November 07, 2023

Boab Metals Limited (ASX: BML) (“Boab” or the “Company”) is pleased to report assay results including a material intercept from the 1st drill hole at the Keep Seismic Target from the Phase VII drilling program at its 75% owned Sorby Hills Lead-Silver-Zinc Project (“Sorby Hills” or “the Project”), located in the Kimberley Region of Western Australia.

HIGHLIGHTS

- Drilling of the “Keep Seismic Target” intercepts significant base metal mineralisation.

- SHSD_185: 9.55 m @ 5.10% PbEq (2.59% Pb & 2.26% Zn) and 17.6 g/t Ag from 242.55 m

- Incl. 3.12 m @ 13.43% PbEq (6.37% Pb & 6.36% Zn) and 26.5 g/t Ag from 245.36m

- Intercepts of the exceptional grade and composition at the Norton Ore body:

- SHSD_171: 11.05 m @ 17.63% PbEq (10.98% Pb & 189 g/t Ag) from 81.95m

- SHSD_174: 11.60 m @ 20.23% PbEq (8.78%Pb & 325 g/t Ag) from 74.40m

- Metallurgical test work now underway to establish uniformity of the Norton deposit metallurgy with other ore domains of the Sorby Hills deposit.

- Significant exploration drill hole intercepts:

- SHSD_164: 6m @ 9.92% PbEq (3.92% Pb & 170g/t Ag) from 101m

- SHSD_183: 2m @ 6.85% PbEq (4.43% Pb & 69g/t Ag) from 103m

- SHSD_184: 2.8m @ 3.84% PbEq (3.17%Pb & 19g/t Ag from 129m

Boab Managing Director and CEO, Simon Noon, stated:

“We are very excited to confirm that the drill hole at the Keep Seismic Target has intersected zinc- lead sulphide mineralisation between 242 and 257m as was anticipated. This is an outstanding success given the conceptual nature of the target and its location in an area, and at a depth where no mineralisation has been intersected before. The location of the drill hole sits around 2 km away from the closest ore reserves at Sorby Hills and will be a catalyst for further exploration within our mining tenements.

It is clear there is more to be discovered at Sorby Hills. The step-out drill holes at Norton and at Beta also confirmed the continuity of mineralisation.

In conjunction with our 2023 drill program, Boab continues to advance toward a final investment decision on the Sorby Hills Project with preferred EPC contractor GRES firming up Front End Engineering & Design work whilst discussions with financiers is ongoing”.

Phase VII Program Details

The Phase VII drilling program concluded with the completion of 22 drill holes for 2,634 (an additional 24% of metres than originally planned). Of the total program, 1,433 m across 13 holes were drilled for a metallurgical purpose with another 1,200m across 9 holes drilled for resource/reserve expansion and exploratory objectives.

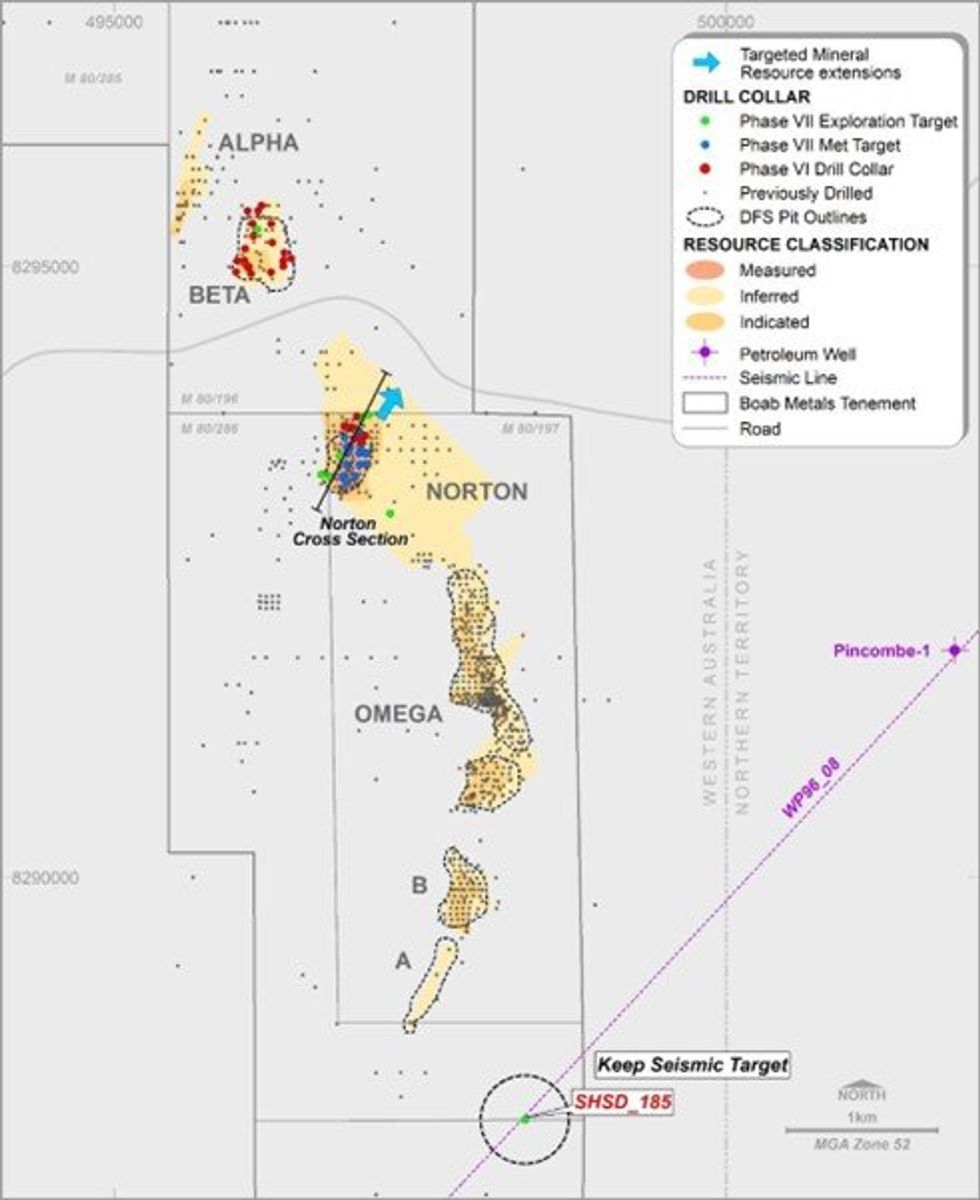

Collar locations for all the completed drill holes are shown below in (Figure 1).

Exploration and Resource Extension Drilling

The resource extension/exploratory drilling targeted the periphery of the known mineralisation, areas of lower confidence in the ore distribution and a conceptual target.

Keep Seismic Target

The highlight of the 1st drill hole into the conceptual target is:

- SHSD_185: 9.55 m @ 5.10% PbEq (2.59% Pb & 2.26% Zn) from 242.55 m

Incl. 3.12 m @ 13.43% PbEq (6.37% Pb & 6.36% Zn) and 26.5 g/t Ag from 245.36m

As announced in October 2023, the interpretation of seismic data from petroleum exploration across the Burt Range Sub-Basin resulted in a conceptual drill target – the Keep Seismic Target. A 306.5m deep drill hole was successfully drilled into the target’s depth range.

Seismic line WP96-08 traverses the project area about 2 km south of B-Deposit and shows the reflectors of the Devonian-Carboniferous sedimentary strata gradually dip to the east and affected by a series of extensional faults (Figures 2 and 3) leading into a half-graben structure flanked on the eastern side by a reef covered basement high which was targeted by the Pincombe No 1 petroleum well, drilled in 1996.

SHSD_185 was aimed at testing the potential for a mineralised feeder fault system, which can be seen in the seismic data, and the potential for stratiform mineralisation at the Knox Formation/Sorby Dolomite interface (Figure 3).

The drill hole intersected the base of the Knox Formation at about 224.6m and was terminated at a depth of 306.5m within massive Sorby Dolomite after intersecting two intervals of mineralisation (Figure 3).

Click here for the full ASX Release

This article includes content from Boab Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

09 January 2025

Boab Metals Limited

Advancing toward near-term lead and silver production in Western Australia

Advancing toward near-term lead and silver production in Western Australia Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00