Drill Tracker Weekly: Step-out Drilling at Continental’s Buritica May be Prelude to Resource Update

Infill and step-out drilling at the Veta Sur and Yaragua vein systems at the company’s Buritica project in Colombia continues to intersect high-grade intervals.

Drill Tracker Weekly is not exclusive to Resource Investing News and is published with permission from Mackie Research Capital Corporation. It highlights drilling results in context with our database of over 10,000 drilling and trenching results. The purpose of this report is to highlight drilling and trenching results that stand out from the pack and compare them to their peer group. This report does not constitute initiation of coverage or a recommendation.

Continental Gold (TSX:CNL)

Price: $2.55

Market cap: $328 million

Cash estimate: $42 million

Project: Buritica

Country: Colombia

Ownership: 100 percent

Resources: Measured and Indicated: 8.39 Mt at 10.4 g/t gold, 31 g/t silver

Project status: Revised Resource expected Q2 / 2015 with PEA in Q4/2015

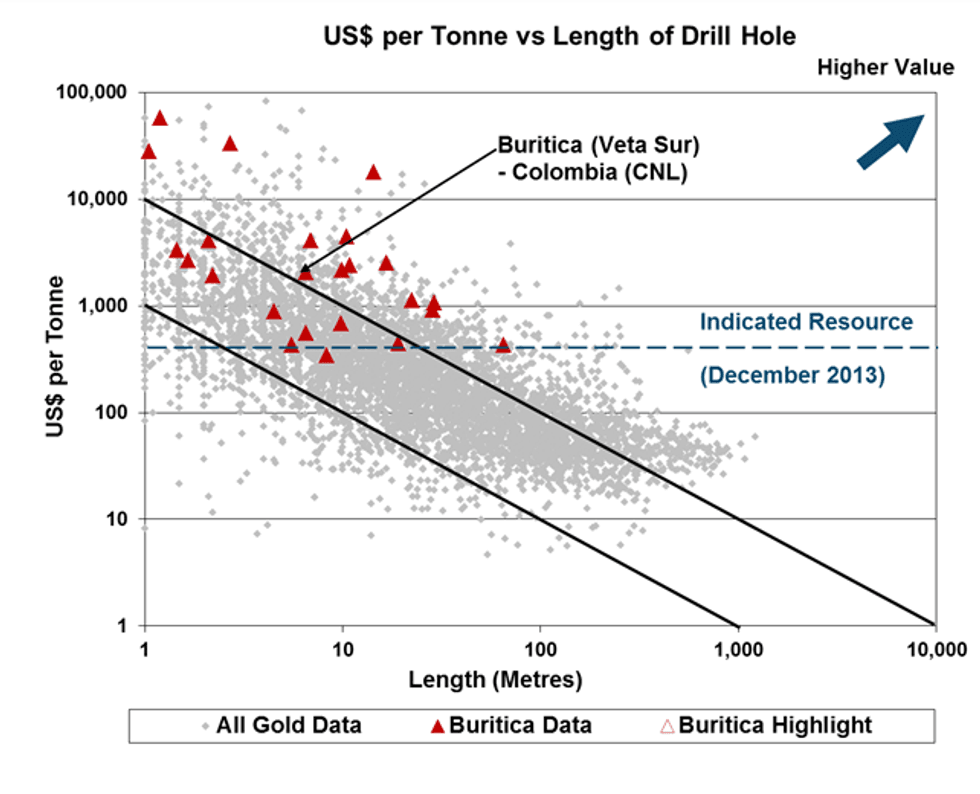

- Infill and step-out drilling on the Veta Sur and Yaragua vein systems on the Company’s 100% owned Buritica Project in Antioquia, Colombia continues to intersect high-grade intervals leading into an updated resource expected in Q2/2015. The Company has completed 285,000 metres of drilling 60,000 metres of which is not included in the current resource estimate December 2013). Since the December 2012 year end, the Company has spent over $127 million advancing the project making it one of the largest global exploration projects.

- Highlights from Veta Sur step-out drilling below and to the east of the existing resource returned high grade values including 5.7 metres of 50.7 g/t Au and 15g/t Ag, as well as 1.3 metres of 178 g/t Au and 109 g/t Ag. The mineralization at Buritica occurs as swarms of narrow sub-parallel carbonate base metal gold/silver veins, with higher grades and often wider zones occurring when a later gold rich phase overprints earlier mineralization. True widths in most holes are reported to be between 50 and 80% of the reported drill interval.

- In May 2014, using a 3 g/t Au cut-off, the Company announced an updated measured and indicated resource estimate at the Buritica deposit totaling 8.39 million tonnes grading 10.4 g/t Au, 31 g/t Ag and 0.5% Zn, with an additional 16.7 million tonnes of inferred grading 7.8 g/t Au, 24 g/t Ag and 0.3% Zn. While calculating the resource, each vein is given a hard geological boundary to prevent smearing the high-grade between vein systems. The total resource is comprised 60% from the Yaragua vein system and 40% from Veta Sur.

- The November 2014 PEA outlined gold production during the first 5 years of 314,000 ounces of gold per annum at an expected cash operating cost of $389 per ounce. The project has an initial capital cost of $737 million with sustaining capital of $346 million over the 18 year life. The vein systems are near vertical and are expected to be mined using long- hole stope method accessed from a development drive situated in the valley bottom. The model predicts an overall average mining dilution of 58% due to the les selective but more cost effected long-hole stopping method. Waste material will be backfilled into mined out stope providing the working platform for the next level.

Development History Small Pre-Spanish historical producer;

Continental Gold acquired the property in 2007. Yaragua Mine in small scale production for 22 years

Current Drilling: 5.7 meters at 50.7 g/t gold, 25 g/t silver; 2.65 meters at 91.2 g/t gold, 42 g/t silver

Risk Analysis

Data contained in DRILL TRACKER WEEKLY is based on early stage exploration activity. The results are obtained at the very early stages of exploration and therefore, individual results may not be reproducible with additional trenching or drilling, nor may the results ultimately lead to the discovery of an economic deposit. Delineation of a resource body requires an extensive data gathering exercise according to guidelines set out in National Instrument 43-101 before investors can be reliably assured of a competent body of mineralization that may be of economic interest. DRILL TRACKER WEEKLY is designed to highlight individual trench or drill results, which stand out as being materially anomalous and are particularly worth of note – a type of early warning flag for a particular property that warrants further attention. Hence, DRILL TRACKER WEEKLY does not provide a recommendation to buy, sell or hold a specific equity – it is an information reference source to help quantify the meaning and relevance of early stage exploration results.

Relevant Disclosures Applicable to: Drill Tracker Weekly

The research analyst or a member of the research analyst’s household owns and/or has options to acquire shares of the subject issuer. At the date of this release the author, Wayne Hewgill, owns shares in the following companies in this report: Fission Uranium Corporation (TSX:FCU)

Analyst Certification

I, Wayne Hewgill certify that the information in this report is sourced through public documents that are believed to be reliable but accuracy and completeness as represented in this report cannot be guaranteed. The author has not received payment from any of the companies covered in this report. This report makes no recommendations to buy, sell or hold. Each analyst of Mackie Research Capital Corporation whose name appears in this report hereby certifies that (i) the recommendations and opinions expressed in this research report accurately reflect the analyst’s personal views and (ii) no part of the research analyst’s compensation was or will be directly or indirectly related to the specific conclusions or recommendations expressed in this research report.