The yellow metal rose 5 percent Thursday to reach $1,260.60 per ounce. That’s its biggest daily gain in seven years.

This article has been updated since it was first published.

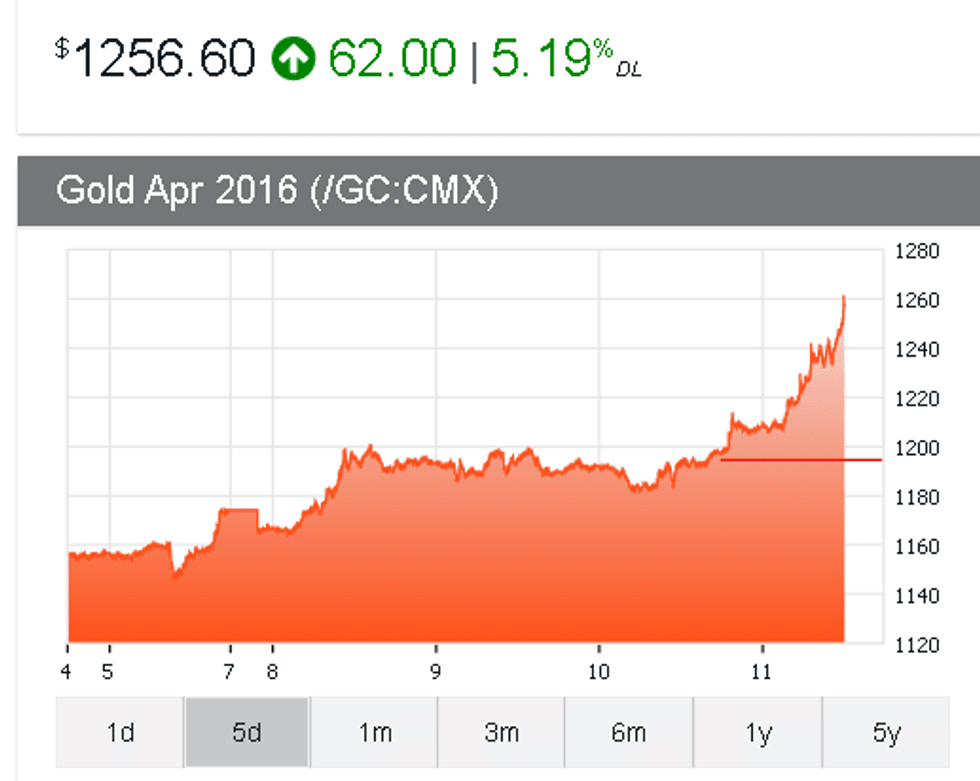

The gold price rocketed 5 percent Thursday to reach $1,260.60 per ounce. That’s its highest level since last February and its biggest daily gain in seven years.

Speaking to Reuters, Macquarie analyst Matthew Turner said that there is a “good explanation for gold’s rally; it is to do with worries about the U.S. economy and the rest of the world.”

But what exactly prompted this sudden increase in concern about the global economy? Addressing that question, Reuters states that fears were spurred partially by a fall in European bank shares, with US Treasury yields and a lower US dollar not helping the situation.

However, some believe investors’ concerns are more widespread than that. In conversation with Kitco, Afshin Nabavi, head of trading with MKS (Switzerland), quipped that investors’ anxiety is being spurred by “everything under the sun” — including weaker oil prices and a rout in global equities, in addition to the lower US dollar.

Whatever the specific catalysts behind gold’s Thursday surge, it’s clear at this point that investors are beginning to think of the metal as a safe haven once again. And so far the consequences of that have been impressive — gold has now gained 20 percent so far in 2016, making it the year’s best-performing commodity.

Check out the chart below for a visual representation of that data:

Of course, for investors, the real question is whether the current gold price rally will continue. Opinions vary on the matter, but many are optimistic.

Bernard Sin, the head of currency and metal trading at MKS (Switzerland), is one market watcher who’s offered some optimism. He commented to Bloomberg, “[p]eople are bullish gold because they have no idea where else they can put their money. We’re seeing a lot of hot money coming into the market, and there’s interest from a lot of new players. The rally could have legs if that continues.”

Well-known commentator Frank Holmes of US Global Investors (NASDAQ:GROW) has also stepped forward to offer three reasons why he believes the current gold price rally is “stickier” than those seen in the past.

That said, gold is by no means out of the woods yet — according to Macquarie’s Turner, “[t]he key risk to gold is that the U.S. economy manages to put in a good performance, like it did last year.” Gold bugs will undoubtedly be watching closely to see what happens. As of 5:00 p.m. EST on Thursday the metal was changing hands at $1,246.40.

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.