Analyst Commentary: Helio Hits Million Ounce Resource Milestone at SMP Gold Project in Tanzania

With its new 1.02 million oz. Measured and Indicated (M&I) resource estimate, Helio Resource Corp (TSXV:HRC) will now look to attach some economic parameters to its SMP gold project via a Preliminary Economic Assessment. However, the junior company is far from finished delineating resources at SMP since only 4 of 30 gold targets have seen enough drilling to attach a resource estimate.

With its new 1.02 million oz. Measured and Indicated (M&I) resource estimate, Helio Resource Corp (TSXV:HRC) will now look to attach some economic parameters to its SMP gold project via a Preliminary Economic Assessment. However, the junior company is far from finished delineating resources at SMP since only 4 of 30 gold targets have seen enough drilling to attach a resource estimate. Think of these targets as pearls in a necklace; each is incremental to the overall value of the necklace.

The magic number with respect to gold production is 100,000 oz. per year. That’s the mark at which the market (and major gold producers) starts to take notice of a company’s earning potential. Another important factor in determining market value is Life of Mine. The production rate should be sustainable for at least 10 years, hence the importance of Helio’s one million oz. resource estimate.

With an excess of a million ounces of gold under its belt, Helio Resource Corp (TSXV:HRC) has now demonstrated it has the resources available to potentially hit that 100,000 oz. per year production target.

The updated resource represents a 104% increase in the M&I category over Helio’s’ maiden resource estimate which it published in 2010. Measured and Indicated Mineral Resources now weigh in at 1,020,000 ounces averaging 1.32g/t gold. Inferred Mineral Resources add 240,000 ounces averaging 1.05g/t gold. The cut-off grade used was 0.5g/t.

The grade of the deposit is also key. The potential mine must demonstrate it can be profitable even at low gold prices based on anticipated capital and operating costs. Helio’s average grades are good. At today’s prices (US$1714/oz. Au), one tonne of rock at Helio’s SMP project would be worth about US$73 in the ground. This is also known as its “in-situ value.” If the company can show it can still make a robust profit after mining, processing and capital costs have eaten away at this gross ”in-situ” value, Helio will be on its way towards attaining the holy grail of junior resource companies – an asset with a profitable production scenario.

Even with an increase in the gold cut-off grade to 0.9 g/t gold (the grade at which the rock is no longer economically feasible to mine and process), Helio still has 860,000 oz. of M&I resources and 170,000 oz. of Inferred resources available to mine at average grades of 1.54 g/t gold and 1.33 g/t gold, respectively. Increasing the cut-off grade and lowering the gold price have similar effects on a mine’s economics.

Another key factor to look at is how much of the resource can be potentially mined. Helio states that initial open pit designs indicate that 87% of the Porcupine and Kenge resources (about 890,000 oz. gold) are easily accessible. Preliminary metallurgical work is also promising with 95% gold recoveries from a conventional cyanidation process.

While this does drop the M&I resource below the magic million oz. mark, we have not included the inferred resources or the fact that the resource remains open to expansion along strike and to depth.

Helio also reports that 96% of resource is hosted in the Kenge and Porcupine deposits. The company has identified 2830 other mineralized zones to date which require additional drilling. In time, these new zones could each add more gold resources to the overall potential mine.

Helio’s SMP deposit looks similar to the early days of the Chirano deposit in Ghana, West Africa. The Chirano mine hosts a series of shallow open pit mines along a major structural zone. A number of these open pit mines were developed into higher-grade underground deposits since the grade of mineralization increased at depth.

In 2010 Red Back Mining was taken over by Kinross Gold in a $7.1 billion deal mainly for its two producing assets the Chirano Mine in Ghana and the Tasiast mine in Mauritania. In 2004, prior to the takeover, Red Back Mining’s Bankable Feasibility Study outlined 29 million tonnes of material averaging 2 g/t gold or (1.8 million contained oz. gold). Production was 123,000 ounces per year. By the time of the takeover six years later, the Chirano Mine had expanded its reserves to over 5 million oz. and was producing at a rate of about 250,000 ounces per year.

Expansion Potential at SMP

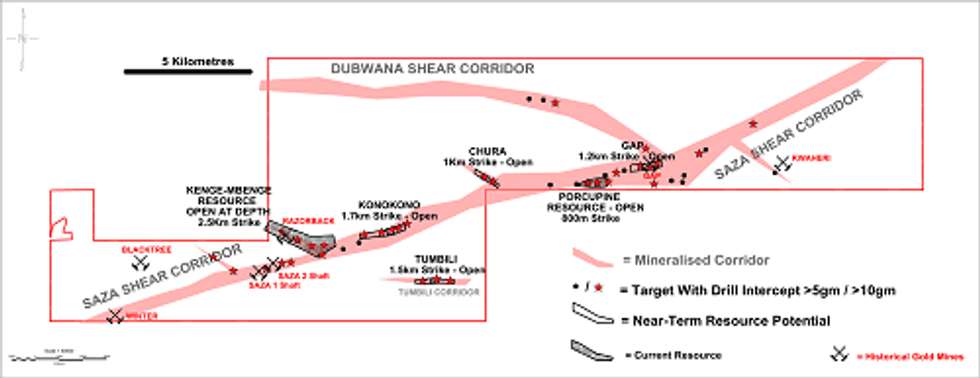

The SMP project lies along the 35-km-long Saza Shear zone and to-date Helio has discovered 30 known mineralized targets. Its current resource is defined within 4 of these 30 targets, namely Porcupine, Kenge, Konokono and Tumbili. All remain open for expansion. Refer to Figure 1.

Figure 1) Resources and targets on SMP project

The resources hosted at Konokono and Tumbili (4% of the total current resource) were only defined within 100 to 150 metres of strike extent. In other words, the drill density was only sufficient to calculate a resource within those 100 to 150 metres. Helio reports that recent drill testing of the Konokono and Tumbili targets indicate a strike length potential of 3,200 metres, implying excellent potential to significantly increase the resource base in these areas.

At Porcupine, recent drill results that were not included in the latest resource upgrade represent excellent potential to add higher grade material to the resource and ounces at depth, beneath the current resource.

Looking Ahead

This year Helio intends to complete a Preliminary Economic Assessment (PEA) report on its currently defined resources at the SMP project. It hopes to table the results in June.

Additional drilling will focus on further delineating the resource potential at the Tumbili, Konokono and Gap targets. Helio also plans to drill beneath the old Saza mine (below 200 metres). The past producing Saza mine cranked out in excess of 2700,000 oz. at grades over 7 g/t gold. It was shut down in 19540’s at the end of British Colonial presence.

Helio currently has $3.5 million in the bank which is enough to take them through the PEA phase at SMP and drill their Namibian target (Gold Kop).

Additional Value in Namibia

Helio has another ace up its sleeve with its newly discovered Gold Kop target on its Damara Gold Project in central Namibia. The discovery of the Gold Kop target (50m @ 2.1g/t Au, 0.8% Cu and 14g/t Ag. See June 13, 2011 news release) was a significant event for the company and will be the focus of ongoing drilling in 2012, the objective being to outline the resource potential as quickly as possible.

Exploration so far has outlined a 1.3 km strike length of the main prospective horizon which is a dolomitic marble that hosts a combination of wide low-grade zones of mineralization and narrower zones of high-grade gold mineralization.

This new discovery is 40 km northeast of and on strike from AngloGold Ashanti’s Navachab gold mine. The Navachab mine has been in production since 1989 and, as of December 2011, has produced over 1.5 million oz. of gold, and currently has a non-NI 43-101 compliant resource of 5.1 million oz. grading 1.15g/t Au (source AngloGold Ashanti Resource Report, 30 June, 2011). Gold Knop has a very similar geology to the Navachab deposit.

Bottom Line

Helio Resources has so far outlined a quality resource in excess of 1 million oz. of gold at its SMP project in Tanzania. This resource averages 1.3 g/t gold and 86% of it lies within a potential open pit. Preliminary metallurgy suggests high gold recoveries (95%) and even when the minimum economic cut-off grade is increased to 0.9 g/t gold, 87% of the resource still falls above the cut-off grade.

Drilling to date at the Kenge, Porcupine, Tumbili, and Konokono targets indicates that the resource can be easily expanded along strike as well as to depth. So far, Helio has only sufficiently drilled 4 of 30 mineralized targets on its SMP project to date to produce its current resource. Based on the results to date, I expect the company to continue to expand its resource base and table a positive preliminary economic assessment later this year.

As an extra kicker, Helio has potentially made a significant discovery at its Gold Kop target in Namibia. This could add extra value as Helio works to define a resource there. Helio has $3.5 million in the bank and a market capitalization of $28.6 million.

Thomas Schuster, Analyst Bio

With a degree in Geological Sciences from the University of Toronto, Thomas started his career in the 1990s as an exploration geologist in the famous Timmins mining camp in Northern Ontario. He then moved to Vancouver and took a position as staff Journalist at the well-known mining publication, The Northern Miner, reporting the merits and shortcomings of Canadian exploration and mining projects worldwide. This built a foundation for his later work as a Mining Analyst for the Toronto-based institutional investment firm, Fraser Mackenzie. Thomas is currently based in Vancouver working as an independent mining analyst.

Disclosure: No positions at time of writing.

Helio is a client of Dig Media. Dig Media was paid a fee for the creation and dissemination of this commentary.

Read Helio’s most recent press releases:

2012 Drill Program Commences at Helio’s Damara Gold Project

Measured and Indicated Ounces Increase by 104% at Helio’s SMP Gold Project