Rare Earth Elements Prices 101

Rare earths are not as rare as you might think, but understanding prices can certainly be complicated.

From electric vehicles and wind turbines to water treatment and nuclear power, rare earth elements (REE) are critical for many of the technologies necessary for a cleaner, greener economy and world. However, understanding pricing for these commodities can be tricky.

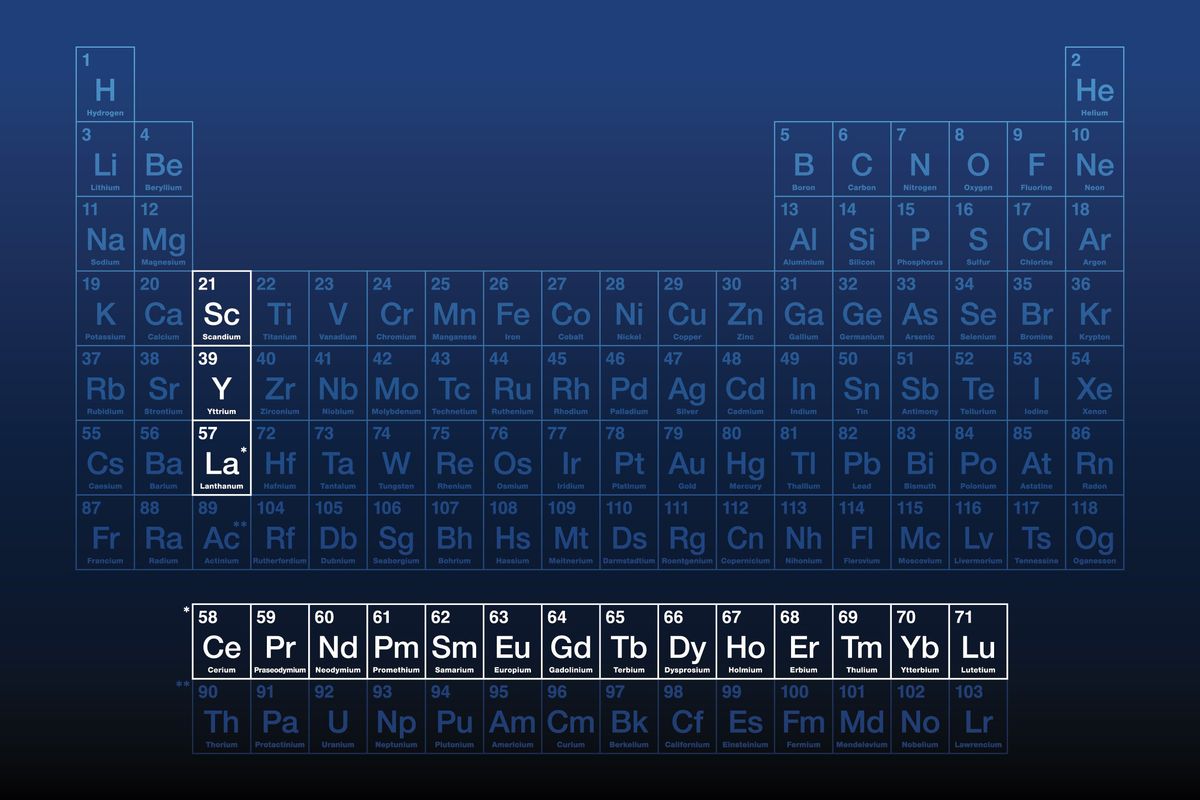

There are 17 rare earth minerals in all, and each is classified under different groups — typically light rare earths and heavy rare earths. Prices are available for multiple individual and mixed products, including for the rare earths used in permanent rare earth magnets, so it can all seem a bit overwhelming.

“The supply chain for rare earth materials and permanent magnets is complex, regionally concentrated and marked by a lack of transparent pricing,” according to international price reporting agency Fastmarkets. “This can lead to unpredictable costs, budgeting difficulties and supply insecurity. Geopolitical tensions further add to this uncertainty.”

Read on for a short introduction to the rare earth elements market and prices.

In this article

What is China's role in rare earth metals pricing?

First and foremost, it’s important to know that China is the main driver when it comes to REE prices and the rare earths market as a whole. The country is the world’s leading rare earths producer by a wide margin, and despite efforts elsewhere also controls about 87 percent of global rare earths refining capacity.

China has such a monopoly on the sector that REE prices spiked in 2010 and 2011 when the country cut exports. That sparked a boom for rare earths companies and mining projects around the world, as they sought to create reliable sources of rare earths supply outside of China. However, many failed to thrive when REE prices fell again.

In 2014, the World Trade Organization ruled against Chinese export quotas for rare earths, and China removed its industry caps in January 2015. The country also eliminated its export tariffs for rare earths in May 2015, leading to a further fall in REE prices. More recently, it banned the export of technology to make rare earth magnets.

The ongoing trade war between the US and China adds a layer of complication to the rare earth metals sector. Recognizing China's key place in the market, the US is undertaking various efforts to build its own supply.

In February 2021, US President Joe Biden signed an executive order aimed at reviewing shortcomings in the nation's domestic supply chains for rare earths, medical devices, computer chips and other critical resources. The next month, the US Department of Energy announced a US$30 million initiative to research and secure domestic supply chains for rare earths, along with battery metals such as cobalt and lithium.

In June 2022, Biden went even further, invoking the Defense Product Act to increase the domestic production of critical minerals such as rare earths, as well as to fund feasibility studies and expand existing resources. Furthermore, in September 2022, the Biden government announced US$156 million in funding to support the creation of "first-of-a-kind facility to extract and separate REEs and critical minerals from unconventional sources like mining waste."

Later, in July 2023, the Department of Energy put up US$32 million to build facilities for the production of REEs and other critical minerals from domestic coal-based resources.

Even with these efforts, China remains the heavyweight for now, so it’s important that investors interested in the rare earths space keep track of what the country is up to in terms of production.

Where to find rare earths prices?

Unlike prices for gold and silver, rare earth elements prices are hard to come by, as there is no widely used public exchange for rare earths. Firms such as Fastmarkets put out regular price assessments based on surveys of traders, consumers and other market participants; this information is available for a fee.

Price forecasts and other information can also be found via analyst firms and pricing forums such as Adamas Intelligence, Argus Media, Technology Metals Research and Asian Metal.

Which rare earths are the most important?

Rare earths are used in a range of different technologies, and demand is higher for some than others. They can be divided into “heavy” and “light” categories based on atomic weight, with heavy often being more sought after.

That said, light rare earths can be important too. Neodymium and praseodymium, used in rare earth magnets, fall into the light category. These and other elements used in rare earth permanent magnets, such as dysprosium, can be quite expensive. Neodymium and praseodymium have also been in the spotlight due to electric vehicles.

The concentration of different rare earths varies within each given deposit, but usually a deposit is dominated by either heavy or light rare earths, with some elements being much more abundant. Cerium, for example, is the most abundant rare earth, and is more plentiful in the Earth’s crust than copper.

Both cerium and lanthanum, used in things such as alloys in steelmaking and industrial catalysts, are oversupplied. As a result, they are priced quite a bit lower than most rare earth magnet materials.

Another group of rare earths to consider is those used in phosphors, or phosphorescent materials, which are the active component that adds color in fluorescent light bulbs and other lighting applications. Yttrium is fairly inexpensive when compared to more rare and therefore more expensive metals such as europium and terbium.

Rare earth concentrates and pricing

Think rare earths are easy to separate? Think again.

As mentioned, rare earths deposits contain various types of rare earths, not to mention a range of other impurities such as uranium and thorium, which can be troublesome to dispose of. The separation process can be difficult and lengthy, and so far separators outside of China have not managed to undercut producers within the country.

The best-known producer of separated rare earths outside of China is Lynas Rare Earths (ASX:LYC,OTC Pink:LYSCF), which owns and operates the Mount Weld mine in Western Australia and a separation facility in Malaysia. In 2023, Lynas received a US$258 million contract from the US Department of Defense to build a rare earths separation facility in Texas.

At the moment, California's Mountain Pass operation, owned by MP Materials (NYSE:MP), is the only working US rare earths mine and processing facility. The facility, which has a storied history, produces high-purity separated rare earth oxides, including lanthanum, cerium and neodymium-praseodymium oxide.

Other big companies developing REE separation operations include Energy Fuels (TSX:EFR,NYSEAMERICAN:UUUU). In Utah, the firm is completing Phase 1 REE separation infrastructure at its White Mesa mill, which will result in separated neodymium-praseodymium capacity of 800 to 1,000 metric tons per year.

According to Adamas Intelligence, "Elsewhere, projects across Sweden, South Africa, Australia and other countries aim to extract rare earths from mine waste and byproducts that could supply 8% of global demand successful."

It’s important to keep in mind that rare earths within a mixed concentrate won’t fetch as high a price as those that are already separated. When looking at technical reports from junior miners, be sure to check that companies have accounted for this discount when calculating their rare earths basket price, which is the price for all the rare earths bundled into a single number based on the distribution of different rare earths within the deposit.

This is an updated version of an article originally published by the Investing News Network in 2015.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Melissa Pistilli, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: Energy Fuels is a client of the Investing News Network. This article is not paid-for content.