June 22, 2022

Materials technology company, ChemX Materials Ltd (ASX:CMX) is pleased to provide the following update on exploration activities at the Company’s Jamieson Tank Project in South Australia.

Key Highlights

- Assays from drilling of manganese targets at ChemX’s Eyre Peninsula tenements confirm significant manganese potential of the Jamieson Tank project

- Results provide significant step forward in ChemX’s Jamieson Tank High Purity Manganese Sulphate Monohydrate (HPMSM) project

- Assays also reveal elevated levels of Rare Earth Elements (REE). The Company is awaiting further assay results from the maiden 2022 drill program which are expected in coming weeks, subject to laboratory schedules.

- Significant intercepts are presented in following tables A and B

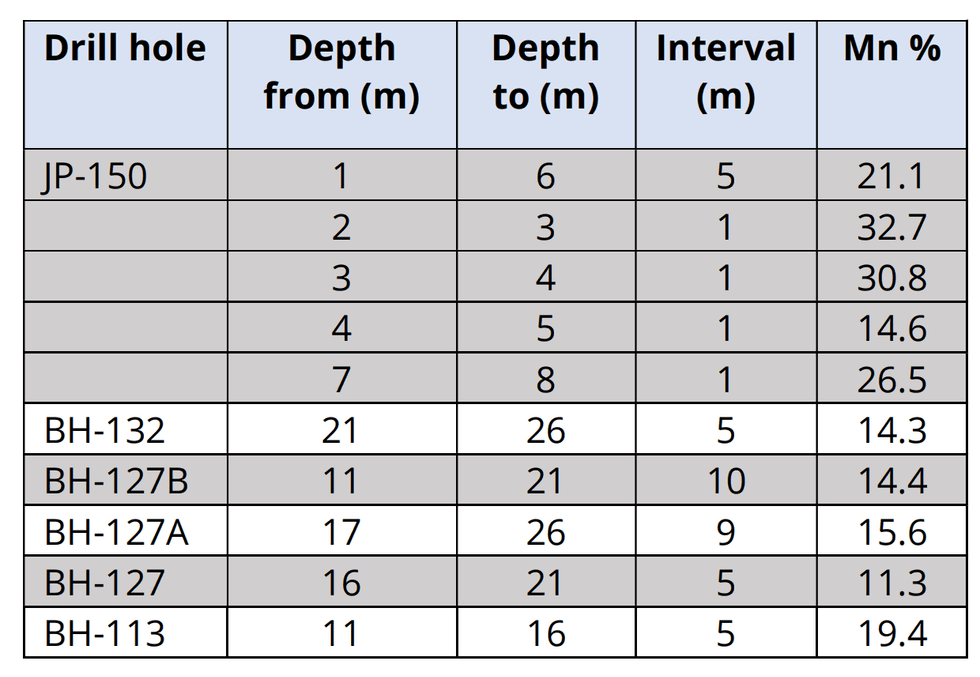

Table A: Significant manganese assay results

Table A: Significant manganese assay results

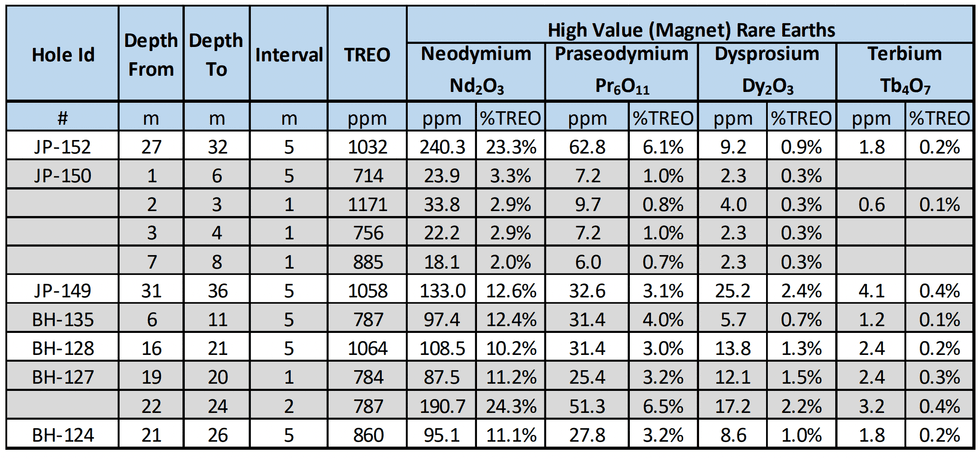

Table B: Significant REE assays

Table B: Significant REE assays

ChemX’s Jamieson Tank High Purity Manganese Sulphate Monohydrate (HPMSM) project is proposed to become a vertically integrated project, with manganese ore to be sourced from its 100% owned Jamieson Tank Manganese Project on the Eyre Peninsula, South Australia. ChemX intends to process ore based on a metallurgical testwork program currently being conducted. The first stage of testwork was positive (ASX announcement: 11 May 2022), with the second stage of testwork scheduled to commence in July 2022.

Click here for the full ASX Release

This article includes content from ChemX Materials, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CMX:AU

The Conversation (0)

01 July 2024

ChemX Materials

Critical materials company developing innovative, processing technology to produce high purity alumina for advanced technology and clean energy applications.

Critical materials company developing innovative, processing technology to produce high purity alumina for advanced technology and clean energy applications. Keep Reading...

28 November 2024

Agreement with Vytas Ltd for High Purity Assay Services

ChemX Materials (CMX:AU) has announced Agreement with Vytas Ltd for High Purity Assay ServicesDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00