Investor Insight

Angkor Resources is an emerging energy and mineral development company blending traditional oil and gas with copper and gold exploration in Cambodia, while generating revenue through oil production and carbon capture projects in Canada. With over a decade of operational experience in Southeast Asia and a reputation for sustainable practices, the company is strategically positioned to deliver both growth and resilience for investors.

Company Highlights

- Diversified Energy & Mineral Portfolio: Exposure to high-impact oil and gas exploration in Cambodia (Block VIII), recurring energy revenues in Canada, and copper-gold porphyry systems with gold epithermal near-surface prospects in Cambodia.

- Near-term Catalysts:

- Results from copper porphyry in Cambodia within 30 to 60 days;

- Seismic completion and interpretation for drill targets on Block VIII within 90 days; and

- Acquisition of oil production for increased recurring revenue streams.

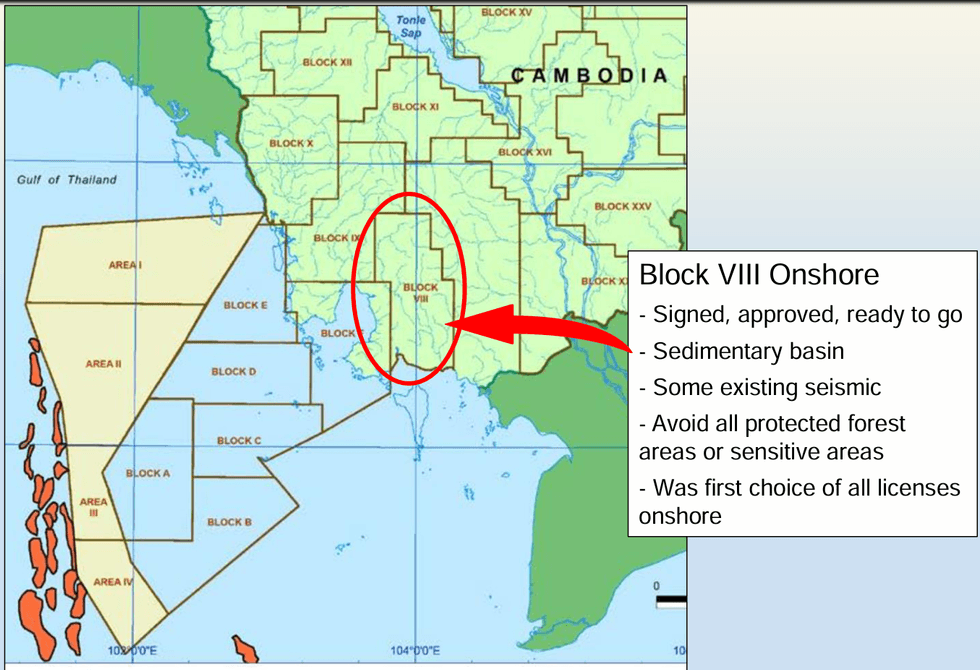

- Transformational Asset: Block VIII is Cambodia’s first onshore oil and gas exploration license, strategically located near export infrastructure. Potential minimum targets estimated at 25 to 50+ million recoverable barrels.

- Revenue-backed Model: EnerCam Canada provides recurring revenue streams via oil production, water disposal, gas processing, and carbon capture solutions, insulating Angkor from over-reliance on equity markets.

- Strong ESG Commitment: Recognized at the United Nations for sustainability, Angkor integrates carbon capture, community partnerships and environmental responsibility into every project.

- Aligned Shareholder Base: Over 40 percent insider ownership with regular insider buying, demonstrating management’s confidence in long-term growth.

Overview

Founded in 2009 and publicly listed in 2011, Angkor Resources (TSXV:ANK,OTCQB:ANKOF) has built a unique dual-focused enterprise across energy and minerals in Asia and North America.

On the energy side, the company is advancing acquisition of cash flow through oil production and carbon capture in Canada, and is poised for transformational growth through the first-ever onshore oil and gas exploration program in Cambodia. Its Canadian subsidiary, EnerCam Exploration, is already generating revenue from oil production, water disposal and gas processing, while also implementing carbon gas capture and conversion solutions for provincial markets. In Southeast Asia, Angkor’s Cambodian subsidiary, EnerCam Resources, is spearheading a national-scale initiative to bring Cambodia its first domestic hydrocarbon energy, with exploration activities underway on the company’s Block VIII concession.

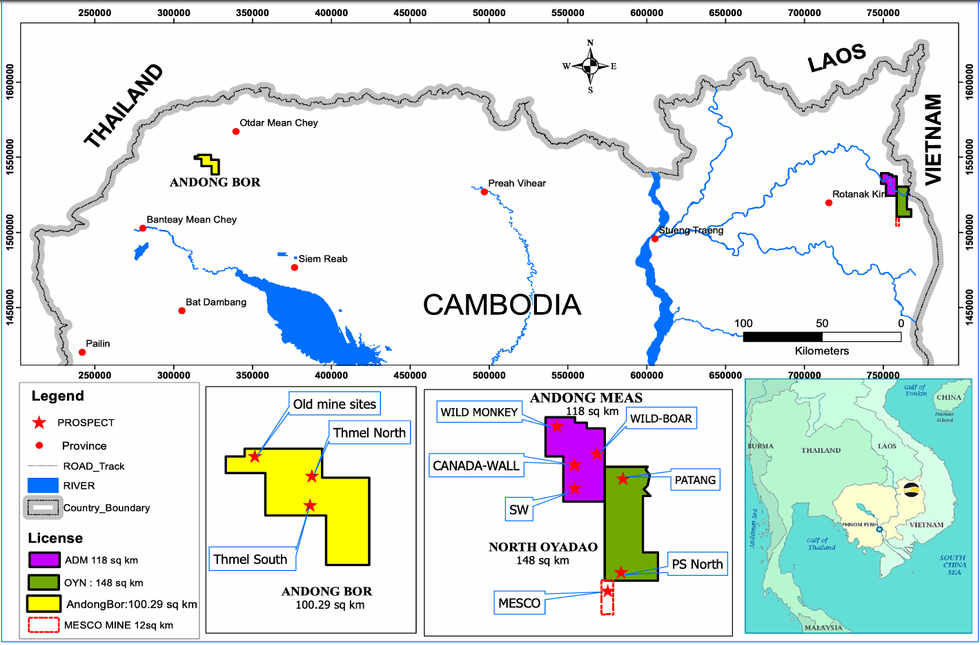

On the mineral side, Angkor has positioned itself as a first-mover in Cambodia’s underexplored mineral belts, holding licenses at Andong Meas and Andong Bor. These projects target both precious and base metals, with copper porphyry systems and high-grade gold mineralization now confirmed through exploration results.

Angkor’s strategy is designed to mitigate shareholder risk by diversifying revenue streams, blending recurring Canadian cash flow with high-impact exploration upside in Cambodia. The company’s management emphasizes hydrocarbons and copper as priorities, noting the potential value of 25 million recoverable barrels in Cambodia alongside significant copper-gold discoveries.

Key Projects

Onshore Cambodia – Block VIII Oil & Gas Concession

Angkor’s flagship asset is Block VIII, a 4,300 sq km oil and gas concession in Cambodia’s underexplored onshore sedimentary basin. The license, structured under a 30-year Production Sharing Agreement with renewal options, represents the first onshore hydrocarbon exploration license in the country. Geoscientific studies conducted by Danish, Canadian and European experts have identified strong indications of a foreland basin system and rift formations with significant petroleum potential. Over 21 natural oil seeps have been mapped and testing of the seeps by Schlumberger confirms the presence of hydrocarbons. Gas showings are also evident across the block.

The block is ideally located adjacent to export infrastructure, close to port with highway access to Phnom Penh and proximity to a deepwater port. Cambodia currently imports all of its petroleum products, making Block VIII strategically important both nationally and regionally. EnerCam, Angkor’s subsidiary, is implementing Cambodia’s first onshore 2D EnviroVibe seismic program, designed to minimize environmental footprint while mapping structural traps and stratigraphic features.

Technical projections suggest that once commercial quantity of recoverable hydrocarbons is proven, Block VIII could host Cambodia’s first onshore oil production. Angkor’s phased development plan includes completing seismic interpretation, definition of drill targets or additional 3D seismic followed by stratigraphic test wells and eventual development drilling. This project is expected to be the company’s most significant value driver and is prioritized as its number one corporate focus.

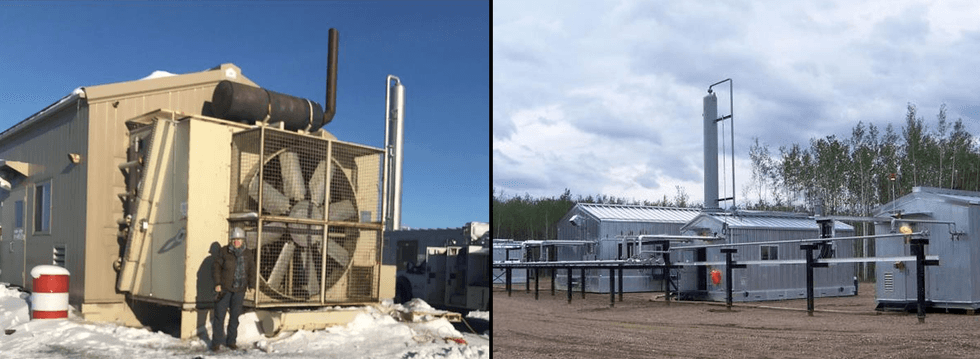

Canadian Energy & Carbon Capture – EnerCam Exploration

In Canada, Angkor operates through EnerCam Exploration Canada, which is a 40 percent interest holder in oil production and carbon solutions across 30 well sites spanning 516 hectares in Saskatchewan. These wells, shut in since 2018 due to low oil prices and mismanagement by previous operators, have been systematically refurbished and restarted. EnerCam participates in the full production cycle, including oil recovery, water separation and gas handling.

A key milestone was the acquisition of the pipeline network and compressor station, which resolved historical venting issues and allowed EnerCam to capture associated gas. This gas is converted into natural gas energy and sold into provincial markets. Angkor’s Canadian revenue streams also include water disposal fees, gas plant operations, and oil production revenues, supplemented by ongoing carbon capture and enhanced recovery of water conversion and injection wells projects.

Angkor holds a 40 percent interest in oil and gas production ventures in Saskatchewan, ensuring a recurring revenue stream. This platform not only offsets G&A costs but also provides a foundation for emission control and potential for further gas capture with surrounding producers in the area.

Cambodia Mineral Properties – Copper and Gold Portfolio

Through its subsidiary Angkor Gold Cambodia, the company holds a strategic portfolio of copper and gold assets in prospective belts. These licenses include Andong Bor and Andong Meas.

The Andong Bor license has emerged as a cornerstone of Angkor’s mineral portfolio. In June 2025, the company confirmed the presence of a copper-gold porphyry system, the first discovery of its kind in Cambodia. This breakthrough positions the project as a potential district-scale copper-gold system. Further drilling is expected to test depth extensions and delineate mineralized zones.

At the Andong Meas license, exploration has revealed high-grade gold mineralization, with surface samples returning assays up to 70 grams per ton (g/t) gold across a 0.8 km by 1.5 km area. This anomaly remains largely untested by drilling and represents a significant near-term target for resource expansion.

Management Team

Delayne Weeks – CEO

With over 25 years of global development experience spanning finance, business development, economic development and ESG initiatives. She has spearheaded Angkor’s CSR programs in Cambodia, earning UN recognition for sustainability leadership. Weeks has overseen Angkor’s transition into energy and its expansion into cash-flowing operations.

Mike Weeks – President, Executive VP Operations

Brings over four decades of operational and executive experience in international resource projects. Mike Weeks is president of Angkor Gold Corp. Cambodia and EnerCam Resources Cambodia. He has had a long and successful career in the oil and gas industry with over 30 years’ experience in project management of petroleum-related industries. Weeks also spent more than 15 years negotiating with foreign governments in developing and implementing natural resource licenses. His experience includes oil production in North Africa, engineering and design in Europe, the development of gas processing facilities and field and plant operations in Canada. Weeks has worked with international oil and gas producers including AEC West, Wintershall, Zuetina, Encana and Amoco.

Dennis Ouellette – VP Exploration, Minerals

Professional geologist with over 40 years of exploration experience in Canada, Central America and Asia. Dennis Ouellette has been a federal geologist in the Yukon for over five years, overseeing the exploration and mining industry across the Yukon by all industry participants. He leads Angkor’s mineral exploration programs, including the copper porphyry discovery at Andong Bor and a second porphyry target on Andong Meas. Ouellette has worked in multiple Canadian provinces, Nevada and Guatemala, and was the industry advocate director for the Yukon Chamber of Mines and president of Yukon Prospectors Association

Keith Edwards – Technical Manager, EnerCam Resources Cambodia

Keith Edwards is a senior geophysicist with over 39 years’ experience in all aspects of geophysics, from acquisition through processing to interpretation. He is known for his proven innovative problem-solving capabilities in software development, consulting services, interpretation and management. Edwards spent 12 years at Kuwait Oil company mentoring junior staff and performing many quantitative seismic interpretation projects. He developed several MatLab applications for Seismic Facies Classification, VSP integration, 3D design and many others.