Drill Tracker Weekly: TerraX Expands New Surface Discovery at Yellowknife Project

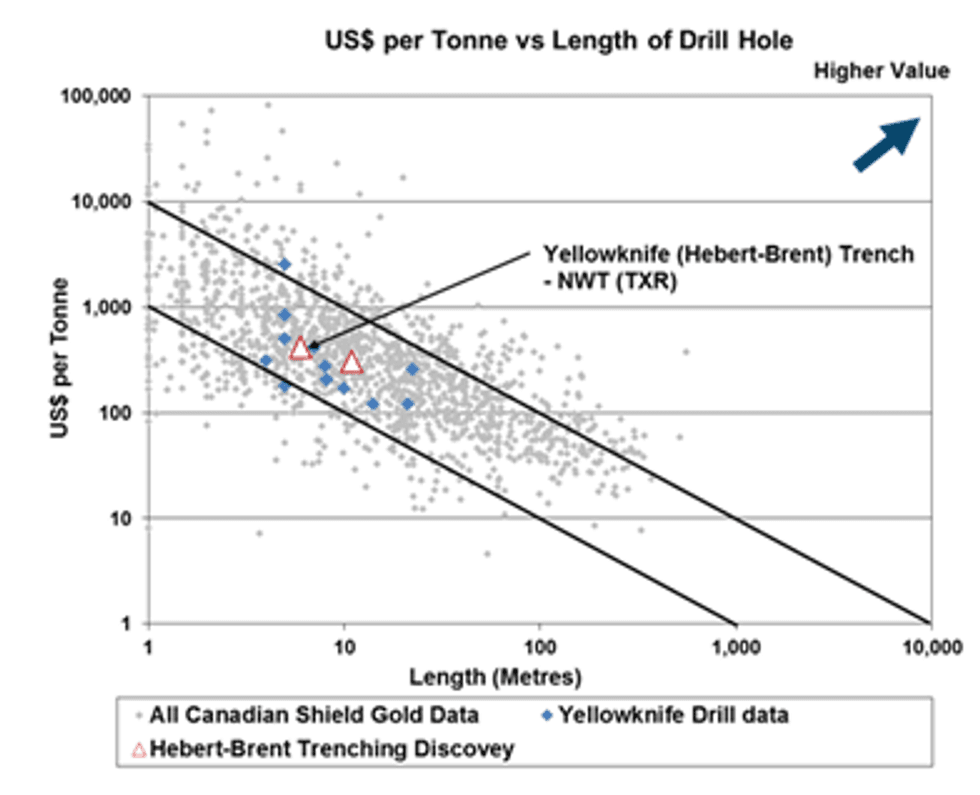

One highlight from current trenching is 6 meters grading 10.26 g/t; that includes three samples greater than 16 g/t gold.

Drill Tracker Weekly is not exclusive to Resource Investing News and is published with permission from Mackie Research Capital Corporation. It highlights drilling results in context with our database of over 10,000 drilling and trenching results. The purpose of this report is to highlight drilling and trenching results that stand out from the pack and compare them to their peer group. This report does not constitute initiation of coverage or a recommendation.

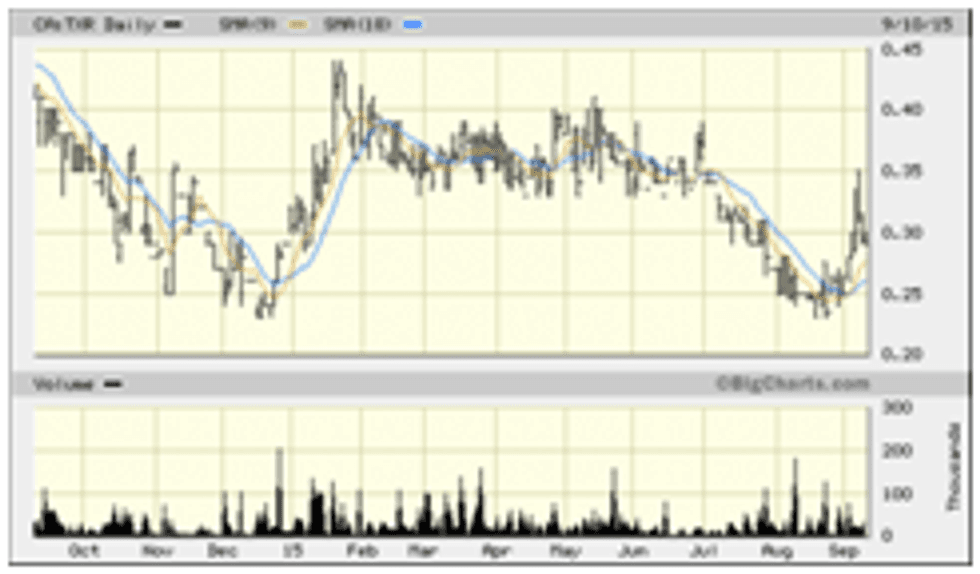

TerraX Minerals (TSXV:TXR)

Price: $0.29

Market cap: $19.5 million

Cash estimate: $5 million

Project: Yellowknife

Country: Canada

Ownership: 100 percent

Resources: N/A

Project status: A new look at an old gold camp

- TerraX Minerals announced additional trenching results from its recent Hebert-Brent discovery on its 100% owned 94.9 km2 Yellowknife City project in the Northwest Territories. The 15 kilometre long Yellowknife City property is the extension of the geology containing the 8.1 million ounce and the 6.1 million ounce Giant Mine and Con Mines. The project is unusual in the NWT in that it is road accessible year round with an eight kilometre road to the Yellowknife airport where the Company has its core storage facility. The project was bought after the previous operator Century Mining declared bankruptcy. Osisko Gold Royalties (TSX:OR) owns 17.2% of TerraX though the merger with Virginia Mines and subsequent private placements.

- Highlights from the current trenching include 6.0 metres grading 10.26 g/t including three samples greater than 16 g/t Au. The sample is located 75 metres to the south of the discovery trench reported August 11, 2015 which returned 11.0 metres of 7.55 g/t Au. The sample was taken within an 80 metre wide sericite altered shear zone one kilometre along strike from the Barney zone. The zone is believed to have no previous surface working or drilling by previous operators. An additional trench 45 metres to the east of the trench reported in August returned 6.0 metres grading 4.05 g/t Au.

- Since acquiring the Yellowknife City project in January 2013, the Company has been systematically re-logging and re-sampling 200 historical drill intersections from the core stored in the Yellowknife core yard at the Giant Mine prior to selective conformation, infill and step out drilling in 2014 and 2015. Since 2013, the Company has also completed a new airborne geophysical survey as well as a high definition LiDAR survey.

Development history: Past gold production in the area includes the 8.1 million ounces Giant Mine and the 6.1 million ounce Con Mines. Terrax acquired the northern extension of the belt in January 2013.

Current and recent trench results in the Hebert-Brent Zone: 6.0 metres @ 10.26 g/t Au; 11.0 metres @ 7.55 g/t Au (August 11, 2015).

Risk Analysis

Data contained in DRILL TRACKER WEEKLY is based on early stage exploration activity. The results are obtained at the very early stages of exploration and therefore, individual results may not be reproducible with additional trenching or drilling, nor may the results ultimately lead to the discovery of an economic deposit. Delineation of a resource body requires an extensive data gathering exercise according to guidelines set out in National Instrument 43-101 before investors can be reliably assured of a competent body of mineralization that may be of economic interest. DRILL TRACKER WEEKLY is designed to highlight individual trench or drill results, which stand out as being materially anomalous and are particularly worth of note – a type of early warning flag for a particular property that warrants further attention. Hence, DRILL TRACKER WEEKLY does not provide a recommendation to buy, sell or hold a specific equity – it is an information reference source to help quantify the meaning and relevance of early stage exploration results.

Relevant Disclosures Applicable to: Drill Tracker Weekly

- The research analyst or a member of the research analyst’s household owns and/or has options to acquire shares of the subject issuer. At the date of this release the author, Wayne Hewgill, owns no shares in the companies in this report:

Analyst Certification

I, Wayne Hewgill certify that the information in this report is sourced through public documents that are believed to be reliable but accuracy and completeness as represented in this report cannot be guaranteed. The author has not received payment from any of the companies covered in this report. This report makes no recommendations to buy, sell or hold. Each analyst of Mackie Research Capital Corporation whose name appears in this report hereby certifies that (i) the recommendations and opinions expressed in this research report accurately reflect the analyst’s personal views and (ii) no part of the research analyst’s compensation was or will be directly or indirectly related to the specific conclusions or recommendations expressed in this research report.