September 25, 2023

Odessa Minerals Limited (ASX:ODE) (“Odessa” or the “Company”) is pleased to provide a further update on the exploration program underway at its Yinnetharra Lithium Project at Lockier Range in the Gascoyne region of Western Australia.

Highlights:

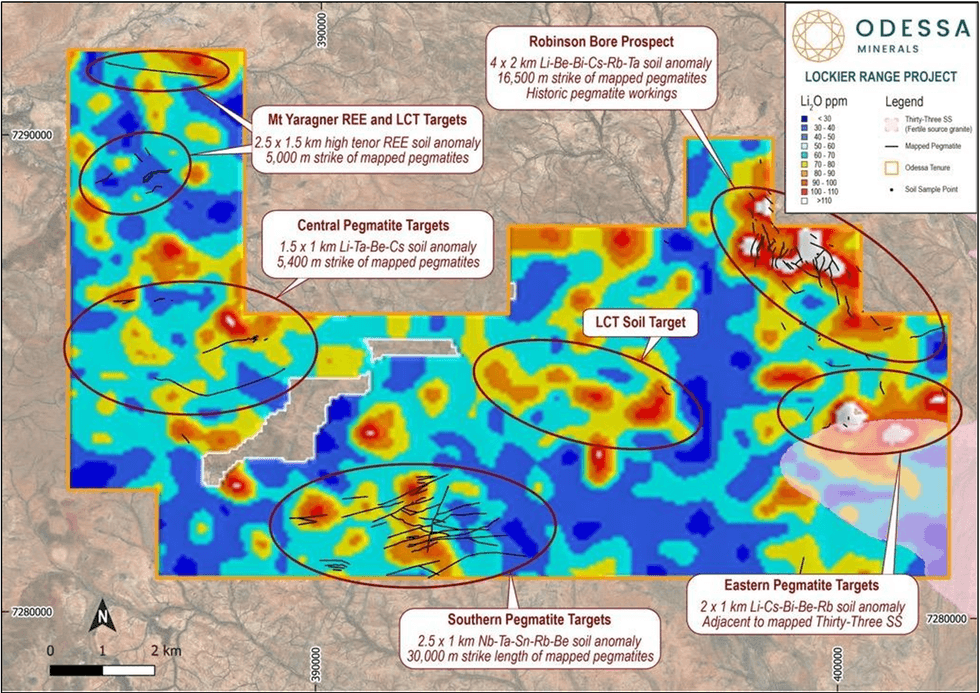

- Over 56,000 metres strike-length of pegmatites1 now mapped by geology crews on Yinnetharra at the Lockier Range tenement

- Over 10,400 metres strike-length of previously undiscovered pegmatites mapped at the new ‘Central Pegmatite Field’ and Mt Yaragner

- 30 metre-wide pegmatites mapped

- The Central Pegmatite Field is coincident with a 1.5km x 1km Li-Ta-Be-Cs soil anomaly

- 1,900 soil samples collected from current exploration program are pending results

- 187 rock samples completed are also pending results

- Robinsons Bore samples have been received by the laboratory with results pending

- Mapping and rock chip sampling of pegmatite targets continues

David Lenigas, Executive Director of Odessa, said: “Our on-going exploration program has certainly raised our expectations of a potential lithium discovery at our Yinnetharra Lockier Range Project. With over 56kms of outcropping pegmatites now mapped, many of which are close to previously identified high-order lithium soil anomalies, our main priority is to receive the assay results and commence interpretation to define LCT drill targets. Drilling these targets as soon as possible is Odessa’s objective.”

Lithium Pegmatite Targets

Pegmatites at the Yinnetharra Lockier Range project have surpassed 56,000 m of total strike-length mapped, with an additional 10,400 metres strike-length of previously undiscovered pegmatites now mapped and sampled at the Central Pegmatite Field and Mt Yaragner.

A total of 187 rock and 1,900 soil samples have been collected to date.

The Central Pegmatite Field is located 6 km from the margin of the lithium-caesium-tantalum (“LCT”) fertile Thirty-Three Supersuite granite and is host to multiple, stacked, 30m-wide outcropping pegmatites. A coincident 1.5 km x 1 km Li-Ta-Be-Cs soil anomaly is present across the Central Pegmatite Field.

The newly completed soil sampling program infilled the Company’s current Lithium-in-soil anomalies to 100m x 100m spacing and has provided higher definition data on potential drill targets. Rock chip samples have been collected from the outcropping pegmatites. Combined, this sampling program aims to delineate fertile pegmatites and generate drill ready LCT pegmatite targets.

The on-ground team are continuing to systematically map and sample the >30,000m strike length of pegmatites at the Southern Pegmatite Field.

Work Program Timeline

The Company anticipates that the Lockier Range on-ground work will be completed by the end of September, depending on weather conditions, and therefore expects to receive assay lab results in batches from October.

Subject to assay results, the Company anticipates that the next steps will be the targeting and identifying drilling locations, obtaining approvals to drill, and then drilling the targets as soon as possible.

Lockier Range Project Location

Odessa’s Lockier Range Lithium and Rare Earth Element (“REE”) Project covers a large area of 125km2 within its substantial Gascoyne tenement package of +3,000 km2; and is ideally located:

- Adjoining Minerals 260’s “Aston” Lithium project with extensive anomalies

- ~8.5km southwest of Delta Lithium’s “Jameson” lithium pegmatite discovery

- ~15km west of Reach Resources’ “Morrissey Hill” lithium pegmatite discovery

- ~25km west of Delta Lithium’s “Yinnetharra” lithium pegmatite discovery

- ~40km west of Voltaic Strategic Resources’ pegmatite discovery

- ~60-70km south of Hastings Technologies’ and Dreadnought Resources’ rare earth projects

Click here for the full ASX Release

This article includes content from Odessa Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

ODE:AU

The Conversation (0)

11 October 2023

Odessa Minerals

Uranium exploration in the Gascoyne Region of Western Australia

Uranium exploration in the Gascoyne Region of Western Australia Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00