Monday’s eclipse knocked out large quantities of solar power across the US, and a number of solar energy stocks have been on the decline since then.

While millions of people across North America gathered to catch a glimpse of the total eclipse on Monday (August 21)–the first one in roughly 100 years–since then, solar energy stocks have also dimmed out.

According to CNBC, Monday’s eclipse knocked out large quantities of solar power across the US, but was likely a result of correlation, analysts said. In addition to that, because solar energy is a relatively new development–especially since the last time there was a complete solar eclipse in North America–Nicholas Steckler, a Bloomberg New Energy Finance analyst said US power “hasn’t seen this sort of natural phenomenon.”

“With so many renewables coming online, especially in the last five to ten years, there is more impact from an eclipse,” he said.

While it’s been a few days since the eclipse, a number of solar energy stocks have yet to recover. Here’s a quick look at how a few stocks have reacted post-solar eclipse. All companies have a market cap of less than $1 billion.

- Alterra Power (TSX:AXY): Based in Canada, Alterra Power manages eight power plants containing 825 megawatts of hydro, wind, geothermal and solar generation capacity in Canada, the US and Iceland. Since Monday, shares of Alterra have dipped marginally by 0.55 percent to $5.41 at the close on Thursday (August 24), but have still risen 3.84 percent year-to-date;

- Canadian Solar (NASDAQ:CSIQ): While Canadian Solar is listed on the NASDAQ, its headquarters are in Guelph, Ontario. The company provides solar power products, service systems and solutions across North America, South America, Europe, Africa, the Middle East, Australia and Asia. Shares of Canadian Solar have dipped more than 6 percent since Monday to $15.57 at market close on Thursday. Year-to-date, however, Canadian Solar’s shares have been on the rise, increasing 27.83 percent;

- EnerDynamic Hybrid Technologies (TSXV:EHT): EnerDynamic develops and produces solar and wind power products, including installations. It supplies materials for a wide range of markets, including modular homes, cold storage facilities, residential and commercial buildings. Post-eclipse, shares of the company have dropped 4.35 percent to $0.11, while year-to-date its share price loss is much more substantial, at 47.62 percent.

- Envision Solar (OTCQB:EVSI): Envision Solar designs and produces solar products and technology solutions for things such as electric vehicle charging infrastructure. Since Monday, shares of the company have dropped 3.17 percent to $0.14, while year-to-date Envision Solar’s stock price has decreased by 28 percent.

- JinkoSolar (NYSE:JKS): JinkoSolar functions through the photovoltaic industry, and has built a vertically integrated solar power product value chain. Shares of JinkoSolar have dipped 6.69 percent since Monday’s total eclipse to $24.55, but have risen 61.2 percent year-to-date.

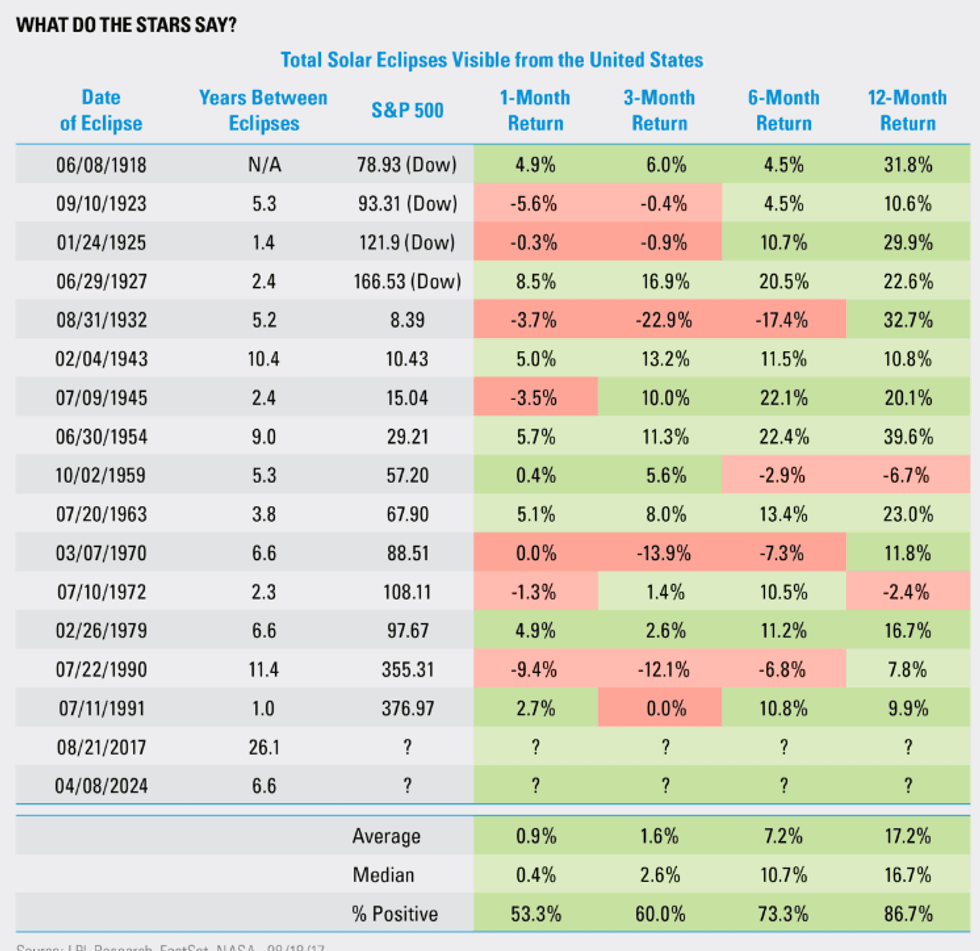

That being said, LP Research suggests that investors shouldn’t fret over how solar energy stocks have reacted. Below is a chart provided by LPL Research, FactSet, NASA that looks at the history of total solar eclipses visible from the US and how the stock market has responded:

“Should you ever invest based on the solar system? Absolutely not, as things like fundamentals, valuations, and technicals are still what drive markets,” LPL Research suggests.

Ryan Detrick, senior market strategist at LPL states that since 1900, every time a solar eclipse has been seen in the US, equity prices have increased 17.2 percent the following year.

With that in mind, while a number of solar stocks have declined since the total solar eclipse, it isn’t nearly as bad as it might seem on the surface.

Don’t forget to follow us @INN_Technology for real-time news updates.

Securities Disclosure: I, Jocelyn Aspa, hold no direct investment interest in any company mentioned in this article.