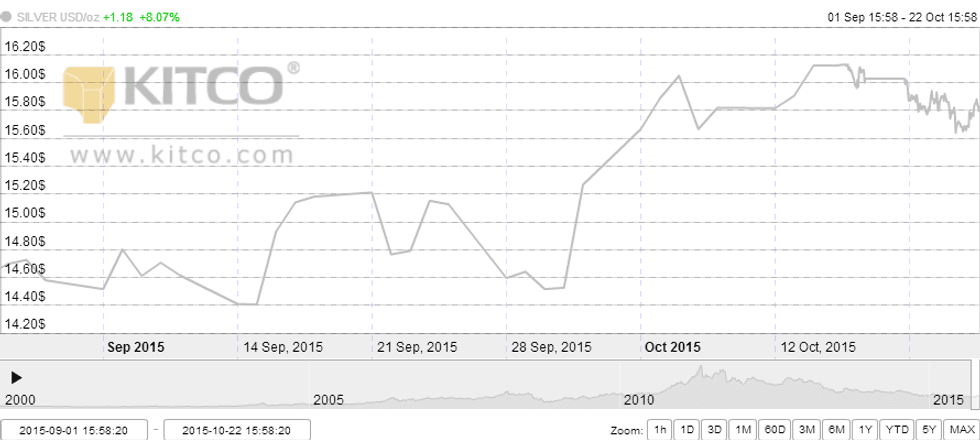

The silver price is up just over 8 percent since the end of September.

The silver price has fared well since the start of September. It’s up just over 8 percent since then, and as of 3:00 p.m. EST on Thursday was changing hands at $15.80 per ounce. Last week, it was even able to breach the $16 mark, albeit briefly.

The US Federal Reserve has been a key driver for the metal for the past month or so. On September 17, the central bank announced after a two-day meeting that it would not be raising interest rates, pushing silver to its highest price yet that month. The release of minutes from that meeting on October 8 have given the metal some added momentum.

This Kitco chart provides a good illustration of those price movements:

Of course, while all that is positive news for silver bugs, savvy investors are wondering whether the white metal’s gains can last. Encouragingly, at least some signs point to yes.

For instance, a recent Bloomberg article states that investor interest in precious metals seems to be on the rise, noting that from October 1 through to October 20, investors added $393 million to US exchange-traded funds backed by precious metals. That’s “on course for the biggest monthly inflow since February.”

The news outlet points to other positive signs for precious metals as well. In particular, it notes that demand for silver coins is exceeding supply, with mints in Australia and the UK rationing supply. Meanwhile, “Russia and China continue to boost gold holdings.”

Whether or not silver is able to keep its momentum as the year draws to a close remains to be seen. For now, investors looking for clues would do best to watch the Fed. Its next two-day meeting is scheduled for October 27 to 28, and may provide more insight on whether interest rates will be raised this year.

Miners release Q3 results

In terms of silver company news, this week has been heavy on Q3 results.

Hecla Mining (NYSE:HL) released its preliminary Q3 production results on Tuesday, commenting that it produced 2,591,546 ounces of silver, 43,635 ounces of gold, 17,435 tons of zinc and 9,123 tons of lead. All in all, it put out 8.7 million silver equivalent ounces during the period.

The company now expects year-end production to be at the high end of its previously estimated range of 10.5 to 11 million ounces of silver and 185,000 ounces of gold. In a press release, President and CEO Phillips S. Baker, Jr. pointed to the Greens Creek mine in Alaska as a key driver behind Hecla’s “strong, consistent production performance.”

The same day, Santacruz Silver Mining (TSXV:SCZ) put out Q3 operating results for its Mexico-based Rosario mine, noting that it produced 277,487 silver equivalent ounces during that time period. That’s an increase of 4.38 percent from the previous quarter.

CEO Arturo Prestamo said the company is now “hitting [its] stride at the Rosario Mine and … anticipate[s] further improvements both operationally and financially.”

Finally, on Thursday Comstock Mining (NYSEMKT:LODE) announced selected unaudited Q3 financial results, stating that mining revenue was $4.3 million compared to $6.5 million in the year-ago quarter. The fall came on the back of a lower average price per ounce of gold, plus lower production.

On a more positive note, costs applicable to mining revenue net of silver credits were $3.5 million, down from $4.4 million in Q3 2014. The 21-percent decrease was “primarily due to mining cost reductions.” Furthermore, Comstock said it has been cash flow positive from operations for the first nine months of the year, and expects that to continue in Q4.

Securities Disclosure: I, Charlotte McLeod, hold no direct investment in any company mentioned in this article.

Editorial Disclosure: Comstock Mining is a client of the Investing News Network. This article is not paid-for content.