February 28, 2022

TinOne Resources Inc. (TSXV: TORC) ("TinOne" or the "Company") is pleased to announce that it has commenced drilling on its Panama Gold Project in northeastern Tasmania, Australia.

Highlights

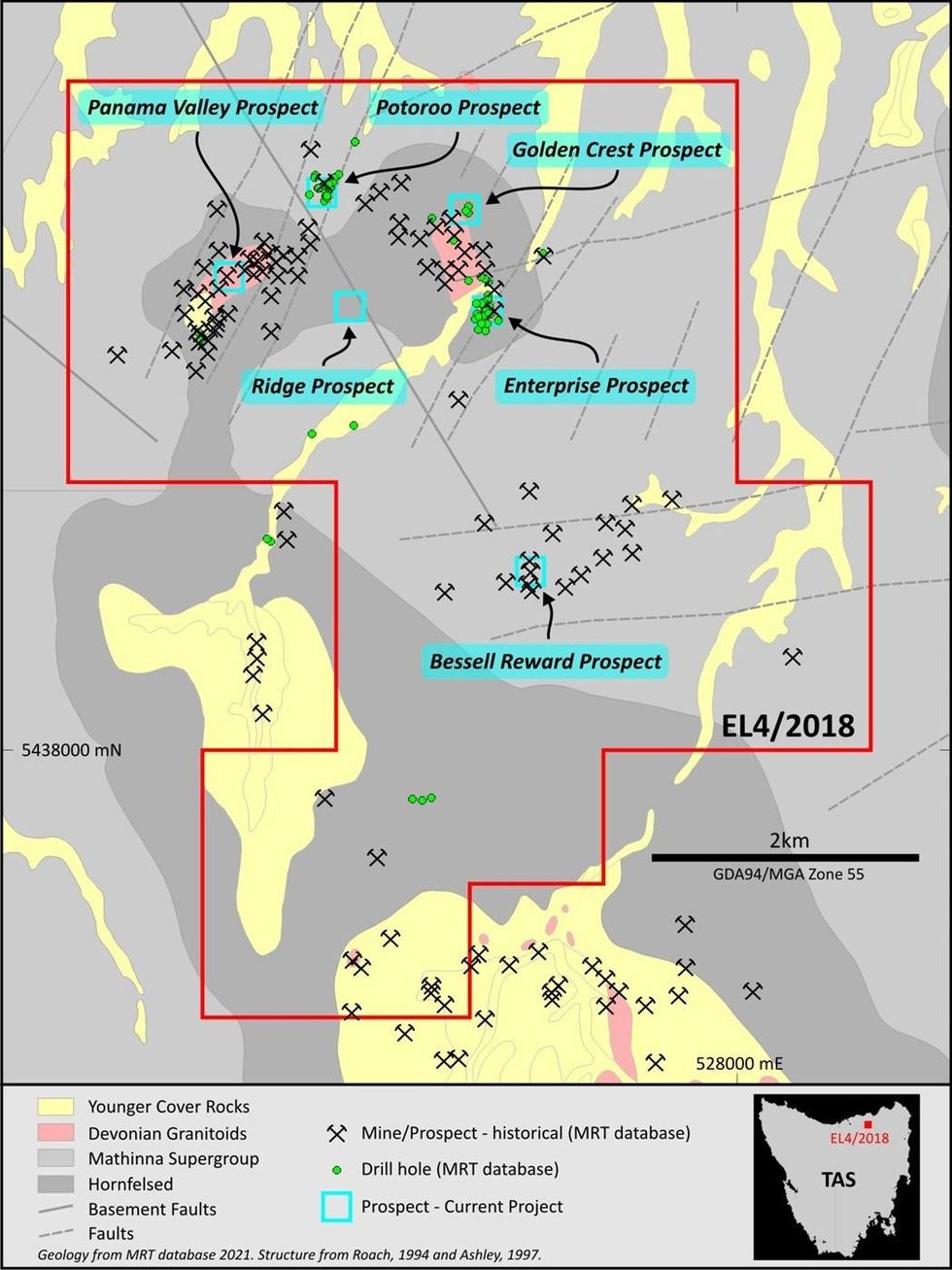

Figure 1: Location of the Panama project in the mining-friendly jurisdiction of Tasmania (CNW Group/TinOne Resources Corp.)

Figure 2: Panama project simplified geology, historical mines and prospects. (CNW Group/TinOne Resources Corp.)

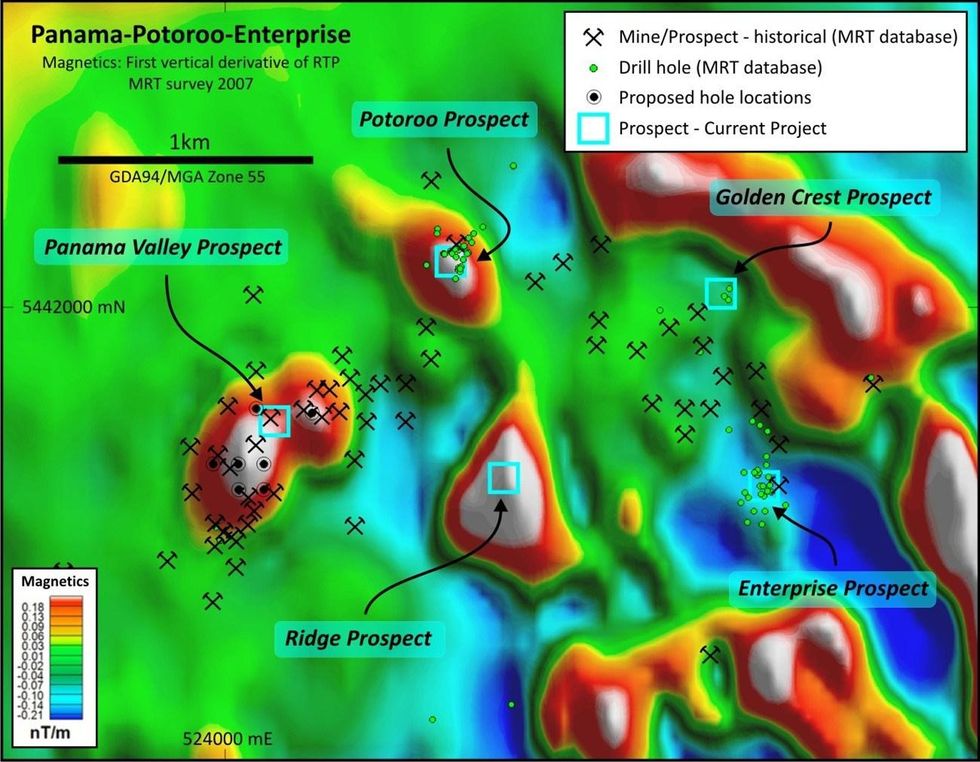

Figure 3: Magnetic image of the northern Panama project area showing the extensive historic mining activity, and location of historical drill holes (from the Mineral Resources Tasmania (MRT) database). The Panama Valley prospect contains more extensive workings, and is larger in area than the previously drilled Potoroo prospect, but remains undrilled. (CNW Group/TinOne Resources Corp.)

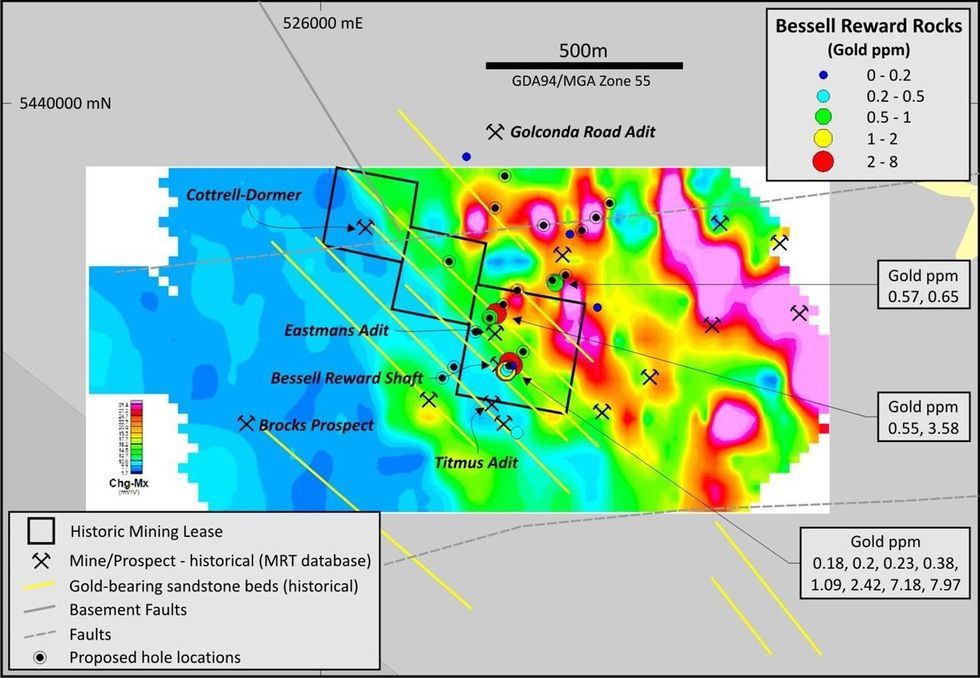

Figure 4: Gradient array IP chargeability image, surface rock sample results and proposed drill hole locations for the Bessell Reward prospect at the Panama Project. (CNW Group/TinOne Resources Corp.)

- A program of 1,860 metres of Reverse Circulation (RC) drilling has commenced at the Company's Panama Gold Project

- Drilling to target previously undrilled prospects defined by surface geology, geophysics, historical exploration and small-scale historical mining activity

- Ranking and Prioritizing Great Pyramid and Aberfoyle tin targets

"We are pleased to have started drilling on our Panama Gold Project which acted as the qualifying property through our transaction with Lamaska," commented Chris Donaldson, TinOne's Executive Chairman. "Panama is a target-rich environment with impressive historical gold intercepts and with our technical team now in place and drilling commencing, it will be a very exciting year for TinOne. While we are currently drilling Panama, we are evaluating and prioritizing targets on our key Tin projects. It is expected that at the completion of this current drill campaign the drill will be mobilized without delay to explore for tin, which of course has seen a tremendous increase in price as a result of heightened demand due to the electrification movement and supply issues worldwide."

Drilling Details

Panama Valley Prospect: The primary target in this prospect is a granodiorite intrusion at the south-western end of Panama Valley. Numerous historic alluvial workings are recorded above the weathered intrusion and prospector diggings occur in the Mathinna Supergroup rocks in the contact aureole, but the granodiorite intrusion has never been drilled or subjected to any modern exploration.

The prospectivity of this target is based on its similarities, in terms of magnetic signature and structural/geomorphic setting, to a smaller granodiorite intrusion, known as the Potoroo prospect, further downslope in the north-east of Panama Valley. Modern exploration at Potoroo by previous companies demonstrated a small but coherent body of low grade, near surface gold mineralisation disseminated through the sericite-clay-sulphide altered granodiorite host rock. The magnetic anomaly source rocks are enriched in accessory pyrrhotite rather than magnetite and the mineralisation at Potoroo correlates with the modelled source of the anomaly.

TinOne has planned a program of 7 holes for 420 metres to systematically test the area of historical workings and coherent magnetic signature.

Bessell Reward Prospect: The undrilled Bessell Reward prospect contains gold mineralisation in sandstone-hosted bedding-parallel veinlets and disseminations within the sandstone interbeds. The target is interpreted to be a zone of structural deformation marked by a significant break in IP chargeability and aeromagnetic signature. The location of the historic alluvial diggings either side of the ridge and rock chip results, indicate that the sandstone ridge is a source of gold. Historical and recent surface rock samples have returned values up to 7.9 g/t Au.

TinOne has planned a program of 17 holes for 1,440 metres to systematically test the area of historical workings, interpreted structural discontinuities and surface geochemistry.

About the Panama Project

The underling geology at Panama is Ordovician-Silurian Mathinna Supergroup sediments that have been intruded by Devonian granodiorite. Both the intrusions and the sediments are considered to be prospective for intrusion related gold systems (IRGS), sediment hosted disseminated gold and mesothermal gold deposits.

The Panama project contains multiple underexplored gold targets with TinOne's focus being bulk mineable, gold in sandstone (Bessell Reward) or granodiorite (Potoroo, Panama) within the historic Lisle-Golconda Goldfield. Alluvial gold was discovered in the Golconda-Lisle area in 1872 and hard-rock mining followed in 1876. The main Lisle alluvial field was discovered by Charles Bessell in 1878, following the discovery of the Tobacco Creek Goldfield (Bessell Reward area) in 1877 and official records (Reid, 1926) indicate production of approximately 88,000 oz although other government sources estimate a total production of approximately 250,000 oz (Twelvetrees, 1909).

Modern exploration commenced in the 1970s and comprised of broad-scale stream sediment, soil, and rock chip sampling. Historical drill intersections within the project area include: 66m @ 0.6 g/t Au, 2m @ 7.4 g/t Au, 1.5m @ 9.0 g/t Au, 4m @ 12.9 g/t Au.

About the TinOne

TinOne is a TSX Venture listed Canadian public company with a high-quality portfolio of tin and gold projects in the Tier 1 mining jurisdictions of Tasmania and New South Wales, Australia. The Company is focussed on advancing its highly prospective portfolio through aggressive exploration programs.

Qualified Person

The Company's disclosure of technical or scientific information in this press release has been reviewed and approved by Dr Stuart Smith., Technical Adviser for TinOne. Dr. Smith is a Qualified Person as defined under the terms of National Instrument 43-101. For additional information regarding the Company's Panama Project, please see the Technical Report entitled "Panama Project" dated effective March 29, 2021, on the Company's profile at www.sedar.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This news release includes certain "Forward‐Looking Statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward‐looking information" under applicable Canadian securities laws. When used in this news release, the words "anticipate", "believe", "estimate", "expect", "target", "plan", "forecast", "may", "would", "could", "schedule" and similar words or expressions, identify forward‐looking statements or information. These forward‐looking statements or information relate to, among other things: the development of the Company's projects, including drilling programs and mobilization of drill rigs; future mineral exploration, development and production; and completion of a maiden drilling program.

Forward‐looking statements and forward‐looking information relating to any future mineral production, liquidity, enhanced value and capital markets profile of TinOne, future growth potential for TinOne and its business, and future exploration plans are based on management's reasonable assumptions, estimates, expectations, analyses and opinions, which are based on management's experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect. Assumptions have been made regarding, among other things, the price of gold and other metals; no escalation in the severity of the COVID-19 pandemic; costs of exploration and development; the estimated costs of development of exploration projects; TinOne's ability to operate in a safe and effective manner and its ability to obtain financing on reasonable terms.

These statements reflect TinOne's respective current views with respect to future events and are necessarily based upon a number of other assumptions and estimates that, while considered reasonable by management, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward‐looking statements or forward-looking information and TinOne has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: the Company's dependence on early stage mineral projects; metal price volatility; risks associated with the conduct of the Company's mining activities in Australia; regulatory, consent or permitting delays; risks relating to reliance on the Company's management team and outside contractors; risks regarding mineral resources and reserves; the Company's inability to obtain insurance to cover all risks, on a commercially reasonable basis or at all; currency fluctuations; risks regarding the failure to generate sufficient cash flow from operations; risks relating to project financing and equity issuances; risks and unknowns inherent in all mining projects, including the inaccuracy of reserves and resources, metallurgical recoveries and capital and operating costs of such projects; contests over title to properties, particularly title to undeveloped properties; laws and regulations governing the environment, health and safety; the ability of the communities in which the Company operates to manage and cope with the implications of COVID-19; the economic and financial implications of COVID-19 to the Company; operating or technical difficulties in connection with mining or development activities; employee relations, labour unrest or unavailability; the Company's interactions with surrounding communities and artisanal miners; the Company's ability to successfully integrate acquired assets; the speculative nature of exploration and development, including the risks of diminishing quantities or grades of reserves; stock market volatility; conflicts of interest among certain directors and officers; lack of liquidity for shareholders of the Company; litigation risk; and the factors identified under the caption "Risk Factors" in TinOne's management discussion and analysis. Readers are cautioned against attributing undue certainty to forward‐looking statements or forward-looking information. Although TinOne has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be anticipated, estimated or intended. TinOne does not intend, and does not assume any obligation, to update these forward‐looking statements or forward-looking information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements or information, other than as required by applicable law.

The Conversation (0)

24 May 2023

TinOne Resources

Exploring Tin Assets in Australia to Support a Sustainable Future

Exploring Tin Assets in Australia to Support a Sustainable Future Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00