While gold and silver have been doing a little better as of late, copper prices have continued to take a beating — the metal dipped to $2.53 on Wednesday. That said, analysts are stressing that the red metal “is categorically not the new oil.”

On the London Metal Exchange, copper futures dropped to their lowest in almost six months, hitting $5,353.25 per tonne before settling at $5,555.25 around 1:00 p.m. in London, according to Bloomberg. Analysts say that dismal oil prices and a weak outlook for economic growth from China are to blame; beyond that, the fact that the World Bank cut its outlook for global growth on Tuesday likely didn’t help Dr. Copper.

Citigroup analyst Ivan Szpakowski told Bloomberg TV that copper is getting dragged down by oil more than other commodities because it’s “played by the macro investors and by people who are looking at the broader picture rather than commodity fundamentals.” This month, oil prices fell below $50 a barrel for the first time since 2009, and were sitting at $45 a barrel on Tuesday.

Meanwhile, CRU Group has called for demand growth in China to dip to 4 percent this year, down from 5.5 percent last year, and economists are calling for the country’s economy to grow at the slowest pace since 1990.

In terms of day to day trading, David Wilson at Citi told the Financial Times that a sell off of the metal in Asia prompted more selling on the London Metal Exchange.

“Right now the fundamentals are irrelevant, it’s the macro overlay that’s driving everything,” he said. “There was massive selling on Shanghai overnight which has prompted more selling on the LME.” Copper buying tends to slow ahead of Chinese New Year in February.

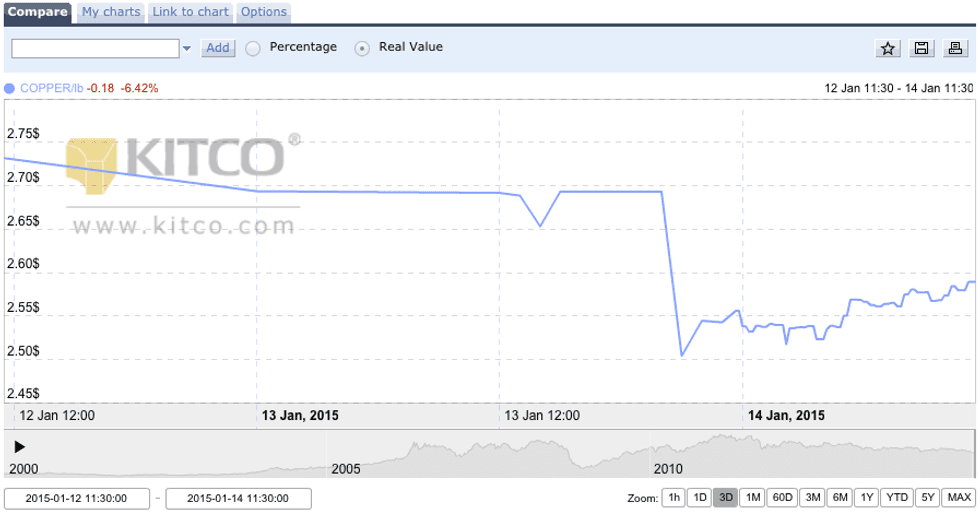

Copper prices over the past three days. Source: Kitco“People have seized on the bearish sentiment to give copper a push and see how far they could take it,” a trader told the publication.

That said, others have stressed predictions that copper won’t go the way of oil. Clive Burstow, a fund manager at Barings Asset Management, told the Wall Street Journal that while oil is oversupplied, copper is in a “much more of [sic] balanced situation.” Macquarie base metals analyst Vivienne Lloyd agrees. “Copper is categorically not the new oil,” she said.

The issue of whether or not copper will be oversupplied next year has been a little contentious, with some predicting any supply deficit will still be a few years out. However, doubts of a surplus are being raised, as Reuters reported that Rio Tinto (NYSE:RIO,ASX:RIO,LSE:RIO), BHP Biliton (NYSE:BHP,ASX:BHP,LSE:BLT) and Glencore (LSE:GLEN) have reduced production forecasts for some of their copper operations for 2015. For its part, Macquarie has cut its oversupply forecast by over 300,000 tonnes of copper to just 98,000 tonnes.

“The market is not going to be as over-supplied as we had originally thought after several announcements on cutbacks,” Lloyd told Reuters. “We expect the market to be quite balanced this year.”

Looking a bit further into the future, it’s worth noting that Rio Tinto’s copper head, Jean-Sebastien Jacques, told the Financial Times last week that the world will need the equivalent of a new Escondida every 15 months to keep up with global demand over the next decade.

That said, the short term hasn’t been great, and miners haven’t been immune to the red metal’s recent fall. Freeport-McMoRan (NYSE:FCX) was down about 15 percent on Wednesday, while BHP and Southern Copper (NYSE:SCCO) were both down about 5 percent. On the Toronto Stock Exchange, First Quantum Minerals (TSX:FM) and Lundin Mining (TSX:LUN) were both down about 17 percent. There was one bright note for copper for the day — junior miner Copper Fox Metals (TSXV:CUU) was up 4.35 percent, at $0.12.

Securities Disclosure: I, Teresa Matich, hold no direct investment interest in any company mentioned in this article.