Drill Tracker Weekly: Nevsun Makes New VMS Discovery 20 Kilometers from Bisha Mine

Nevsun Resources announced a new VMS discovery 20 kilometers to the southwest of its operating Bisha mine in Eritrea. The new discovery is part of a follow-up program based on geological mapping and sampling, as well as airborne and ground EM surveys carried out in 2014.

Drill Tracker Weekly is not exclusive to Resource Investing News and is published with permission from Mackie Research Capital Corporation. It highlights drilling results in context with our database of over 10,000 drilling and trenching results. The purpose of this report is to highlight drilling and trenching results that stand out from the pack and compare them to their peer group. This report does not constitute initiation of coverage or a recommendation.

Nevsun Resources (TSX:NSU)

Price: $4.85

Market cap: $965 million

Working capital: $517 million

Project: Bisha/Asheli

Country: Eritrea

Ownership: 60 percent

Resources: New Brownfields Discovery

Project status: Brownfields Exploration

- Nevsun Resources announced a new Volcanogenic Massive Sulphide (VMS) discovery 20 kilometres to the southwest of its operating Bisha Mine in Eritrea. The new discovery is part of a follow up programme based on geological mapping and sampling, as well as airborne and ground EM surveys carried out in 2014.

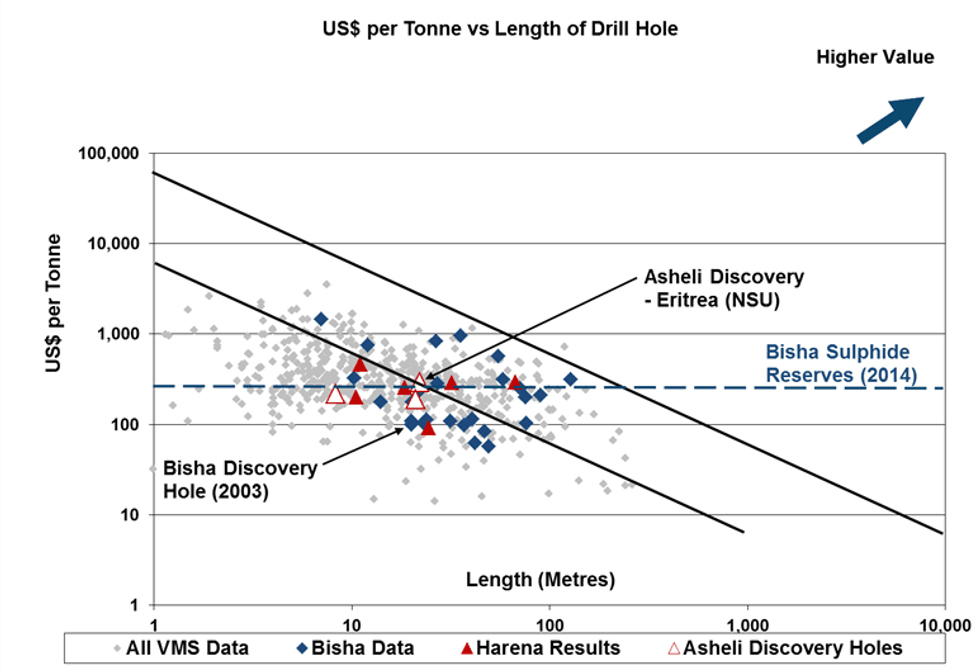

- The new Asheli discovery holes were drilled beneath shallow historic holes that failed to intersect sulphide mineralization beneath a gold bearing gosson. Highlights include the discovery hole MX-044 which intersected 9.30 metres grading 1.44% Cu, 4.00% Zn, 0.37 g/t Au, 27 g/t Ag starting at 202 metres. Additional assays from this section are pending.

- Step out drilling 100 metres to the northwest returned 20.90 metres grading 1.26% Cu, 6.08% Zn, 0.28 g/t Au and 26 g/t Ag starting at 142 metres depth. An additional hole on the same section intersected 22.90 metres of 2.29% Cu, 4.50 % Zn, 0.45 g/t Au and 37 g/t Ag from 242 metres. Step out drilling at 100 metre spacing is being guided by the TEM geophysical survey.

- With the discovery of a fourth significant massive sulphide occurrence on the Bisha property, the region is clearly developing into a district scale exploration camp. On top of the new discovery at Asheli, there are now three satellite deposits to the Bisha Mine with 43-101 resource in the Bisha area including the Harena, Northwest, Hambok deposits. The Drill Tracker Chart plots the 2003 Bisha discovery as a reference point for an early stage discovery hole.

- The Company is well positioned with over $500 million in working capital and strong cash flow from the current copper dominated operation. As the mine continues deeper, Bisha will become a significant zinc producer starting in 2016.

Exploration and Development History: Nevsun discovers Bisha in 2003 – 20 meters at 1.31 percent copper, 0.55 percent lead, 0.60 g/t silver

Historic drilling at Asheli intersects low grade oxide gold

Discovery Hole Asheli (June 2015): 8.30 meters at .144 percent copper, 4.00 percent zinc, 0.37 g/t gold, 27 g/t silver;

22.9 meters at 2.29 percent copper, 4.50 at zinc, 0.45 g/t gold, 37 g/t silver;

20.9 meters at 1.26 percent copper, 6.08 percent zinc, 0.28 g/t gold, 26 g/t silver

Risk Analysis

Data contained in DRILL TRACKER WEEKLY is based on early stage exploration activity. The results are obtained at the very early stages of exploration and therefore, individual results may not be reproducible with additional trenching or drilling, nor may the results ultimately lead to the discovery of an economic deposit. Delineation of a resource body requires an extensive data gathering exercise according to guidelines set out in National Instrument 43-101 before investors can be reliably assured of a competent body of mineralization that may be of economic interest. DRILL TRACKER WEEKLY is designed to highlight individual trench or drill results, which stand out as being materially anomalous and are particularly worth of note – a type of early warning flag for a particular property that warrants further attention. Hence, DRILL TRACKER WEEKLY does not provide a recommendation to buy, sell or hold a specific equity – it is an information reference source to help quantify the meaning and relevance of early stage exploration results.

Relevant Disclosures Applicable to: Drill Tracker Weekly

The research analyst or a member of the research analyst’s household owns and/or has options to acquire shares of the subject issuer. At the date of this release the author, Wayne Hewgill, owns shares in the following companies in this report: Fission Uranium Corporation (TSX:FCU)

Analyst Certification

I, Wayne Hewgill certify that the information in this report is sourced through public documents that are believed to be reliable but accuracy and completeness as represented in this report cannot be guaranteed. The author has not received payment from any of the companies covered in this report. This report makes no recommendations to buy, sell or hold. Each analyst of Mackie Research Capital Corporation whose name appears in this report hereby certifies that (i) the recommendations and opinions expressed in this research report accurately reflect the analyst’s personal views and (ii) no part of the research analyst’s compensation was or will be directly or indirectly related to the specific conclusions or recommendations expressed in this research report.