A weaker-than-expected April has pushed tellurium prices to their lowest point in more than eight months as the solar and appliance industries see slow sales. However, rising cell efficiencies should provide some light at the end of the tunnel.

First Solar (NASDAQ:FSLR), a bellwether of tellurium solar demand, experienced a fall in net sales of twelve percent in the first quarter of 2012. The company said in March that it was planning to reduce its workforce by 30 percent and intended to close a plant in Germany.

Increasing competition from China and sagging demand from European governments reduced solar panel prices by 49 percent in 2011. Combined with record-low natural gas prices, these factors have led to a turnover across the solar industry for both cadmium-telluride solar panel producers and for tellurium demand.

“[G]overnmental investment in the solar industry in European countries has shrunk, indicating nervousness over the Eurozone crisis,” a Chinese tellurium trader told Metal-Pages.

Slowing solar demand has also raised concerns of a potential overhanging supply that would fetter the market to lower tellurium prices for the next four to five years, a First Solar representative told Metal-Pages. In 2011, tellurium demand from the solar industry represented just over 35 percent of total consumption, or about 300 of the 845 tonnes, a figure that is projected to fall by up to 50 percent this year due to cheap supplies of polysilicon – a solar technology competing with thin-film cadmium telluride – and natural gas.

But despite the current melancholic state of the recently bright solar market, technological advances and swings in support can quickly turn the market around.

One of the technologies most closely monitored by industry watchers is ever-improving photovoltaic cell efficiency levels, which represent the amount of sunlight energy a cell is capable of transforming into electricity.

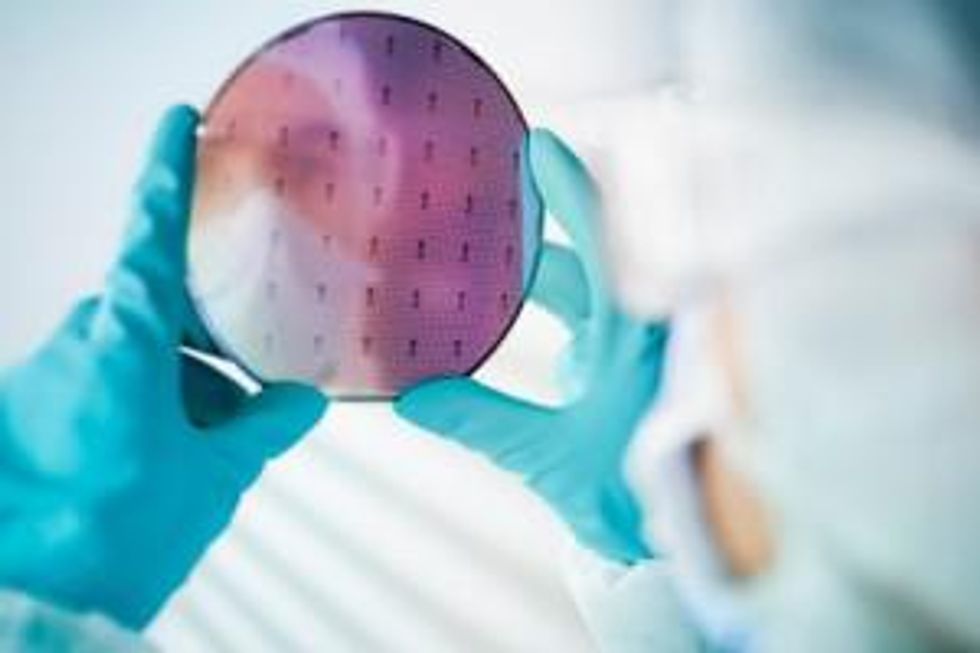

Cell efficiencies for cadmium-telluride cells currently rank behind those of its competitor technology, crystalline silicon wafer cells. This difference explains the market share gap between the two technologies (silicon wafer cells currently hold about 80 to 90 percent of the total solar market).

Recent testing provided by SGS Germany has shown that the cadmium-telluride cells of Calyxo GmbH (founded by Q-Cells SE in 2005) have reached a record energy conversion efficiency of 16.2 percent based on proprietary low-cost atmospheric deposition technology.

“Based on this achievement, we are confident of reaching 17-18% cell efficiency and 14-15% top module efficiency later this year,” the firm’s chief technology officer, Michael Bauer, commented.

Such advances are warmly welcomed by tellurium markets as rising efficiency places solar cadmium-telluride thin-film cells in a more competitive environment in the long run. Thus, despite tellurium’s often sharp price swings, new companies that are able to adopt and streamline production of more efficient solar panels will likely be better placed when markets rebound in the months and years ahead.

Securities Disclosure: I, James Wellstead, hold no direct investment interest in any company mentioned in this article