(TheNewswire)

Vancouver, Canada April 12, 2024 TheNewswire Nexus Gold Corp. (" Nexus " or the " Company ") (TSX-V: NXS, OTCQB: NXXGF, FSE: N6E) is pleased to provide a corporate update regarding its plans to return to the Dakouli 2 Gold Project, located in Burkina Faso, West Africa.

The Dakouli 2 property is a 9,800-ha gold project with several established zones of mineralization. Gold is situated from near surface to 200m depth, with the majority of the significant drill intercepts in the 100-meter range. The Company recently paid taxes on the property and intends to raise sufficient capital in the near term to begin multiple follow-up work programs during the remainder of the 2024 calendar year.

"Dakouli has proven to be a highly prospective gold target", said Milad Zareian, CEO. "With gold showing strong gains now is the time for Nexus to get back to developing what is a superb exploration project. West Africa holds some the planet's most prolific gold endowments, and Dakouli is located on the one of the more prolific greenstone belts. We're excited about gold's recent rise and we believe now is the perfect time to ramp up our operations in West Africa," continued Mr. Zareian.

Drilling to Date at Dakouli

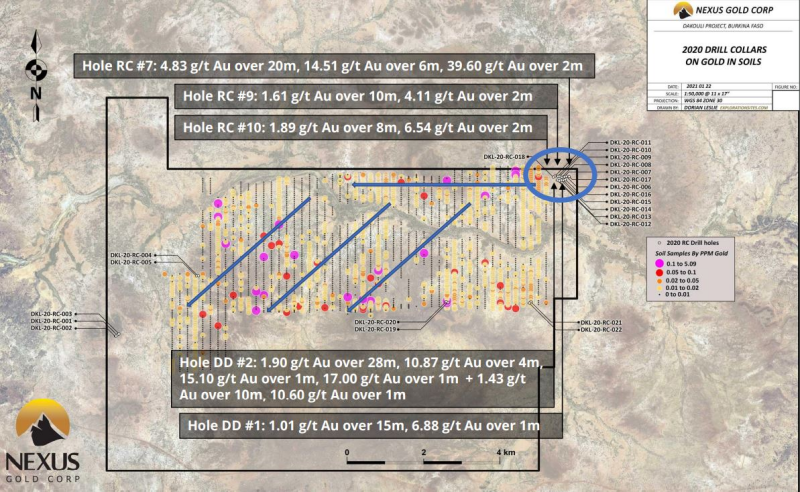

In late 2020 the Company conducted a Reverse Circulation ("RC") drill program at the 98-sq kms concession consisting of 2,914 meters of exploratory drilling. The first-ever drill program on the property was designed to test several areas that have returned either high gold values from rock samples or coincidental soil geochemical and geophysical anomalies proximal to artisanal workings ("orpaillages").

Significant results were encountered in several holes, including:

DKL-20-RC-007

-

4.83 grams-per-tonne ("g/t") gold ("Au") over 20 meters

-

Including 14.51 g/t Au over 6m

-

And 39.6 g/t over 2m

DKL-20-RC-009

-

1.61 g/t Au over 10m

-

Including 4.11 g/t Au over 2m

DKL-20-RC-010

-

1.89 g/t Au over 8m

-

Including 6.54 g/t Au over 2

| DRILL HOLE | AZ | DIP | FROM (METERS) | TO (METERS | INTERCEPT METERS | GOLD INTERCEPT GRAMS PER TONNE fire assay |

| DKL-20-RC-007 | 350 | -60 | 108 | 138 | 30 | 3.31 |

| 108 | 128 | 20 | 4.83 | |||

| 108 | 126 | 18 | 5.35 | |||

| 108 | 124 | 16 | 5.92 | |||

| INCLUDES | 108 | 110 | 2 | 1.175 | ||

| 110 | 112 | 2 | 1.06 | |||

| 118 | 120 | 2 | 2.28 | |||

| 120 | 122 | 2 | 39.6 | |||

| 122 | 124 | 2 | 1.645 | |||

| DKL-20-RC-009 | 360 | -45 | 50 | 60 | 10 | 1.61 |

| INCLUDES | 54 | 56 | 2 | 1.6 | ||

| 52 | 54 | 2 | 4.11 | |||

| 76 | 84 | 8 | 0.26 | |||

| 96 | 104 | 8 | 0.21 | |||

| 108 | 118 | 10 | 0.2 | |||

| 120 | 126 | 6 | 0.31 | |||

| 128 | 136 | 8 | 0.24 | |||

| 140 | 150 | 10 | 0.47 | |||

| DKL-20-RC-010 | 360 | -45 | 64 | 66 | 2 | 1.46 |

| 74 | 82 | 8 | 1.89 | |||

| INCLUDES | 2 | 6.54 |

In addition, several holes returned lengthy intercepts of sub-one gram gold, including DKL-20-RC-006 which returned .59 g/t Au over 18 meters, DKL-20-RC-017, which returned .91 g/t Au over 10m, and DKL-20-RC-002 which returned .64 g/t Au over 16 meters.

In the summer of 2021, the Company returned to Dakouli to conduct a 2000m follow up Diamond Drill program. Results from this program expanded upon the earlier RC drill results with several significant intercepts:

DKL-21-DD-001

-

0.95 g/t Au over 23m

-

Including 1.01 g/t Au over 15m

-

1.46 g/t Au over 7m

-

Including 4.87 g/t Au over 1m and 6.88 g/t Au over 1m

DKL-21-DD-002

-

1.90 g/t Au over 28m

-

Including 10.87 g/t Au over 4m

-

Including 15.1 g/t Au over 1m, and 17 g/t Au over 1m

-

1.43 g/t Au over 10m

-

Including 10.6 g/t Au over 1m

DKL-21-DD-008

-

0.86 g/t over 17m

-

Including 1.18 g/t Au over 12m and 2.19 g/t Au over 6m

| DRILL HOLE | AZIMUTH | DIP | FROM | TO | LENGTH | Au g/t |

| DKL-21-DD-001 | 0 | -60 | 80 | 81 | 1 | 2.87 |

| 103 | 135 | 32 | 0.75 | |||

| INCLUDES | 112 | 135 | 23 | 0.95 | ||

| INCLUDES | 120 | 135 | 15 | 1.01 | ||

| 123 | 135 | 12 | 1.14 | |||

| Includes | 129 | 130 | 1 | 2.46 | ||

| 134 | 135 | 1 | 6.88 | |||

| 187 | 194 | 7 | 1.46 | |||

| INCLUDES | 188 | 189 | 1 | 2.03 | ||

| 190 | 191 | 1 | 4.87 | |||

| DKL-21-DD-002 | 0 | -50 | 75.5 | 77 | 1.5 | 1.94 |

| 91 | 119 | 28 | 1.90 | |||

| INCLUDES | 91 | 95 | 4 | 10.87 | ||

| 91 | 92 | 1 | 15.10 | |||

| 94 | 95 | 1 | 17.00 | |||

| 102 | 103 | 1 | 1.78 | |||

| 106 | 107 | 1 | 1.09 | |||

| 110 | 111 | 1 | 1.79 | |||

| 118 | 119 | 1 | 2.38 | |||

| 144 | 145 | 1 | 2.04 | |||

| 154 | 164 | 10 | 1.43 | |||

| INCLUDES | 156 | 157 | 1 | 10.60 | ||

| DKL-21-DD-008 | 360 | -60 | 168 | 180 | 12 | 1.18 |

| INCLUDES | 179 | 180 | 1 | 12.7 |

Drilling has so far primarily been confined to a small section in the upper northeastern portion of the concession ground.

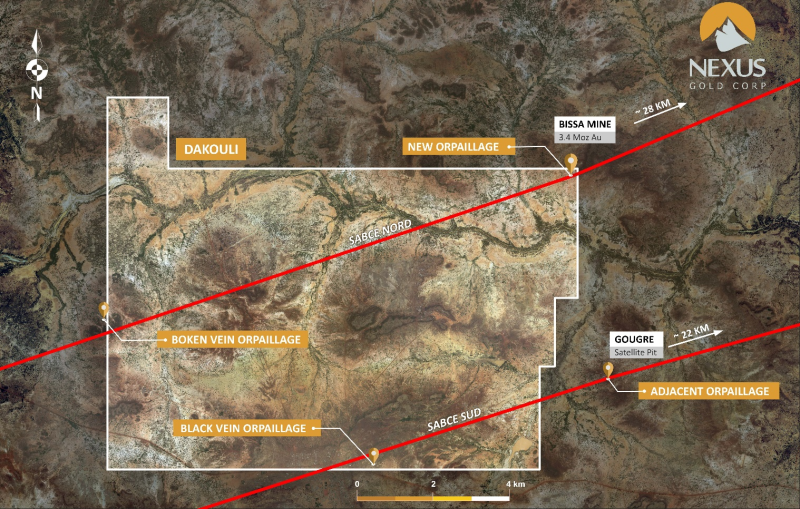

Image 1: Location of Dakouli 2 project, Goren Greenstone Belt, Burkina Faso, West Africa

Image 2: Bisecting Sabce faults (red) and artisanal zones, Dakouli 2 project, Burkina Faso, West Africa

About the Dakouli 2 Gold Concession

The Dakouli 2 exploration permit is a nearly 100-sq km gold exploration property located approximately 100 kilometers due north of the capital city Ouagadougou. Situated on the Goren greenstone belt, Dakouli is proximal to Nordgold's Bissa Mine, and is bisected by the gold-bearing Sabce shear zone.

In late 2018 Company geologists conducted a comprehensive ground reconnaissance program to the west and south of the main orpaillage (artisanal zone) and identified new near surface workings being exploited by artisanal miners. Rock samples collected from these new zones contained various concentrations of visible gold, including coarse nuggety samples.

Follow up work outlined an anomalous zone extending some 500 meters west from the sample zones. Based on those results the Company initiated a 150-line kilometer soil geochemical survey covering the northern half of the Dakouli 2 property. This survey identified three prominent gold geochemical trends.

The primary gold trend parallels the Sabce fault zone and extends for approximately 10 kilometers in a northeast-southwest direction and bisects the property from the northeast corner of the property to its western boundary. The Sabce fault hosts multiple deposits including Nordgold's 3.4M oz Bissa Mine, located approximately 25km east of the Dakouli ground.

Two secondary gold trends which extend for approximately 6.5 kilometers each are oriented in a northwest to southeast direction and bisect the primary trend. All three gold geochemical trends are coincidental to geophysical trends identified from the national regional airborne geophysics.

* Please note that while the Company considers sampling and reporting results from the new portions of the exploration permit to be accurate, readers are cautioned that a Qualified Person has been unable to verify the laboratory involved in the analysis of these samples, and no documentation was available regarding quality control procedures utilized in the analysis.

Warren Robb P.Geo., Vice President, Exploration, is the designated Qualified Person as defined by National Instrument 43-101 and is responsible for, and has approved, the technical information contained in this release.

About the Company

Nexus Gold is a Canadian-based exploration company with a focus on precious metals in proven global mining jurisdictions. The company's primary asset is the 98-sq km Dakouli 2 Gold Concession, located in Burkina Faso, West Africa.

For more information, please visit nxs.gold

On behalf of the Board of Directors of

Nexus Gold CORP.

Milad Zareian, Chief Executive Officer

Tel: 416-846-4599

info@nexusgoldcorp.com

www.nexusgoldcorp.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain forward-looking statements. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially because of factors discussed in the management discussion and analysis section of our interim and most recent annual financial statement or other reports and filings with the TSX Venture Exchange and applicable Canadian securities regulations. We do not assume any obligation to update any forward-looking statements, except as required by applicable laws.

Copyright (c) 2024 TheNewswire - All rights reserved.