Drill Tracker Weekly: Gold Reach Expands Copper-Moly-Gold Mineralization at Ox Porphyry

Drilling at Gold Reach’s Ox deposit continues to outline near-surface copper-gold-moly porphyry mineralization.

Drill Tracker Weekly is not exclusive to Resource Investing News and is published with permission from Mackie Research Capital Corporation. It highlights drilling results in context with our database of over 10,000 drilling and trenching results. The purpose of this report is to highlight drilling and trenching results that stand out from the pack and compare them to their peer group. This report does not constitute initiation of coverage or a recommendation.

Gold Reach Resources (TSXV:GRV)

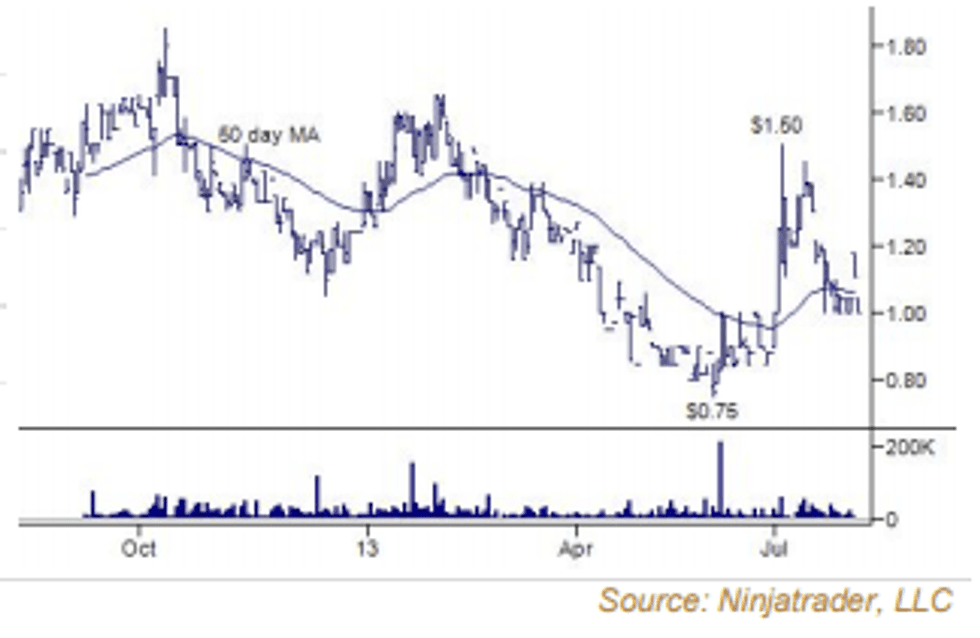

Price: $1.11

Market cap: $35 million

Cash estimate: $2.9 million

Project: Ootsa

Country: Canada

Ownership: 100 percent

Resource: 67.7 Mt @ 0.21% Cu, 0.015% Mo, 0.17 g/t Au indicated; 463 Mt @ 0.17% Cu, 0.1 g/t Au, 0.02% Mo, 1.87 g/t Ag inferred

Project status: Advanced exploration

Catalysts: Additional drilling — resource update

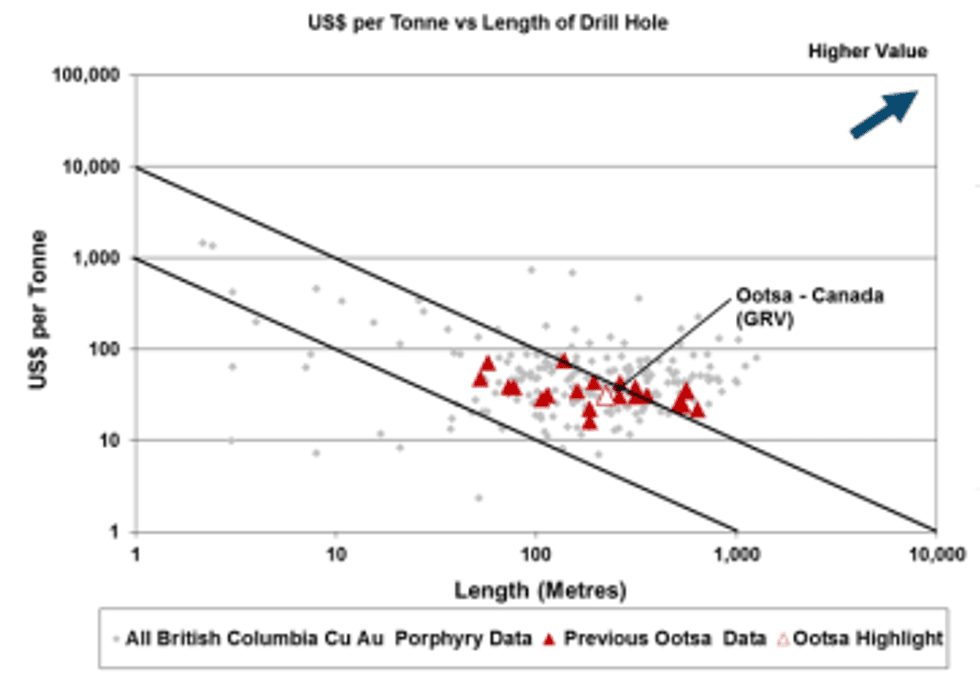

- Drilling on the Ox deposit four kilometres to the north-northeast of the Company’s West Seel deposit continues to outline near-surface copper-gold-molybdenum porphyry mineralization.

- Hole Ox13-78 intersected 225.6 metres grading 0.30% Cu, 0.032% Mo, 0.05 g/t Au, and 1.73 g/t Ag (0.48% Cu equivalent) starting at a depth of 8.7 metres. An additional hole (Ox13-77) starting at a depth of 14 metres intersected 148.2 metres of 0.35% Cu, 0.033% Mo, 0.07 g/t Au and 1.82 g/t Ag (0.55% Cu equivalent).

- The Ootsa Project, while typical of many low grade British Columbia porphyry deposits, has some advantages over many current development projects. The key issue is the number of holes that are very near surface thus creating a situation that may provide opportunities for a low-strip, near surface starter pit that could potentially reduce the up-front capital cost of the project (Note: no economic studies have been completed by the Company). The second advantage is the higher than average grade of potential by-product molybdenum.

- The Company has outlined a total indicated resource of 67.7 million tonnes grading 0.21% Cu, 0.015% Mo, and 0.17 g/t Au with an additional 463 million tonnes of inferred resource at 0.17% Cu, 0.10 g/t Au and 0.02% Mo (0.2% CuEq cut-off).

DISCLOSURES

This report was prepared by Wayne Hewgill, Analyst. At the date of release of this report Wayne Hewgill owned no shares of the issuers contained in this report.

Tempest Capital Corp. does not have formal coverage on the highlighted issuers in this report and the information within this report is for information purposes only.

Any and all reports or studies by a third-party expert consulted in preparing this report have been cited in this report.

To the extent reasonably practicable, research will be disseminated contemporaneously to all of Tempest Capital Corp. clients and potential clients who have requested and are entitled to receive Tempest Capital Corp.’s research.

The information contained in this report has been drawn from sources believed to be reliable but its accuracy or completeness is not guaranteed, nor in providing it does Tempest Capital Corp. assume any responsibility or liability. Tempest Capital Corp., its directors, officers and other employees may, from time to time, have positions in the securities mentioned herein. Contents of this report cannot be reproduced in whole or in part without the express permission of Tempest Capital Corp.

This report is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities.