The Conversation (0)

Gold And Silver Premiums Rising, But COT Report Doesn't Concur

Nov. 30, 2016 03:00PM PST

Precious Metals InvestingChina is buying all the gold and silver the West is selling. Once again, what we saw in 2013 is happening all over again.

By Albert Sung

After several abysmal weeks of declines in precious metals, I see a renewed physical interest in gold and silver.

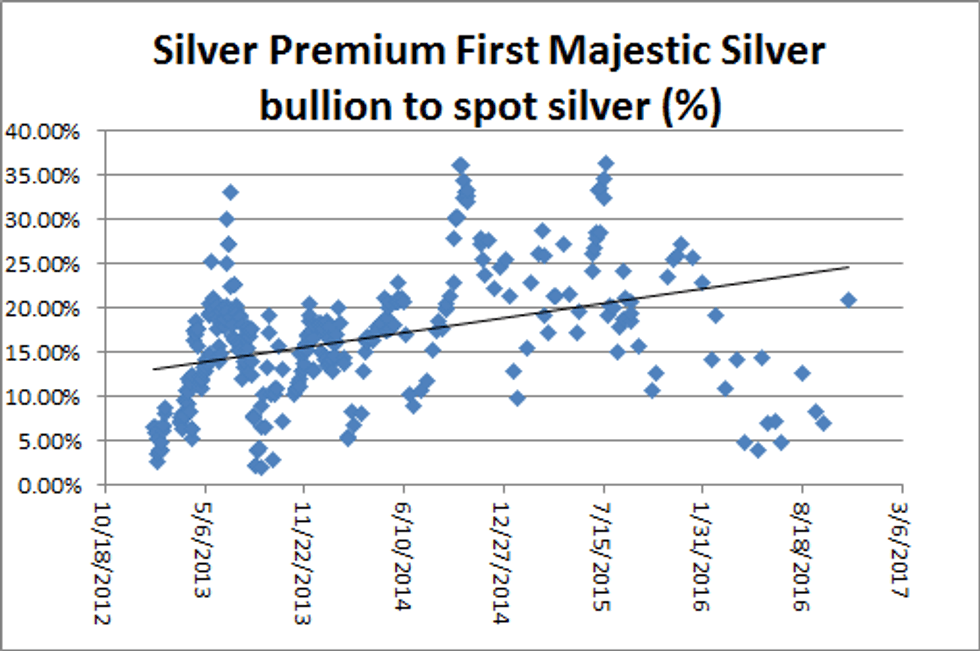

First of all, mining companies keep their physical bullion prices at the same level which leads to high premiums.

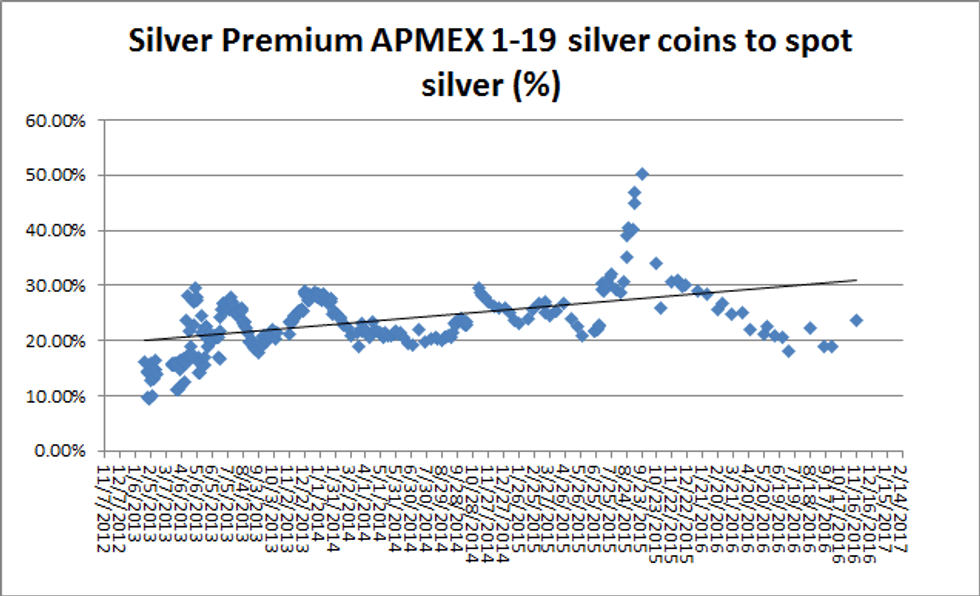

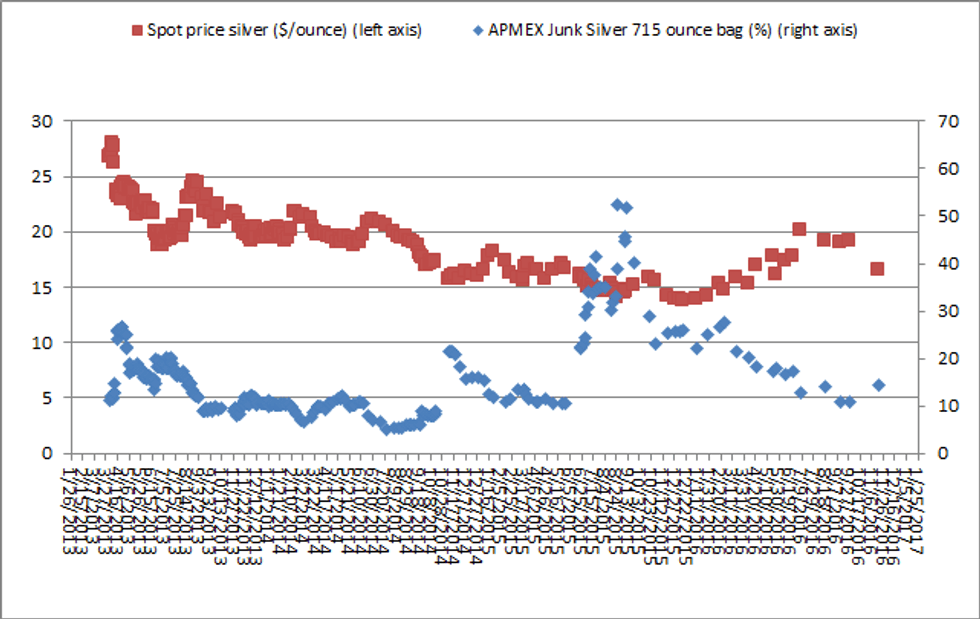

Furthermore, precious metal dealers see a high premium again. Not too shabby, but it’s improving. We will need to give this some time.

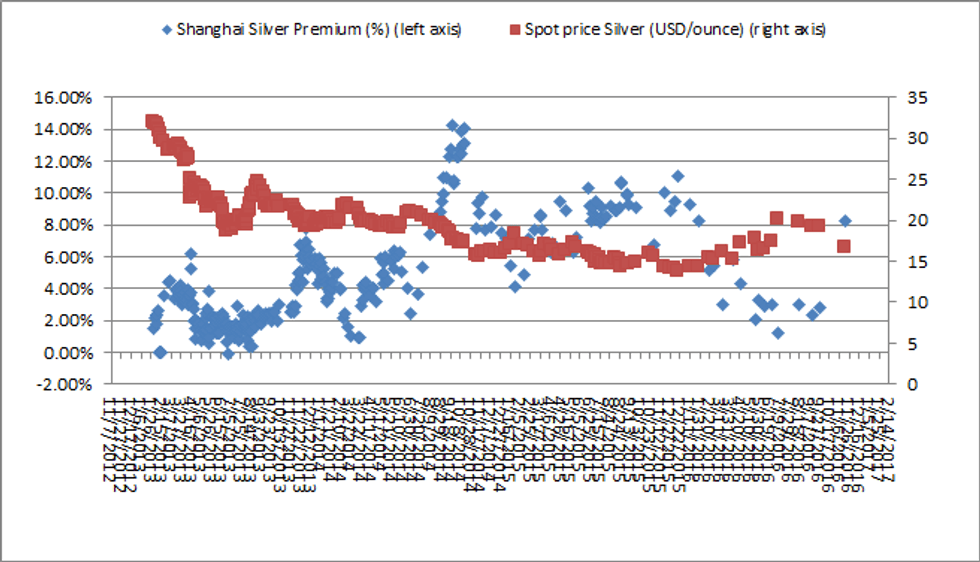

But what is most interesting is that China is buying all the gold and silver the West is selling. Once again, what we saw in 2013 is happening all over again. Shanghai silver premiums have skyrocketed back to 8%, so a bottom is near.

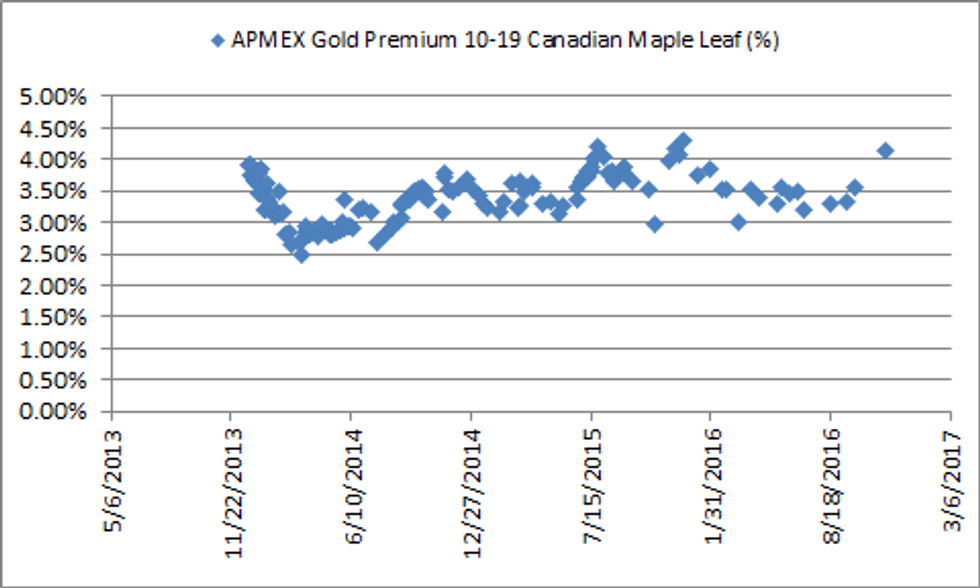

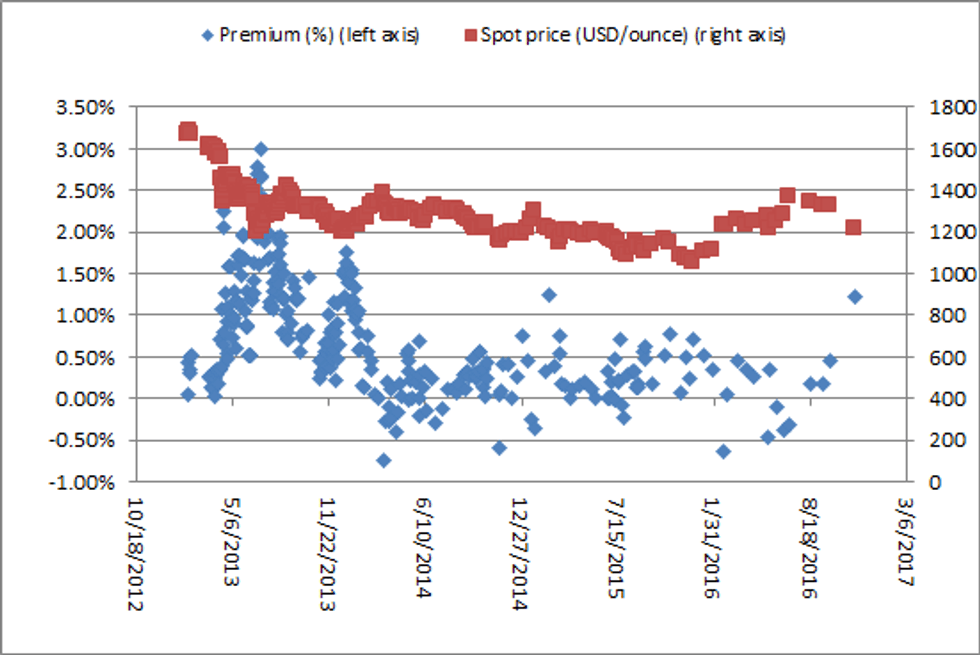

Shanghai gold premiums are moving up very swiftly, indicating that China is bargain hunting.

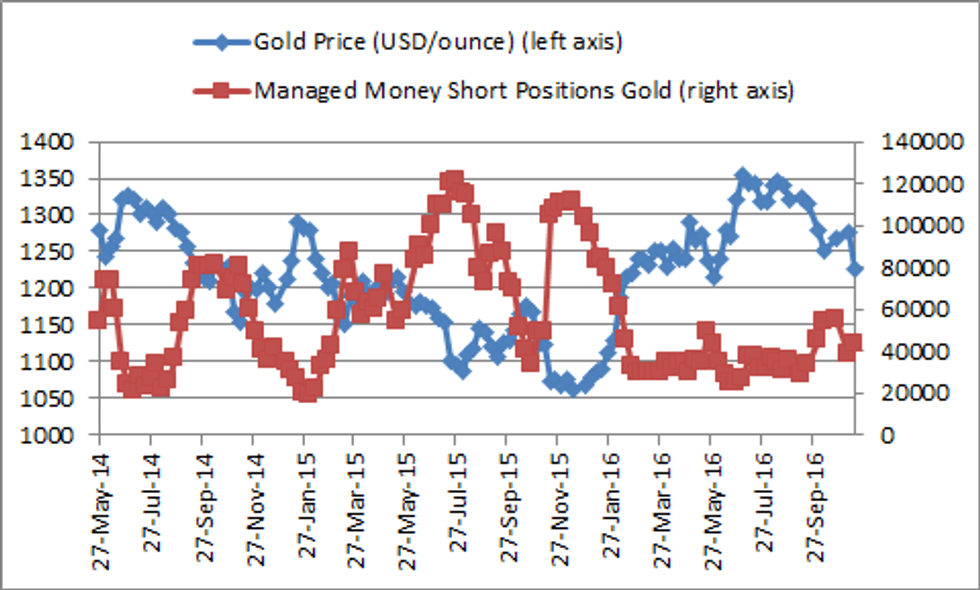

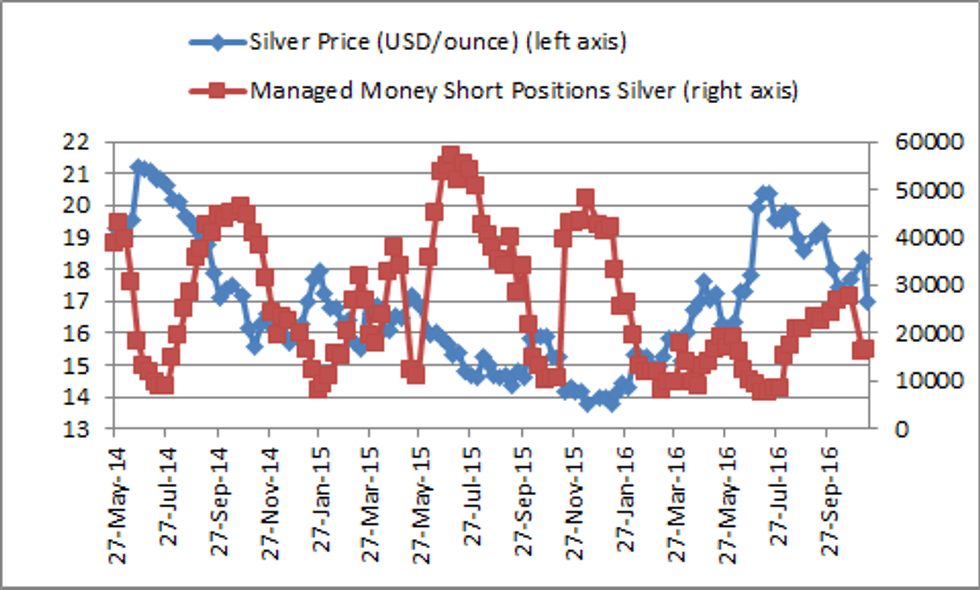

However, the COT report is not looking good at all. Managed money is still very long and a lot of large commercial shorts are still in the market. So weakness in precious metals could persist until the end of the year.

Don’t forget to follow us @INN_Resource for real-time news updates!

About the Contributor:

Albert Sung is the author of Correlation Economics, monitoring breaking economic news on a day to day basis. He started investing in 2008 because of the economic crisis and holds a Master’s Degree in Chemical Engineering. Previously, he worked several years as a process engineer at Ashland, a competitor of Dow Chemical. Today, he works as a regulatory compliance consultant at J&J, but his real passion will stay in macro-economics. His experience in the chemical and pharmaceutical industry allows him to monitor the economy from a process engineering standpoint, analyzing macro-economic charts, correlations and trends.

This article originally appeared on Seeking Alpha on November 19, 2016.

Source: seekingalpha.com