Copper North Mining Doubles Mineral Resources at Carmacks

This Monday, Copper North Mining released an updated and increased resource estimate for its Carmacks copper-gold-silver project in Canada’s Yukon. Overall, mineral resources at the project have roughly doubled.

This Monday, Copper North Mining (TSXV:COL) released an updated and increased resource estimate for its Carmacks copper-gold–silver project in Canada’s Yukon.

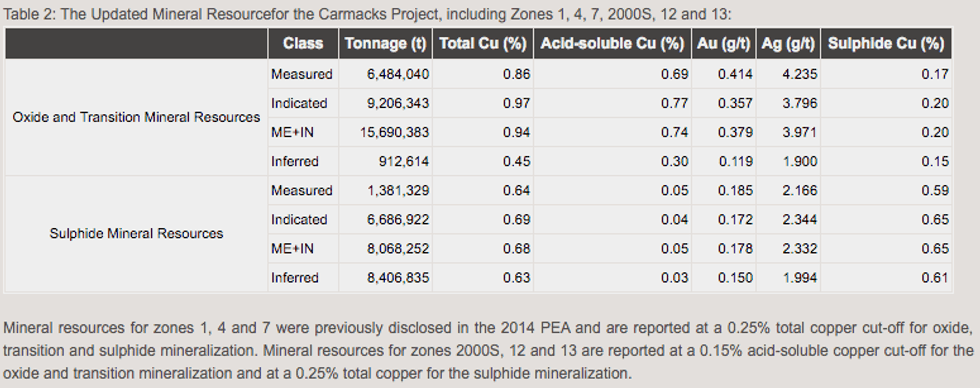

Breaking it down, measured and indicated resources now stand at 15.7 million tonnes grading 0.94 percent copper in oxide and transition resources, and at 0.9 million tonnes grading 0.45 percent copper in inferred resources.

For sulphide mineralization at the project, measured and indicated resources came in at 8.1 million tonnes grading 0.68 percent copper, with inferred resources of 8.4 million tonnes grading 0.63 percent copper. Here’s a closer look at the results of the updated estimate:

And here’s a breakdown of how the new resource compares to the maiden mineral resource estimate for Carmacks:

- 31% increase in measured and indicated oxide and transition mineral resources

- Tenfold increase in inferred oxide and transition mineral resources

- 86% increase in measured and indicated sulphide mineral resources

- 108% increase in inferred sulphide mineral resources

The Investing News Network reached out to Copper North President and CEO, Dr. Harlan Meade, for more insight into those results. Meade mentioned that the mineral resource estimate for Carmacks has roughly doubled.

“The expansion of the mineral resources of both oxide and sulphide indicates that the resource potential is much larger than previously thought,” he said. “Historically the 7 year mine life for mining of zones 1, 4 and 7 was seen as being too small and therefore an impediment to project financing. With the new oxide resources, the mining and leaching of zones 2000s, 12 and 13 zones provide the potential to expand mine life.”

That news itself is exciting news for the company, but beyond that, Meade added that the large increase in sulphide mineral resources, “warrants consideration for processing of sulphide mineralization as mining of oxides continues.”

To be sure, exploration work at the deposit so far has exceeded Meade’s expectations.

“At the time of commencing drillings we were uncertain as to the continuity of the mineralized zones and grades of both oxide and sulphides,” he explained. However, assay results for the first series of drill holes at the 2000s zone returned higher than expected grades, supporting drilling at Zones 12 and 13.

More specifically, mineralized structures at the property were thicker than expected, and as such, Copper North will continue testing the sulphide zones down dip of the near surface sulphide mineralization.

So far, Meade has found that shareholders are pleased with the results of the study, and with the company’s ingenuity. “We have received very positive ‘great news’ response,” he explained. “Most people we are talked to are surprised that we could double our overall mineral resource with such a modest expenditure of about $800,000.

Moving forward, Copper North will look to complete a preliminary economic assessment for the project (PEA). “We need to raise approximately $250,000 to complete the PEA and then we will seek to raise approximately $800,000 to complete the Prefeasibility necessary for project financing,” Meade said. Once it is commenced, he expects the PEA to take roughly two months to complete, with the prefeasibility taking another six months.

Weak copper prices and the current market environment have made it exceedingly difficult for junior mining companies. But Meade was cautiously optimistic about the state of things.

“I believe that the testing of the dip of copper price beneath US$2.00 per pound during the past few days and recovery of copper back to $US$2.05 may signal the bottom for this cycle,” he stated. However, he also hastened to add, “although this seems to be a positive, we will need to wait for much of the year for copper to break out above a range of $2.00 to $2.20 per pound. “

At those prices, Meade expects to see more mine closures, which he believes could lead to a “modest rally” for copper prices in the second half of 2016. In any case, that isn’t out of line with what analysts are saying. Stefan Ioannou of Haywood Securities, for example, has pointed out that at $2 copper prices, roughly 20 percent of the world’s copper production is no longer economic on a C1 cash cost basis.

In any case, Meade is positive on the future of Carmacks. “All work we have done points to very positive economics, even at $2.00 per pound copper,” he said. “We are therefore confident that we will be able to timely raise the needed funds to complete the necessary work.”

Securities Disclosure: I, Teresa Matich, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

Copper North Mining is a client of the Investing News Network. This article is part of the company’s advertising campaign.

Related reading:

Copper North CEO Harlan Meade on the Future of the Carmacks Project