSXV:CEM) ("Constantine") is a Canadian resource company actively advancing the Palmer copper-zinc-silver-gold-barite project, located near Haines, Alaska with its joint venture partner Dowa Metals & Mining Co. Ltd. (“Dowa"), where Constantine is the project operator. The Dowa and Constantine partnership was initiated in 2013 and in 2019 advanced the project to a positive Preliminary Economic Assessment (PEA). The PEA presents a low capex, low operating cost, high margin underground mining operation with attractive environmental attributes. The Joint Venture partnership is focused on advancing the Palmer project to feasibility, while continuing exploration to locate additional resources in this world class mining district.

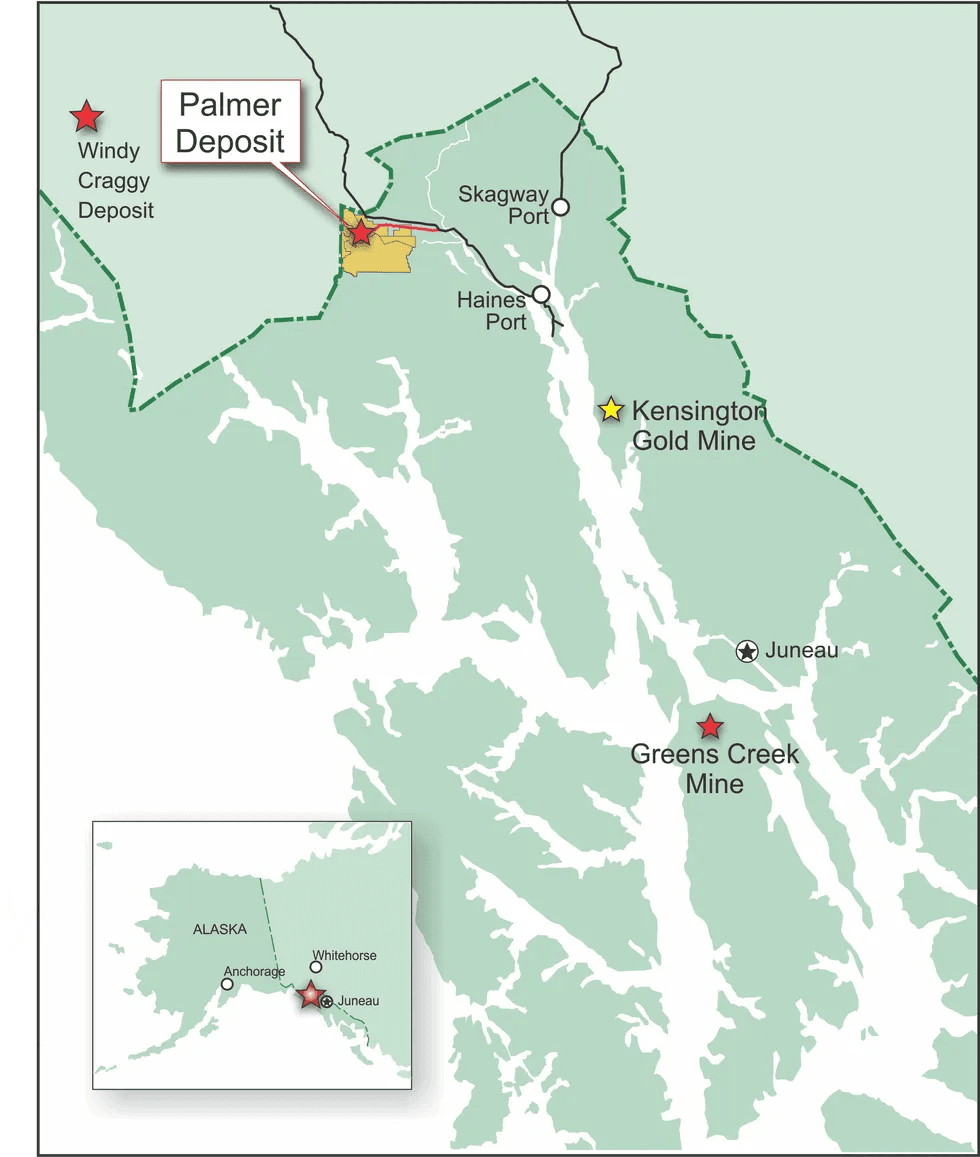

The Palmer property is located in southeast Alaska within a premiere mineral belt that is home to Greens Creek (Hecla Mining), a producing, very high grade, Ag-Zn-Au-Pb mine, the Kensington Gold Mine (Coeur Mining), and the giant world-class Windy Craggy Cu-Zn-Au-Ag deposit. Palmer, Greens Creek and Windy Craggy are volcanogenic massive sulphide (VMS) deposits that all occur in rocks of the same age.

* Mineral deposits on adjacent or similar properties are not indicative of mineral deposits on the Company’s property and there is no certainty of the same or similar deposits on the Company’s property.

The Palmer property is host to two NI 43-101 compliant resources, the Palmer Deposit and AG Deposit, with a total consolidated mineral resource of 4.68 million tonnes of 10.2% zinc equivalent in the indicated category and 9.59 million tonnes of 8.9% zinc equivalent in the inferred category.

The Palmer project and exploration camp facilities are located approximately 14 km by good gravel road from the Haines Highway, and provide excellent access to a local workforce, local services, established power and a deep seaport in Haines AK (~60 km by road).

*The PEA report is preliminary in nature and includes inferred mineral resources that are too speculative geologically to have economic considerations applied to enable them to be categorized as mineral reserves. There is no certainty that PEA results will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

Why Zinc?

The rise in the price of zinc, which has increased significantly since the start of 2021, can be largely attributed to a returned demand for steel production that uses zinc as an anti-corrosion coating for galvanized steel. As countries around the world continue to develop and invest in infrastructure, the demand for steel and therefore zinc may continue to rise. Zinc is also being evaluated as an important component in large scale energy storage batteries. Other less commonly known zinc applications include use in beauty and skin creams, sun blocks, diaper rash creams, and as an additive to fertilizers in areas of zinc deficient soils, particularly in Africa where zinc deficiencies are linked to serious health problems. Another interesting zinc use is made by fishermen and boat owners, who are known to secure zinc bars to a boat's hull to prevent corrosion of the boat's propellor by salt water.

Why Copper?

Copper is key to achieving decarbonization goals and also in developing the green economy. In current global efforts to decarbonize the planet, copper availability can be a limiting factor; for the goal of decarbonizing tomorrow's world copper is likely to continue to play an important role.

Copper has unique properties that make it critical for new green technologies, and is a key enabler to global decarbonization efforts:

- Electrical and thermal conductivity: Copper has the highest conductivity of any industrial metal, making it a success factor in electricity generation and transmission, and heat exchange applications.

- Flexibility: Copper can be formed, stretched, and heated without breaking, making it ideal for forming into intricate wiring in cars, smartphones, pipes and more.

- Recyclability: Copper can be recycled without any loss of quality.

Recycling efficiency is a huge part of supplying the ongoing demand for copper and Dowa, Constantine’s joint venture partner, is a world leader in metal recycling with proven integrated smelter capability.

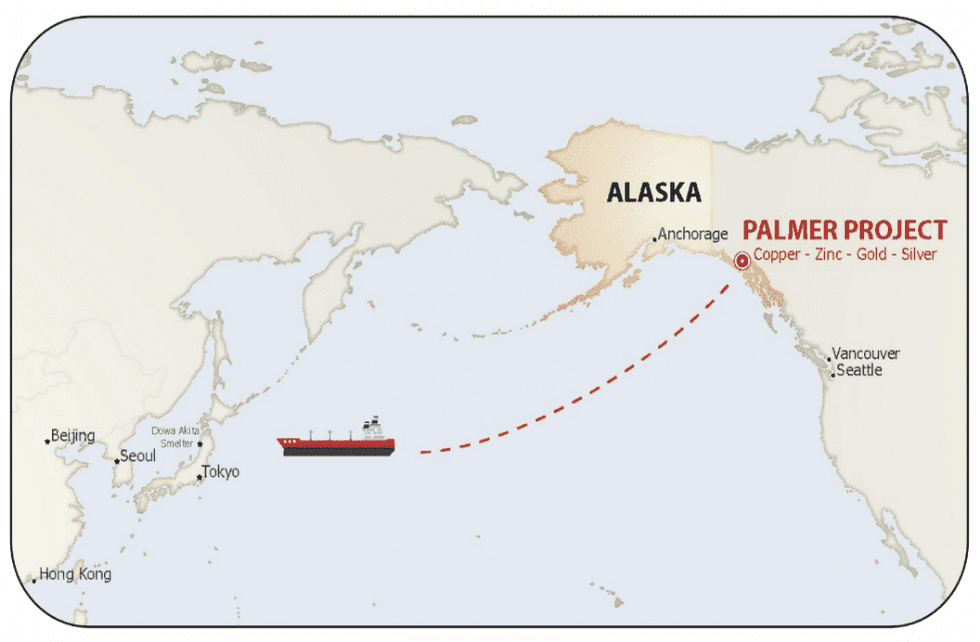

An important part of Constantine’s Palmer project story is its potential to produce high grade, underground, copper and zinc concentrate with exceptionally low greenhouse gas emissions. The Palmer project has environmentally low impact advantages as it is located where road access already exists and in proximity to a deep seaport that could offer convenient and efficient transport of goods.

Why Constantine?

Constantine is working aggressively to answer the current and future demand for base metals and has an active roadmap, with its partner Dowa, to move the Palmer Joint Venture project forward to production. In addition, the Company holds 100% interest in the Big Nugget gold project located “next door" to the Palmer project and has leased, with an option to purchase, the Bouse copper-gold project in southwest Arizona.

Company Highlights

- Constantine Metal Resources Ltd. (TSXV:CEM) is a base and precious metal exploration company focused on mining at premier locations in North America.

- The Company is led by a strong management team, providing decades of mining and international business experience.

- The flagship Palmer copper-zinc-silver-gold-barite project in southeast Alaska is a strategic Joint Venture with Dowa Metals & Mining Co. Ltd., the largest zinc smelting company in Japan. Dowa's involvement significantly de-risks the project and holds the off-take rights for 100% of the zinc concentrate at arm's length commercial terms.

- The Palmer project is 60 kilometers by road from a deep seaport, and a local community workforce.

- The property has favorable geology for responsible mine design: (1) underground (2) small footprint (3) abundance of carbonate-rich, environmentally benign host rocks. It represents a unique, low-sulphide VMS deposit with more barite than pyrite (actually a sulphide-sulphate deposit).

- The deposit is twenty-five weight percent barite that is environmentally inert and has favorable metallurgy to potentially produce by-product drilling muds for the oil and gas industry.

- The 2019 Preliminary Economic Assessment (PEA) of the project estimates a US$266M after-tax NPV 7% at more conservative prices than today and presents a low capex, low operating cost, high margin underground mining operation with attractive environmental attributes.

- In September 2019, Constantine successfully spun-out its gold assets into HighGold Mining Inc. (TSXV: HIGH) where shareholders received one HighGold share for every three Constantine shares held. The properties include the high-grade Johnson Tract gold project in south-central Alaska and the Munro-Croesus gold property in the Timmins area, Ontario which is renowned for its high-grade mineralization.

- More recently, the 100% owned Big Nugget Gold project, located 8 kilometers east of the Palmer project, was recognized as a potential gold lode source area, immediately upstream from the +80,000 ounce gold Porcupine Placer operations.

- In May 2021 Constantine announced the acquisition of the Bouse Cu-Au Property in southwest Arizona that will be explored for its copper-gold potential.

- In October 2021 Constantine announced acquisition of 100% interest in the 3,016 acres (1221 hectares) Hornet Creek property located in the Hornet Creek mining district of west-central Idaho, USA.

*The PEA report is preliminary in nature and includes inferred mineral resources that are too speculative geologically to have economic considerations applied to enable them to be categorized as mineral reserves. There is no certainty that PEA results will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

Get access to more exclusive Gold Investing Stock profiles here