With Russian stockpiles in the equation, it can be hard to know what’s next for palladium. However, analysts see overall demand for palladium rising as the metal heads into its fourth year of structural deficit.

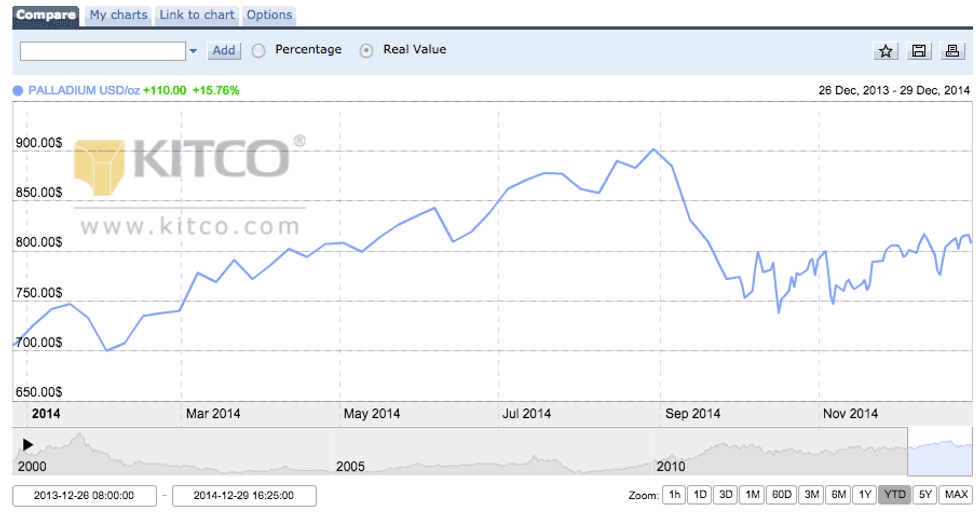

Overall, palladium is up 15 percent this year, a stark contrast to its sister metal platinum, which is down about 10 percent. At the end of 2013, both metals were expected to see gains.

Speaking to what could have driven palladium’s positive performance, Sergey Raevskiy of SP Angel pointed out that holdings in palladium exchange-traded funds (ETFs) have grown by roughly 50 percent, or 1 million ounces, due to the launch of two new ETFs in South Africa; that’s compared to a growth of just 100,000 ounces in platinum funds.

“Palladium investment demand has seen a stark deviation from the dynamics in the platinum market regarding ounces involved,” he said, noting that his company underestimated growth in investment demand due to the new South African funds.

Raevskiy sees this year’s sanctions against Russia due to tensions with Ukraine as another key factor that has lent support to prices. Russia produces about 40 percent of the world’s palladium.

Strong auto sales helped the palladium market this year as well — about 50 percent of the world’s palladium is used in catalytic converters, mostly for gasoline engines. In November, auto sales figures hit record highs in both Canada and the US, and that trend is set to continue — global auto demand should continue to grow by 3 percent next year, according to a report from ScotiaMocatta. Gross demand for palladium from the auto industry is set to increase by about 4 percent.

Meanwhile, a long-running strike in South Africa — which halted operations run by Anglo American Platinum (LSE:AAL), Impala Platinum (JSE:IMP) and Lonmin (LSE:LMI) for five months — did not boost PGM prices nearly as much as expected.

Demand to rise in 2015

Looking forward, ScotiaMocatta sees demand for palladium slipping in sectors such as jewelry, where it can be replaced when prices get too high. However, the firm expects other applications, such as water treatment, as well as tighter emission restrictions for factories and machinery, to help lift demand.

On the supply side, ScotiaMocatta notes that recycled material is the second-largest source of palladium supply after Russia, having overtaken South Africa in 2013. As palladium continues to be used more and more in autocatalysts, this figure should increase.

The firm suggests that there will likely be a supply deficit of 1.85 million ounces for palladium in 2014. That said, aboveground stockpiles — both in Russia and in the hands of global industrial users — are still a sizeable unknown that could mute the effects of a boost for palladium. Indeed, the metal is heading into its fourth year of structural deficit, and some are saying that prices are not as high as they could be.

Although no one knows just how much palladium Russia has stockpiled, ScotiaMocatta states that the general view is that palladium stocks must be depleted after years of sales. However, Russia’s Norilsk Nickel (MCX:GMKN) said in September that it wants to buy palladium stocks worth as much as $2 billion from the country’s central bank in a bid to improve transparency in the market, raising concerns that stockpiles might not be as depleted as once thought.

That could mean a major offset for the projected global deficit. Still, ScotiaMocatta reassures investors in its report that “Norilsk as a PGM producer would be unlikely to flood the market with Palladium as that would be counter-productive.”

Overall, the firm suggests that relatively lower prices and firm fundamentals could stoke investor interest in palladium. In terms of prices, it forecasts a fairly wide range of $725 to $900 per ounce for 2015, adding that any dips below that level will be short lived.

For his part, Raevskiy sees prices increasing to roughly US$900 per ounce, up from an average of around US$800 per ounce in 2014. “[W]e are more bullish on palladium than platinum due to strong demand from the auto sector forecast in China and North America as opposed to weakening sentiment in the Eurozone,” he said.

Securities Disclosure: I, Teresa Matich, hold no direct investment interest in any company mentioned in this article.

Related reading: