November 14, 2023

On the 24th October 2023 Belararox Limited (ASX: BRX) (Company) made a market announcement titled: “Quarterly Activities Report for the Period Ended September 2023.”

It has come to the Company’s attention that the disclosures required under ASX Listing Rule 5.3.4 were inadvertently omitted from the Quarterly Activities Report lodged. The attached document sets out the Company’s actual use of funds to date in relation to the outlined use of funds included within its Prospectus in accordance with ASX Listing Rule 5.3.4.

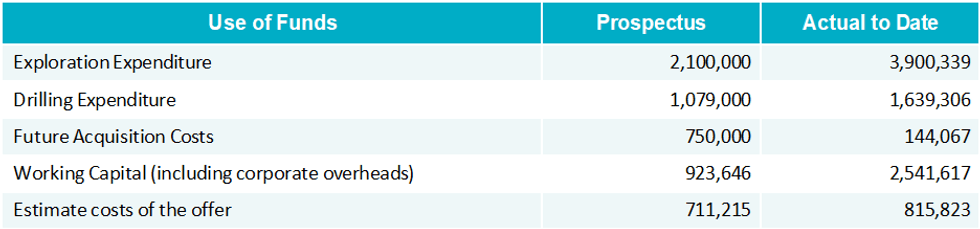

In accordance with ASX Listing Rule 5.3.4, summarised below are the Company's expenditures to date in relation to the outlined Use of Funds included within its Prospectus.

The material variances noted above are as a result of a number of factors, including:

- As announced in previous quarterly activity reports, the Company’s exploration efforts for the Belara project were higher than originally anticipated, partly due to weather conditions, which limited drill productivity, as well as labour shortage and machinery supply pressures, and their impact on costs.

- The Company remains open to future acquisitions and incurred costs associated with the FOMO transaction noted above.

- The Company has incurred higher than anticipated working capital costs, including:

- Expansion of the Administration team to support operations;

- Costs associated with the equity instruments offered including the non-renounceable entitlements issue and the recently completed capital raising for $2.5 million (before costs); and

- Consumer Price Index and associated inflationary pressures experienced across a broad range of working capital costs.

- The Company completed a capital raising of $2.5m (before costs) in the quarter ended 30 June 2023. The proceeds from this capital raising in conjunction with those conducted in previous quarters will be applied towards the Company’s strategic and operational cash flow needs, including those as originally included within the Company’s Prospectus (as outlined above).

For the quarter ended 30 September 2023, the Company had cash outflows from operating and investing activities of $692,264. This included $268,048 in exploration and evaluation expenditure which was capitalised during the quarter. The remaining expenditure incurred was attributed primarily to corporate and administration costs.

Click here for the full ASX Release

This article includes content from Belararox Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BRX:AU

The Conversation (0)

14 September 2023

Belararox Limited

Developing Precious and Base Metal Assets to Meet Future Demand

Developing Precious and Base Metal Assets to Meet Future Demand Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00