Overview

Driven by increasing demand from the electric vehicle industry, the outlook for lithium is promising and forecasts are showing no signs of slowing down. On top of this rising demand, the US government has also deemed lithium a “critical material” and released a National Blueprint that outlines a goal to secure access to raw materials for lithium batteries and establish a program to increase domestic processing and production.

As the push to develop a domestic supply chain for lithium batteries in the US gets underway, one region in the country stands out among the rest. Nevada’s Clayton Valley is home to the only operating lithium brine mine in the US –– Albemarle’s (NYSE:ALB) Silver Peak Lithium Mine, which has produced lithium for more than 60 years. Nevada is ranked the top mining jurisdiction in the world based on investment attractiveness in 2020. Of note, Albemarle has indicated it is planning on doubling its Silver Peak’s lithium production by 2025.

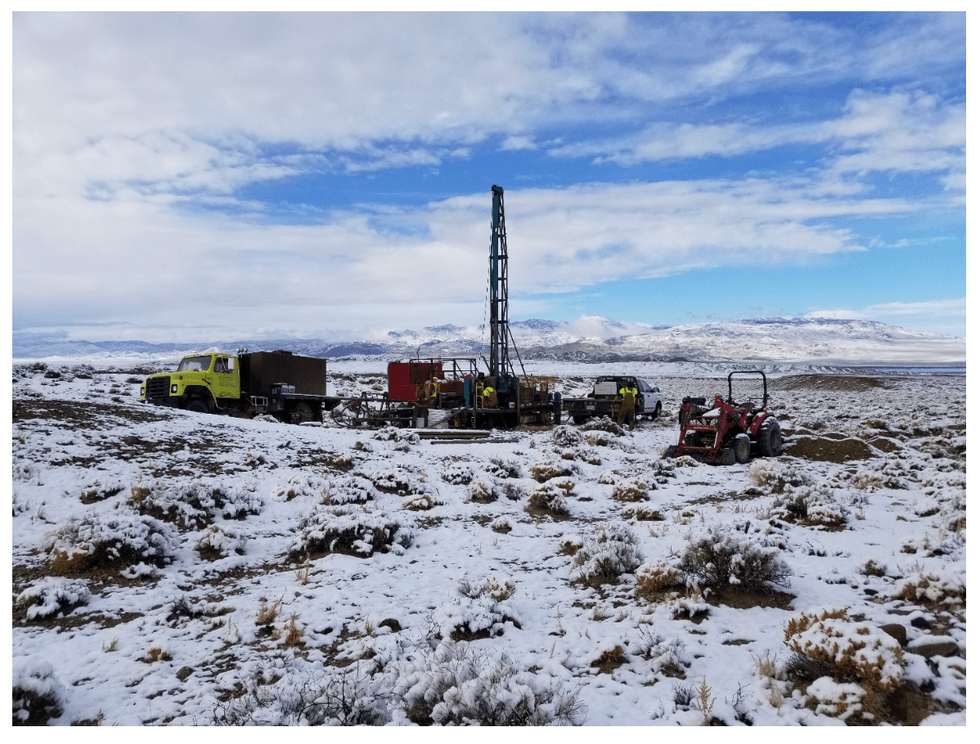

One company focused on a lithium project in Clayton Valley, Nevada, is Noram Lithium (TSXV:NRM; OTCQB:NRVTF; FRA:N7R). Its flagship Zeus Lithium Project is a high-grade lithium asset that spans 2,800 acres, located adjacent to Albemarle’s Silver Peak Lithium Mine, with extensive infrastructure including power at site and a paved highway directly to the project. It is also in the same state as Tesla’s (NASDAQ:TSLA) first gigafactory.

A preliminary economic assessment (PEA) on the Zeus Lithium Project showed robust economics using a price forecast of US$9,500/t LCE indicating a US$1.299 billion after-tax NPV at eight percent with a 31 percent after-tax IRR, spanning a mine life of 40 years and indicated resources for up to 200 years of operation.

Noram Lithium is fully funded with a strong cash position to advance and de-risk its Zeus project and an aggressive development plan. The company obtained US$14 million in strategic financing from Lithium Royalty Corp. and Waratah Capital Advisors Ltd. The transaction consisted of the purchase of a one percent gross overriding royalty on the company's high-grade Zeus Lithium Project.Company Highlights

- Noram Lithium’s Zeus project has a preliminary economic assessment that indicates robust economics using a price forecast of US$9,500/tonne (t) lithium carbonate equivalent (LCE): a US$1.299 billion after-tax net present value (NPV) at eight percent, a 31 percent internal rate of return (IRR) and a mine life of 40 years.

- 100-percent-owned with a one percent gross overriding royalty

- A significant mineral resource estimate at cut-off grades of 400 parts per million (ppm), including a total, measured and indicated resource of 1.8 million tonnes of lithium carbonate equivalent and a total inferred resource of 3.9 million tonnes of lithium carbonate equivalent

- Zeus features a high-grade and shallow lithium deposit, which may result in a relatively low-cost operation supported by high lithium recoveries and low contamination

- Situated near Albemarle’s Silver Peak, which is the only other US producer of lithium

- Noram’s share structure remains tight with below 89 million shares issued, with approximately 12 percent controlled by management and insiders.

- Noram Lithium closed its US$14 million strategic financing with Lithium Royalty Corp. and Waratah Capital Advisors Ltd.

- Noram's working capital position as of October 31, 2022 was approximately C$15 million, with no debt.

Get access to more exclusive Lithium Investing Stock profiles here