Leveraging exploration experience on a new project with similarities

to Storm Copper and deposits of the Central African Copper Belt

Aston Bay Holdings Ltd. (TSX-V:BAY)(OTCQB:ATBHF) (the "Company" or "Aston Bay") is pleased to announce that on February 29, 2024, it entered into a binding letter agreement (the "Agreement") with Emerald Geological Services ("EGS") pursuant to which it has been granted an option (the "Option") to acquire an undivided 80% beneficial interest in a property owned by EGS in Nunavut, Canada (the "Property

Highlights

- $3 million total expenditure over four years to acquire an 80% interest with no yearly minimums

- Over 74-kilometre ("km") long trend of sediment hosted style stratiform copper ("Cu"), silver ("Ag"), zinc ("Zn") and cobalt ("Co") mineralization

- Chalcocite boulders at surface yield up to 61.2% Cu with 5600 grams per tonne ("g/t") Ag in select grab samples

- Several polymetallic trends already identified in rock and soil sampling

- Recent prospecting rock grab samples yielded up to 37.8% Cu, 27.4% Zn, 1100 g/t Ag, 3 g/t gold ("Au") and 1700 ppm Co

- Mineralization is similar in style to the mineralization in deposits of the Central African Copper Belt and the Storm Copper Project

- Airborne electromagnetic ("EM") geophysics and prospecting planned for 2024 season

- Permitting for drilling is well advanced

"We are very excited to option the Epworth Property," stated Thomas Ullrich, CEO of Aston Bay. "This is an impressive 74-kilometre-long trend of high-grade copper, silver and zinc mineralization with accompanying gold, cobalt and lead. This mineralization is in a style typical of the Central African Copper Belt that boasts several large, high-grade deposits. We have similar mineralization at our Storm Project and look to leverage our knowledge and experience gained there to make new discoveries at Epworth."

Bruce MacLachlan from Emerald Geological Services added, "EGS is extremely pleased to partner with Aston Bay in advancing the Epworth Property, as we feel that this underexplored sedimentary belt has the potential to host large base metal deposits. We are excited to work with a company that shares our vision and which has already had success in similar geological settings in Nunavut."

Figure 1: Payback South Boulder. Massive chalcocite with silver (61% Cu, 5600 g/t Ag).

Location

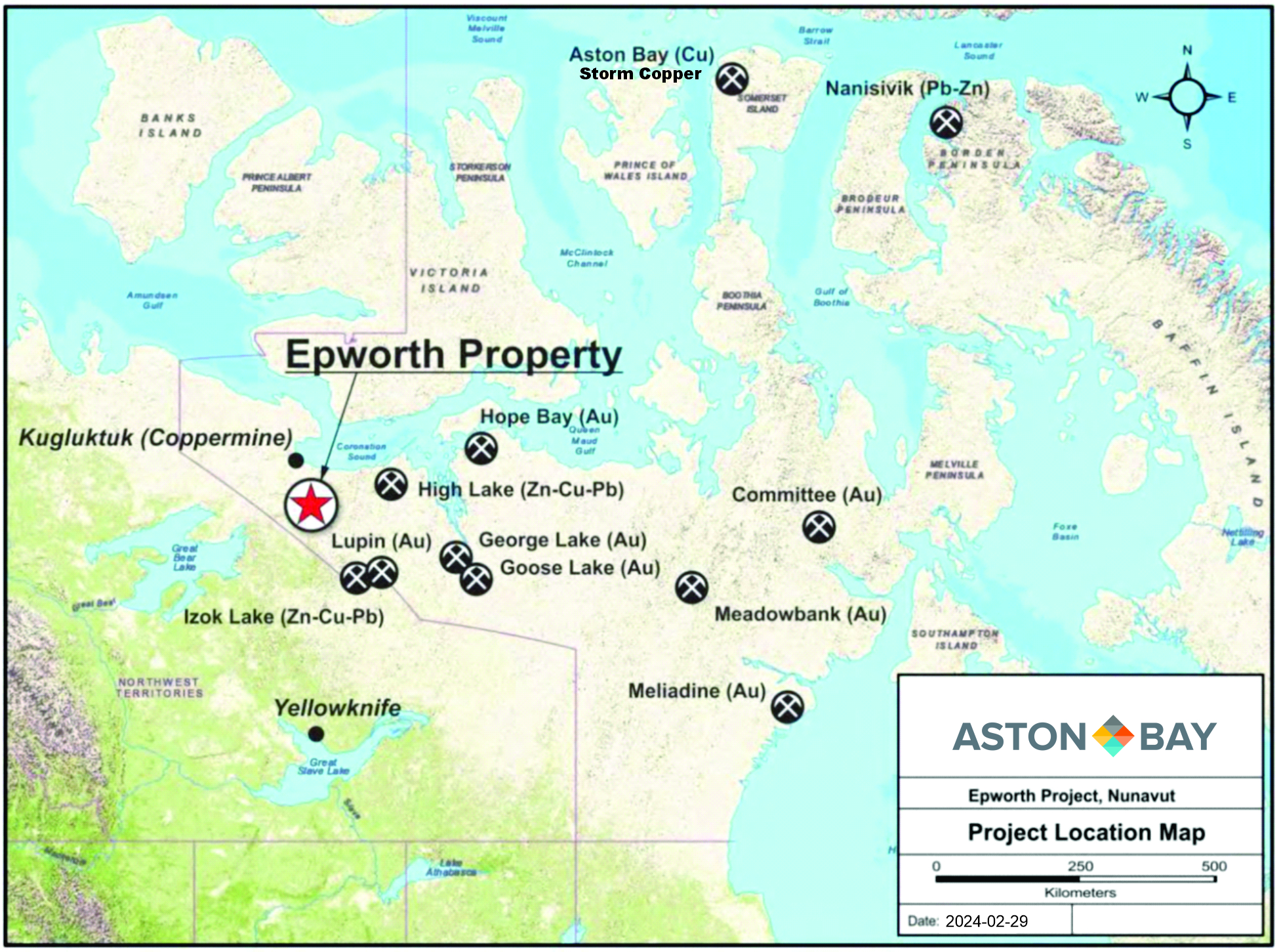

The Epworth Property is located approximately 80 km southeast of the village of Kugluktuk (formerly Coppermine) in the Kitikmeot Region of Nunavut, Canada (Figure 2). The property is approximately 70 km from tidewater to the north. Logistical access is provided by float plane and helicopter from Kugluktuk and the city of Yellowknife 500 km to the south. Recent staking has significantly expanded the size of the property from 15 claims over 8320 hectares (20,559 acres) to now consist of 51 claims covering an area of 71,134.86 hectares (175,778 acres) over a trend approximately 74 km by 14 km in lateral extent.

Figure 2: Location of the Epworth Property, Nunavut, Canada.

Geology

The Epworth Project is part of a broad platform-type clastic carbonate sequence belonging to the early Proterozoic Coronation Supergroup that extends from the north shore of Takijuq Lake to the Coronation Gulf for over 130 km. Polymetallic sulphide mineralization occurs as disseminations in the matrix of coarse clastic quartzites or as concordant zones of cherty replacements within permeable dolomite. The mineralization assemblage, stratigraphy, diagenetic evolution and rift-related tectonic setting of the Coronation Supergroup compares favourably to the African Copperbelt that hosts large (>100mt) high-grade (3-4% Cu) sediment-hosted stratiform copper deposits.

History

Noted from the air by a bush pilot in the 1940s, The Epworth Project was explored by Noranda Mining and Exploration in the mid-1990's discovering new base metal showings. Prospecting, mapping, geophysics and sparse drilling (only 132m in the original claim block,

Recent Work

Prospecting programs in the 2020's have defined several trends in conjunction with historic work. Rock grab samples up to 38% Cu, 1100 g/t Ag, 3 g/t Au, 27% Zn, 17% lead along with 1700 ppm Co and other anomalous mineralization define the 2.8 km long "Metallic Trend." Prospecting and soil sampling have yielded promising new trends and showings such as the new Northeast Showing discovered in 2023 yielding up to 19% Pb and 0.8% Cu in rock grab samples.

Aston Bay will provide more comprehensive information on the Epworth Property on an updated website in the coming weeks.

Terms of the Agreement

Under the terms of the Agreement, Aston Bay can earn an 80% undivided interest in the Property by spending a minimum of $3 million on qualifying exploration expenditures ("Expenditures") over a four-year period. Aston Bay also agreed to make a cash payment of $50,000 to EGS on the business day following the date of the Agreement. EGS shall be the operator during the term of the Agreement, but the parties shall also establish a technical committee to approve all Expenditures. The technical committee will be composed of two members, one appointed by each of Aston Bay and EGS, with Aston Bay to have a casting vote.

The Agreement provides for an 80 / 20 joint venture (the "JV") to be formed between the parties upon Aston Bay earning its interest in the Property. The Agreement is binding, but it also provides that it will be replaced by a definitive agreement and such agreement will contain the terms of the agreement that will govern the JV. Pursuant to that agreement, EGS will have a carried interest until the JV completes a bankable feasibility study in respect of the Property, with EGS's contributions to the JV to be credited against future revenue from the Property. After completion of a bankable feasibility study, EGS shall be diluted in the event it does not contribute its proportionate share and its interest will be converted into a 2% net smelter return if its interest is diluted to below 10%. Aston Bay shall have a right to repurchase 50% of such royalty for $1.5 million during the two-year period after commencement of commercial production from the Property.

Qualified Person

Michael Dufresne, M.Sc., P.Geol., P.Geo., is a qualified person as defined by National Instrument 43-101 and has reviewed and approved the scientific and technical information in this press release.

About Aston Bay Holdings

Aston Bay is a publicly traded mineral exploration company exploring for high-grade copper and gold deposits in Virginia, USA, and Nunavut, Canada. The Company is led by CEO Thomas Ullrich with exploration in Virginia directed by the Company's advisor, Don Taylor, the 2018 Thayer Lindsley Award winner for his discovery of the Taylor Pb-Zn-Ag Deposit in Arizona. The Company is currently exploring the high-grade Buckingham Gold Vein in central Virginia and is in advanced stages of negotiation on other lands with high-grade copper potential in the area.

The Company is 100% owner of the Storm Project property, which hosts the Storm Copper Project and the Seal Zinc Deposit and has been optioned to American West Metals Limited.

Further details are available on the Company's website at https://astonbayholdings.com/.

Statements made in this press release, including those regarding the Agreement, grant of the Option and Expenditures to be made on the Property, management objectives, forecasts, estimates, expectations, or predictions of the future may constitute "forward-looking statement", which can be identified by the use of conditional or future tenses or by the use of such verbs as "believe", "expect", "may", "will", "should", "estimate", "anticipate", "project", "plan", and words of similar import, including variations thereof and negative forms. This press release contains forward-looking statements that reflect, as of the date of this press release, Aston Bay's expectations, estimates and projections about its operations, the mining industry and the economic environment in which it operates. Statements in this press release that are not supported by historical fact are forward-looking statements, meaning they involve risk, uncertainty and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. Although Aston Bay believes that the assumptions inherent in the forward-looking statements are reasonable and undue reliance should not be placed on these statements, which apply only at the time of writing of this press release. Aston Bay disclaims any intention or obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except to the extent required by law. We seek safe harbour.

Neither TSX Venture Exchange nor its regulation services provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

FOR ADDITIONAL INFORMATION CONTACT:

Thomas Ullrich, Chief Executive Officer

thomas.ullrich@astonbayholdings.com

(416) 456-3516

SOURCE: Aston Bay Holdings Ltd

View the original press release on accesswire.com