Feb 02, 2026

10 Biggest EV Stocks to Watch in 2026

Dec 22, 2025

Nickel Price Forecast: Top Trends for Nickel in 2026

Dec 09, 2025

Top 5 ASX Gold Stocks

Nov 04, 2025

How to Invest in Palladium Stocks, ETFs and More

More Featured Articles and Inverviews

Overview

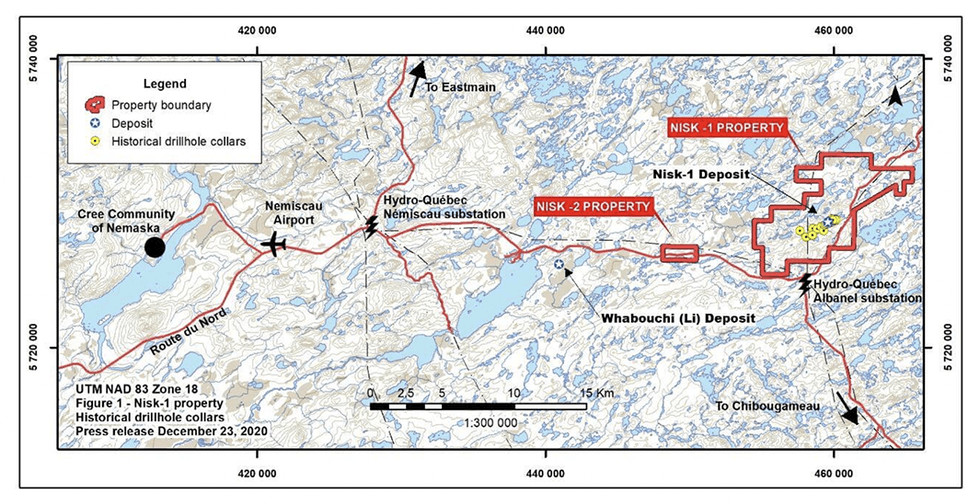

As a historically Chilean focused company, Power Nickel (TSXV:PNPN) has since been reshaped into a multi-project junior miner following two substantial acquisitions announced in 2020. To date, Power Nickel has an advanced, high-grade nickel-copper-cobalt-PGE in the James Bay Area. The NISK deposit is a very interesting Golden Ivan project in the heart of the Southern portion of the Golden Triangle.

Power Nickel is currently advancing the Nisk nickel sulphide project, comprising a large land position (20 kilometers of strike length) with numerous high-grade intercepts for multiple battery metals, including copper, cobalt, palladium, platinum and Class-1 nickel.

In 2022, Power Nickel announced the Nisk Project mineral resource estimate with combined estimated indicated resources of 2.6 million tonnes grading 1.20 percent nickel equivalent (NiEq) and estimated inferred resources of 1.4 million tonnes grading 1.29 percent NiEq.Company Highlights

- Power Nickel is a mining exploration company with assets in Chile (Tierra de Oro and Zulema) and British Columbia, Canada (Golden Ivan). The company receives 3 percent NSR royalty for its Copaquire deposit, which sold for more than C$3 million.

- The company’s wholly owned Tierra de Oro and Zulema projects are located within Chile’s prolific iron-oxide-copper-gold (IOCG) belt, which hosts a number of significant copper-gold deposits.

- The company acquired 100 percent of the Golden Ivan property located within British Columbia’s world-class Golden Triangle.

- Power Nickel has filed an NI 43 101 technical report and mineral resource estimate for the Nisk Project, located in Eeyou Istchee James Bay territory.

- The company announced a new, fully funded 5,000 meter drill program after reporting high grade results at Nisk.

- Power Nickel and Critical Elements Lithium Corporation confirmed the presence of high-grade nickel mineralization in the central portion of the Nisk Main mineralized lens.

Get access to more exclusive Nickel Investing Stock profiles here

The Conversation (0)

Latest News

Latest News

Outlook Reports world

Featured Stocks

Browse Companies

MARKETS

COMMODITIES

CURRENCIES