Investor Insight

First Helium’s scalable development strategy, differentiated by a multi-commodity approach and supported by a well-defined project roadmap, positions it as a potential leader in helium production within North America.

Overview

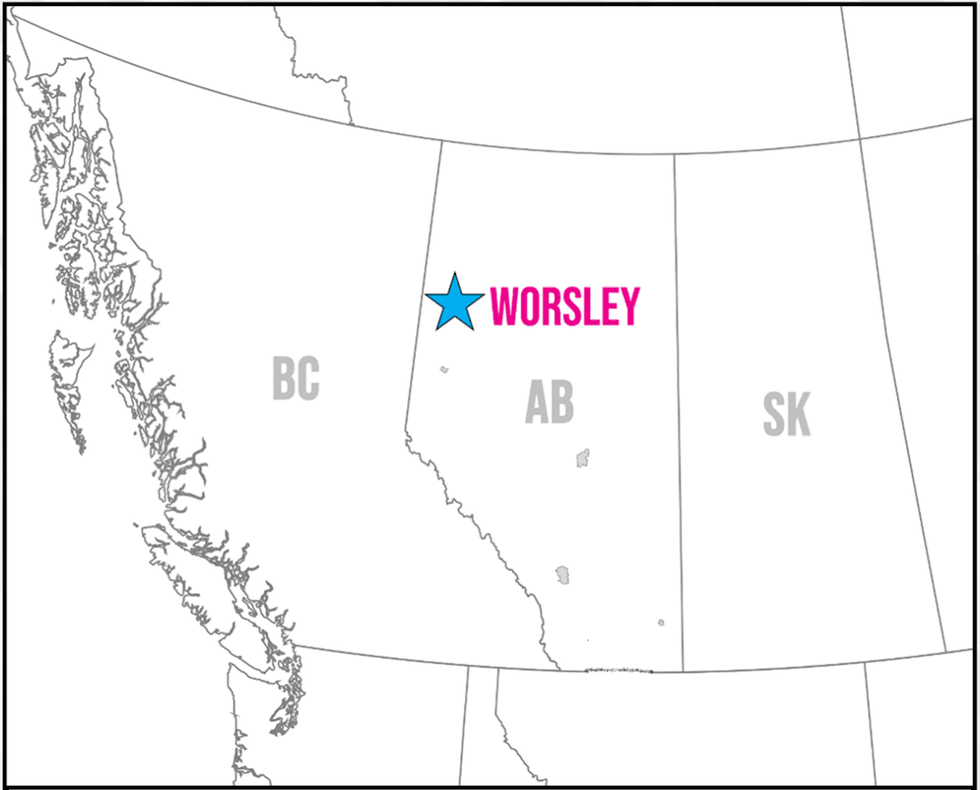

First Helium (TSXV:HELI,OTCQB:FHELF,FRA:2MC) is a Canadian company focusing on exploring and developing helium resources in Alberta, Canada. The company’s primary asset is the Worsley project, which spans 53,000 acres and includes both helium-enriched natural gas, oil and other natural resources. First Helium has made significant progress with multiple discoveries, including a helium discovery well and successful oil wells. The company aims to grow its production and cash flow through ongoing exploration and drilling activities.

First Helium is poised for substantial growth in the coming years, with the scalability of the Worsley project providing a path to significant increases in production and revenue. The company has set ambitious financial goals, targeting over $100 million in annual revenue within the next three to five years. Based on current projections, vertical drilling alone could generate over $100 million in annual revenue, with cash flow estimated to reach $70 million annually.

Helium, a critical and scarce resource, is indispensable in various high-tech industries, including semiconductor manufacturing, artificial intelligence, space exploration, defense and healthcare. Helium's demand is projected to grow 300 percent by 2030, driven by its irreplaceable role in industries that require precision, cooling and inert properties. Major companies like Google, Amazon, SpaceX, NVIDIA and Intel rely on helium for their operations. The global helium market, valued at $3.94 billion in 2021, is expected to grow to $13.26 billion by 2030.

However, the supply of helium is under pressure due to geopolitical uncertainties and production limitations from major global suppliers, including Qatar, Algeria and Russia. Additionally, the US, currently the largest producer of helium, is expected to become a net importer within the next three to five years. This shift opens significant opportunities for Canada, which is the fifth-largest global resource of helium but contributes less than 2 percent of the world’s annual production. The Canadian government has also classified helium as a critical mineral, underscoring its strategic importance in the transition to a sustainable future.

This global dynamic is creating opportunities for helium explorers such as First Helium to leverage a growing market. Led by an experienced management and technical team with successful track records in the oil and gas, mining and energy sectors, First Helium is well-placed for significant growth.

First Helium’s long-term vision is to establish a regional helium-enriched natural gas and oil play in Alberta, with the Worsley project serving as a template for future developments. The company is actively evaluating potential partnerships and acquisition opportunities to accelerate the development of its assets and capitalize on the growing demand for helium across North America and globally.

Get access to more exclusive Oil and Gas Investing Stock profiles here