To help investors understand where the company is currently seated in regards to the status of the Land Bill’s trek through Congress and the importance of the Pumpkin Hollow deposit, not only to Nevada Copper but also to the surrounding communities, Copper Investing News recently spoke with Giulio Bonifacio, the company’s president and CEO.

On the open-pit deposit, additional drilling in 2012 increased reserves by 30 percent. The underground deposit has not been drilled since 2010 and further drilling is planned from underground upon completion of the 2,100-foot, production-sized shaft, with commercial production to commence in early 2016.

However, despite the project’s vast upside potential, low risk profile and with permitting secured and construction started for Stage 1 of the operations, Nevada Copper has been sitting on the sidelines for some time, actively awaiting one very important piece of legislation: the Land Bill.

For the company, obtaining the Land Bill is vital for ensuring an accelerated permitting path for Stage 2 of the project’s development. To help investors understand where the company is currently seated in regards to the status of the Land Bill’s trek through Congress and the importance of the Pumpkin Hollow deposit, not only to Nevada Copper but also to the surrounding communities, Copper Investing News (CIN) recently spoke with Giulio Bonifacio, the company’s president and CEO.

CIN: According to a January press release, there are three final stages for passage by Congress before the long-awaited Land Bill gets signed into law by the president. Barring no setbacks, when do you think the Bill will be passed and what will be the company’s next steps?

GB: While it is difficult to predict when the land bill will actually be passed, Nevada Copper does expect some official action in April or May on the Bill, absent some national or international crisis. The Bill has already been passed out of the relevant subcommittees of the House and Senate and is ready for a vote of the floor of the Senate. The House version of the Bill is also being readied for a floor vote and our representatives in Washington are working to ensure that no objectionable language gets attached to this version of the Bill prior the vote.

CIN: Understandably the Land Bill is of vital importance to the company, but can you talk about how it will also benefit the state of Nevada?

GB: The Land Bill will benefit both local and state entities. With a $900 million initial capital outlay, Stage 2 of the Pumpkin Hollow development is three times the size of Stage 1 and will be one of the largest construction projects in Nevada. It will employ 300-600 construction workers depending on the stage in the construction schedule.

Of primary importance to the City of Yerington is that it will receive significant share of property and minerals taxes that it would not otherwise receive if the land bill is not passed. Passage of the land bill is necessary for the City to be able to acquire and annex the lands into its jurisdiction. This makes the City a key, vested stakeholder in the land transfer and the success of the project.

The project will also generate tens of millions of dollars in net proceeds of minerals taxes and sales taxes. Once operating, the 900+ person, net increase in the workforce from Stage 1 to Stage 2 will generate huge benefits to the entire state of Nevada. Also, Nevada Copper is presently utilizing over 90 Nevada vendors and service suppliers. Stage 2 construction and operations will both increase the number of vendors and amount of expenditures to have a very broad-based impact on business in Nevada

CIN: On a similar note, how will Pumpkin Hollow benefit the local community? I understand you’ve been good about keeping in contact with community leaders.

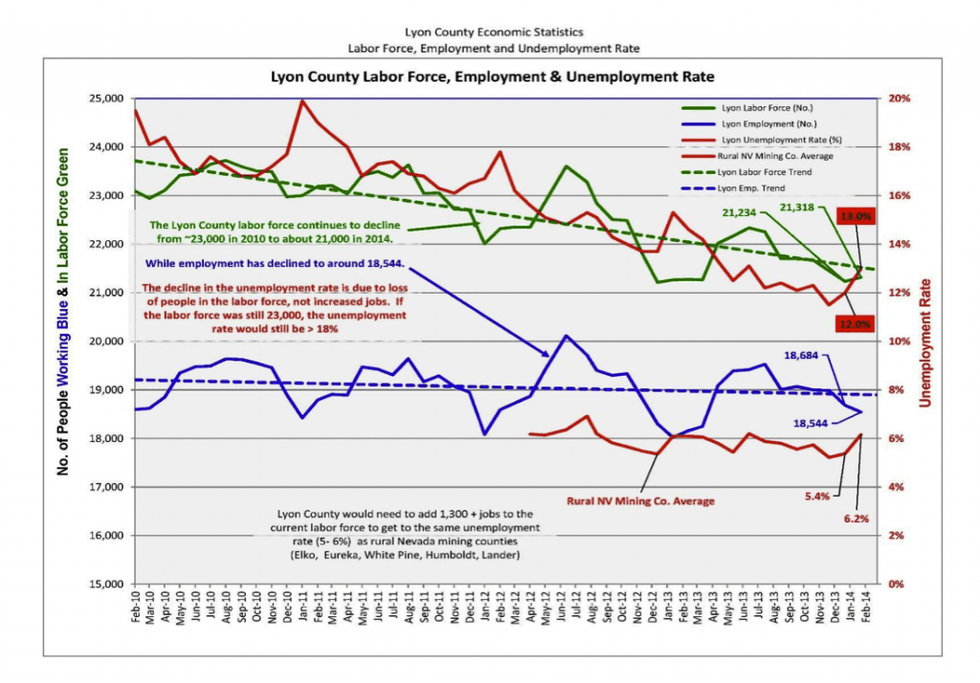

GB: With a projected payroll of ~$40-45 million annually, the project’s benefit to the local economy is huge, representing about 30 to 40 percent of the gross domestic product in Lyon County, and even more in the local Yerington economy. Though we have done no in-depth studies, we estimate that the Nevada Copper payroll will probably represent 50 to 60 percent of the private sector payroll in Yerington and Mason Valley.

With regard to impact on unemployment it could reduce unemployment by half in Lyon County (see Figure 1).

Figure 1

CIN: Nevada Copper’s tagline for the Pumpkin Hollow is: One Project-Two Mines. Can you explain a little bit about the company’s two-stage mining plans for the project?

GB: Stage 1 is an underground mine project. Stage 2 is the open pit. Each of these could be stand-alone projects if they were in different locations – 20 miles or even 1,000 miles apart. However, they are in the same location, separated by only 2 miles. The fact that they are that close means that once fully developed they can be integrated into “one project.” That includes infrastructure – electrical power, water, access roads, sewer, and general administrative facilities – and the workforce. Overall management can be integrated into one management organization in the same location.

Since they are two mines that can be developed independent of each other, it has given Nevada Copper huge advantages to develop each of them independently. The company does not have the entire project held hostage by political, permitting (or “licensing”) or other external time delays. Stage 1 is also located entirely on private land that has indeed facilitated development under the more streamlined and timely Nevada state permitting process. Stage 1 is permitted and under construction. There are many, many other projects around the world that are often unable to start any development on any portion of the project because of the noted factor.

Also, as part of the Land Bill, additional lands not needed for mining will most likely be utilized by project vendors to set up support operations. One large equipment supplier has advised that once the Land Bill is passed they would likely set up a major maintenance facility on land made available by the bill, “outside the gate.” The fact that such a facility would be just outside the gate means that large machinery could be brought to the facility via dedicated, non-public roads that would not require transport on public roads. This is very attractive, as often these types of facilities would be miles away. For example, in Elko and Winnemucca, Nevada, these facilities are in the respective cities, while the mines are 20-50 miles away. Being right outside the “mine gate” is very, very attractive to any of the service and equipment suppliers. It is also very, very attractive to Nevada Copper to reduce transportation time and costs associated with these types of services. By having two mines at one project they also have a greater value proposition for vendors to set up shop near the “project”.

From the above perspective, Pumpkin Hollow is one of the most attractive locations of any mine project in the world. As the old saying goes: location, location, location!

CIN: I also noticed on your project timeline that you plan to begin reclamation and stabilization at Pumpkin Hollow not long after processing starts. Why is it important to start that process early?

GB: Concurrent reclamation has multiple benefits:

- Nevada requires that all disturbances be bonded – a financial assurance must be posted in the amount equal to the outstanding cost of reclamation and closure. By conducting relation as we go, we can reduce that carried financial burden. The company can also conduct reclamation with its own equipment and workforce by integrating reclamation with operating work schedules. Waiting until the end requires that a larger workforce be retained when there is no production or cash flow to support that.

- Unreclaimed areas, especially tailings, can become operational costs because of wind and water erosion. Many copper mine tailing facilities incur significant annual cost to control that erosion. Reclaiming concurrently permanently stabilizes areas where mining activity has been completed.

- Concurrent reclamation also reduces visual impacts to adjacent lands that often result in community objections and diminishment of reputation in the community. It also helps sustain the positive public image that the company and project have with the local and state community. To date, none of Nevada Copper’s permits have one comment or objection. Maintaining a positive public perception helps us with ongoing acceptance (often referred to as the implied social license to operate) and, in the future, when expansions and modifications to permits are required, we will likely have no or fewer objections to those.

- Reclamation is one part of our mantra to “build our brand and protect our brand”, just as any other company competing in a marketplace would do. That applies to:

- Local community support;

- Regulatory agency respect for the company and its practices;

- Support from local, state and national elected officials (most elected officials want to know about Pumpkin Hollow and want to support us!);

- The financial community who are now subscribing to principles like ISO 14000, Equator Principles and International Finance Corporation’s environmental and community standards; and

- The investment community that seeks to invest in companies with a solid reputation and high level of performance in the social and environmental aspects of mine projects because they prevent interruptions and delays in project execution.

CIN: So overall, how does Nevada rank as far as mining-friendly jurisdictions are concerned?

GB: The Fraser Institute in Canada ranked Nevada as one of the most mining-friendly jurisdictions in the world:

The fundamental reason Nevada is not ranked higher is “regulatory uncertainty” and regulatory duplication and uncertainties. The primary reason for uncertainty, inconsistency and duplication is the federal permitting process. Those are eliminated or reduced at Pumpkin Hollow for two reasons: 1) Stage 1 is located on private land, do not require federal permits and the permits have been received and 2) passage of the land bill would remove the requirement for federal permits for Stage 2. If Pumpkin Hollow were to be ranked per the Fraser Institute criteria, it would likely be ranked in the top two or three.

CIN: Since acquiring the Pumpkin Hollow project in 2005 NCU has consistently hit milestones, but share performance has been mixed. Outside the “global market” are there any reasons for the large fluctuations investors should be aware of?

GB: In the base metals sector, junior mining companies have been suffering due to general market conditions. In addition to this, a major institutional shareholder losing their mandate, and the manager subsequently being terminated, the fund was forced to liquidate its 19.5-percent shareholding. The selling pressure caused by the liquidation has now passed and may very well prove to be an excellent buying opportunity for new shareholders.

Nevada Copper, as a development story, has also been subjected to market angst about project and funding execution risks due to other high profile capital cost “blow-outs,” however, Nevada Copper’s project is located close to infrastructure and is not subject to those pressures.

CIN: Well let’s hope that the Land Bill comes to pass soon. Thank you for taking the time to give us an update on the company.

GB: Thank you.

Securities Disclosure: I, Vivien Diniz, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: Nevada Copper is a client of the Investing News Network. This article is not paid-for content.

Interviews conducted by the Investing News Network are edited for clarity. The Investing News Network does not guarantee the accuracy or thoroughness of the information reported. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.