Positive preliminary metallurgical results on samples from Jumbo Spodumene Pegmatite target at San Domingo Pegmatite District, Arizona

Bradda Head Lithium Ltd (AIM:BHL)(TSX-V:BHLI)(OTCQB:BHLIF), the North America-focused lithium development group, is pleased to announce positive metallurgical heavy liquid separation ("HLS") results from test work undertaken by the SGS Metallurgical Process Facility in Lakefield, Canada ("SGS Canada") on quartered drill core samples taken from its Jumbo Exploration Target at San Domingo District, Arizona, USA

Overview

- Three composite samples were selected for test-work, representing the low grade, medium grade and high-grade environment reflected in the maiden 2022/2023 exploration programme previously reported from drilling undertaken at the Jumbo Target in the San Domingo Pegmatite district in Arizona.

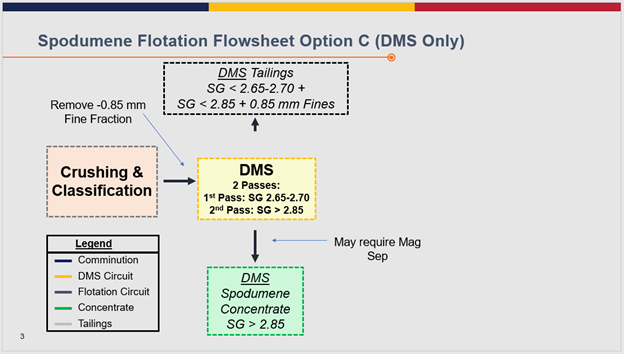

- After discussion with SGS Canada, an initial HLS test was undertaken to evaluate the potential for dense media separation ("DMS") to produce a sellable Li-oxide concentrate product (see attached test work flowsheet). This test work is predominantly preliminary in its approach. The measured head grade of the samples were 3.05% Li2O, 1.03% Li2O and 0.34% Li2O, reflecting the high, medium and low-grade range seen in our drilling results to date.

- Despite the preliminary nature of this test-work programme, it was highly encouraging to see the medium-grade sample produce an 'in spec' lithium oxide concentrate product with a 6.0% Li2O grade and an interpolated recovery of contained lithium to the concentrate of 50.3%, at a ¼" size crush size. Tailings rejection was considered efficient in this scenario with the rejection of 60.6% mass and a loss of only 2.1% lithium.

- Alternately, at a crush size of 3/8" (9.5 mm), a concentrate was produced with a grade of 5.5 % Li2O at a 55.5% recovery of contained lithium oxide. This is still considered in spec in the current market. 'In spec' Li concentrate currently sells in the Lithium-Oxide Spot Market for circa US$2,100/ tonne.

- Using the medium-grade sample, the flotation feed, a combination of middling product from the HLS testing at a crush size of ¼" and under sized fraction (minus 0.85 mm), recorded an upgraded value of 1.57% Li2O with Li distribution of 47.0% and a mass distribution of 30.5%.

- At our request, SGS Canada also undertook Tescan Integrated Mineral Analyzer analysis of the medium grade sample, finding a dominance of spodumene as the primary lithium mineral with possible, but very minor petalite and eucryptite, along with muscovite, minor beryl, tourmaline, calcite, and apatite. The overall iron content is low,

- Bradda is currently undertaking a second drilling programme at its San Domingo Pegmatite District with approximately 75% of the programme being complete. Assay results to date were released on November 12 2023, highlighted by drill hole SD-DH23-049 which contains 6.35m @ 0.83% Li2O followed by 3.05m @ 1.03% Li2O, with more results arriving in the near future.

- Metallurgical test work is now currently on hold whilst Bradda collects more representative samples from this next phase of drilling to undertake a more detailed test work programme.

Bradda has 33km2 license area under its control within this exciting pegmatite district. It is a historical lithium mining environment with over 7 historic mines that focused on shallow open pit extraction of spodumene during the late 1940s and early 1950s. Bradda commenced drilling in H2 of 2022 (7,300m) and is on its second campaign of 6,100 meters of core drilling, designed to expand on existing mineralized intercepts and drill-test newly developed high-quality lithium in pegmatite targets derived from soil sampling and surface mapping.

Diamond core drilling continues at the San Domingo Pegmatite project with approximately 75% of the program completed, where many of the holes have encountered long intervals of pegmatite with visible spodumene mineralization. Assay results have been slow to arrive due to the summer rush at the laboratory, but drilling progress is good. Additional permits were received from the State and BLM, sites are being constructed at the historic Morning Star lithium mine and drilling there is planned to commence shortly. The Company hopes to have news on San Domingo within the next few weeks as preliminary results have started to arrive.

Ian Stalker, Executive Chairman, commented:

"These results are highly encouraging, and quite simply better than expected from what can only be described as preliminary non-detailed scoping test work. To produce an 'in spec' sellable gravity concentrate reflecting over 50% recovery to the concentrate from a sample grading 1.03% Li2O on first pass test work is simply mouth watering. Gravity Concentration, in this case, otherwise referred to as dense media separation, is a standard, low cost, simple process with a small, relatively non-invasive foot print.

"It is the kind of process operation that is quick to design and install, and yet can deliver very attractive economic returns. We are therefore highly encouraged, and when the next phase of drilling at San Domingo is complete and sufficient sample material is available, we will revert quickly to SGS with a more detailed test work and study programme to further the above objective."

For further information please visit the Company's website: www.braddaheadltd.com

Qualified Person (BHL)

Joey Wilkins, B.Sc., P.Geo., is Head of North America at BHL and the Qualified Person who reviewed and approved the technical disclosures in this news release. Mr. Wilkins is a graduate of the University of Arizona with a B.Sc. in Geology with more than 37 years of experience in mineral exploration and is a qualified person under the AIM Rules and a Qualified Person as defined under NI-43-101. Mr. Wilkins consents to the inclusion of the technical information in this release and context in which it appears.

Independent Qualified Person (SGS)

The technical content relating to metallurgical testing disclosed in this document was reviewed and approved by Curtis Mohns, P.Eng., Senior Metallurgist at SGS Canada. Mr. Mohns has an M.Sc. in Mineral Processing Engineering and 29 years of related professional experience. Mr. Mohns is a Qualified Person as defined under NI 43-101.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES OF THE MARKET ABUSE REGULATION (EU No. 596/2014) AS IT FORMS PART OF UK DOMESTIC LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT 2018. UPON THE PUBLICATION OF THIS ANNOUNCEMENT VIA A REGULATORY INFORMATION SERVICE, THIS INSIDE INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN AND SUCH PERSONS SHALL THEREFORE CEASE TO BE IN POSSESSION OF INSIDE INFORMATION.

ENDS

Contact:

| Bradda Head Lithium Limited | +44 (0) 1624 639 396 |

| Ian Stalker, Executive Chairman Denham Eke, Finance Director | |

| Beaumont Cornish (Nomad) James Biddle/Roland Cornish | +44 20 7628 3396 |

| Panmure Gordon (Joint Broker) | +44 20 7886 2500 |

| John Prior / Hugh Rich | |

| Shard Capital (Joint Broker) | +44 207 186 9927 |

| Damon Heath / Isabella Pierre | |

| Red Cloud (North American Broker) | +1 416 803 3562 |

| Joe Fars | |

| Tavistock (Financial PR) | + 44 20 7920 3150 |

| Nick Elwes / Adam Baynes | braddahead@tavistock.co.uk |

About Bradda Head Lithium Ltd.

Bradda Head Lithium Ltd. is a North America-focused lithium development group. The Company currently has interests in a variety of projects, the most advanced of which are in Central and Western Arizona: The Basin Project (Basin East Project, and the Basin West Project) and the Wikieup Project.

The Basin East Project has an Indicated Mineral Resource of 17 Mt at an average grade of 940 ppm Li and 3.4% K for a total of 85 kt Lithium Carbonate Equivalent ("LCE") and an Inferred Mineral Resource of 210 Mt at an average grade of 900 ppm Li and 2.8% K (potassium) for a total of 1.0 Mt LCE. In the rest of the Basin Project, SRK has determined an Exploration Target of 250 to 830 Mt of material grading between 750 to 900 ppm Li, which is equivalent to a range of between 1 to 4 Mt contained LCE. The Group intends to continue to develop its three phase one projects in Arizona, whilst endeavouring to unlock value at its other prospective pegmatite and brine assets in Arizona, Nevada, and Pennsylvania. All of Bradda Head's licences are held on a 100% equity basis and are in close proximity to the required infrastructure. Bradda Head is quoted on the AIM of the London Stock Exchange with the ticker of BHL, on the TSX Venture Exchange with a ticker of BHLI, and on the US OTCQB market with a ticker of BHLIF.

Technical Glossary

Li2O | Lithium Oxide |

pegmatite | A pegmatite is an igneous rock showing a very coarse texture, with large interlocking crystals usually greater in size than 1 cm (0.4 in) and sometimes greater than 1 meter (3 ft). Most pegmatites are composed of quartz, feldspar, and mica, having a similar silicic composition to granite. However, rarer intermediate composition and mafic pegmatites are known. |

Spodumene | Spodumene is a pyroxene mineral consisting of lithium aluminium inosilicate, LiAl(SiO3)2, and is a source of lithium. Spodumene contains 3.73% lithium. |

Lepidolite | Lepidolite is a lilac-gray or rose-colored member of the mica group of minerals with chemical formula K(Li,Al)3(Al,Si,Rb)4O10(F,OH)2.[2][3] It is the most abundant lithium-bearing mineral[4] and is a secondary source of this metal. It is the major source of the alkali metal rubidium. Lepidolite contains 3.58% lithium. |

The formula to convert lithium in parts per million (PPM) to lithium oxide is to multiply Li ppm times 2.1527, then is reported in percent.

| Kt | Thousand tonnes |

| Ppm | Parts per million |

| Exploration Target | An estimate of the exploration potential of a mineral deposit in a defined geological setting where the statement or estimate, quoted as a range of tonnes and a range of grade (or quality), relates to mineralisation for which there has been insufficient exploration to estimate a Mineral Resource. |

| Inferred Mineral Resource | That part of a Mineral Resource for which quantity and grade (or quality) are estimated on the basis of limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological grade (or quality) continuity. It is based on exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes. An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to an Ore Reserve. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration. |

| Indicated Mineral Resource | That part of a Mineral Resource for which quantity, grade (or quality), densities, shape and physical characteristics are estimated with sufficient confidence to allow the application of Modifying Factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Geological evidence is derived from adequately detailed and reliable exploration, sampling and testing gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes, and is sufficient to assume geological and grade (or quality) continuity between points of observation where data and samples are gathered. |

Forward-Looking Statements

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This News Release includes certain "forward-looking statements" which are not comprised of historical facts. Forward-looking statements include estimates and statements that describe the Company's future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as "believes", "anticipates", "intends to", "expects", "estimates", "may", "could", "would", "will", or "plan". Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management's expectations. Risks, uncertainties and other factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward looking information in this news release includes, but is not limited to, following: The Company's objectives, goals or future plans. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to: failure to identify mineral resources; failure to convert estimated mineral resources to reserves; delays in obtaining or failures to obtain required regulatory, governmental, environmental or other project approvals; political risks; future operating and capital costs, timelines, permit timelines, the market and future price of and demand for lithium, and the ongoing ability to work cooperatively with stakeholders, including the local levels of government; uncertainties relating to the availability and costs of financing needed in the future; changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices; delays in the development of projects, capital and operating costs varying significantly from estimates; an inability to predict and counteract the effects of COVID-19 on the business of the Company, including but not limited to the effects of COVID-19 on the price of commodities, capital market conditions, restriction on labour and international travel and supply chains; and the other risks involved in the mineral exploration and development industry, and those risks set out in the Company's public documents filed on SEDARplus. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact rns@lseg.com or visit www.rns.com.

SOURCE: Bradda Head Lithium Limited

View source version on accesswire.com:

https://www.accesswire.com/806936/bradda-head-lithium-ltd-announces-positive-san-domingo-metallurgical-results