Investor Insight

Pinnacle Silver and Gold presents a compelling investment opportunity in the precious metals sector as it continues to advance its flagship high-grade El Potrero project in Mexico and its Red Lake, Ontario assets. The company’s proven business model focuses on rapidly reactivating past-producing mines to generate early cash flow, while simultaneously exploring for district-scale potential, offering a strong value proposition in a bullish gold-silver environment.

Overview

Pinnacle Silver and Gold (TSXV:PINN,OTC:PSGCF,Frankfurt:P9J) is a promising player positioned for growth in the precious metals exploration sector, with its strategic focus on high-potential projects, commitment to responsible mining practices, and experienced leadership team.

Focused on

silver and

gold projects in the Americas, Pinnacle is strategically placed to capitalize on the growing demand for these valuable resources. Its core projects include the high-grade El Potrero gold-silver project in Mexico, and the Argosy gold mine and North Birch gold project in Ontario’s Red Lake District – each offering near-term development potential and strong exploration upside.

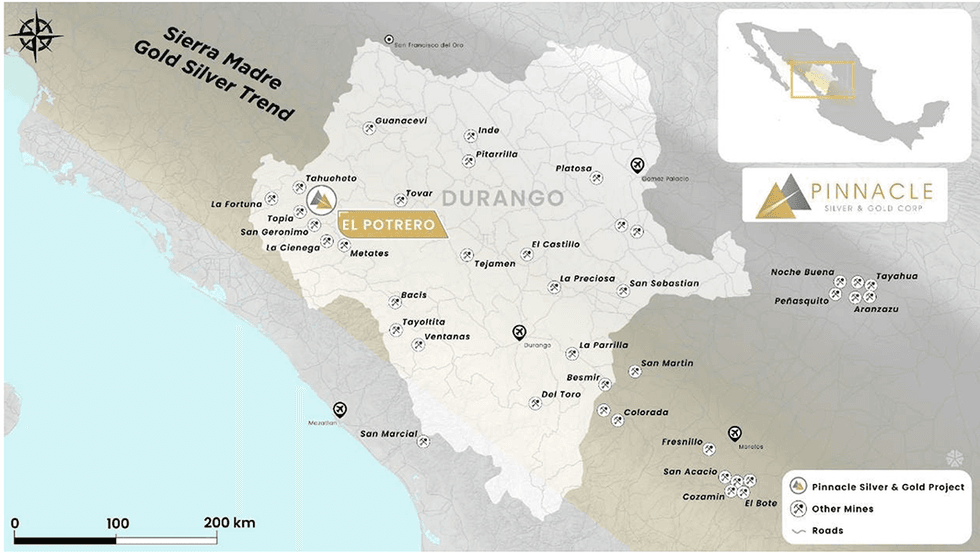

Pinnacle’s current flagship project, El Potrero, is located within the Sierra Madre Gold Silver Trend.

The company's investment appeal stems from several key factors:

- A robust pipeline of projects at various stages of exploration and development

- Strategic focus on high-potential areas in North and South America

- Effective capital management practices

- Aggressive expansion strategy through strategic acquisitions

The company’s business strategy involves the acquisition of past-producing mines that can be put back into production quickly to generate cash flow. By focusing on high-grade, underground mines, Pinnacle can leverage low capex, a smaller operational footprint, easier and faster permitting process and protection against metal price volatility. At the same time, the company conducts brownfield exploration for resource expansion, increasing its potential for district-scale discovery.

Pinnacle's emphasis on creating shareholder value is evident in its approach to project selection and development. The company's portfolio is carefully curated to balance near-term production potential with long-term growth prospects, offering investors exposure to both immediate returns and future upside.

Company Highlights

- Pinnacle Silver and Gold is a Canada-based exploration and development company dedicated to building long-term shareholder value with its silver- and gold-focused assets in North and South America.

- The company’s flagship El Potrero gold-silver project, located in Mexico’s Sierra Madre Belt, has returned exceptional underground sample grades up to 85.1 grams per ton (g/t) gold and 520 g/t silver, with exploration potential across a 1.6 km strike length.

- The 100-percent-owned Argosy gold mine and North Birch project are located in the Red Lake District in Northwestern Ontario, a region famous for gold production and high-grade underground mines.

- The company’s strategy is to generate near-term production from past-producing assets while growing its resource base through modern, brownfields exploration.

- Pinnacle is led by a highly experienced management team with a successful track record in advancing exploration-stage assets through to production.

Key Projects

El Potrero Gold-Silver Project

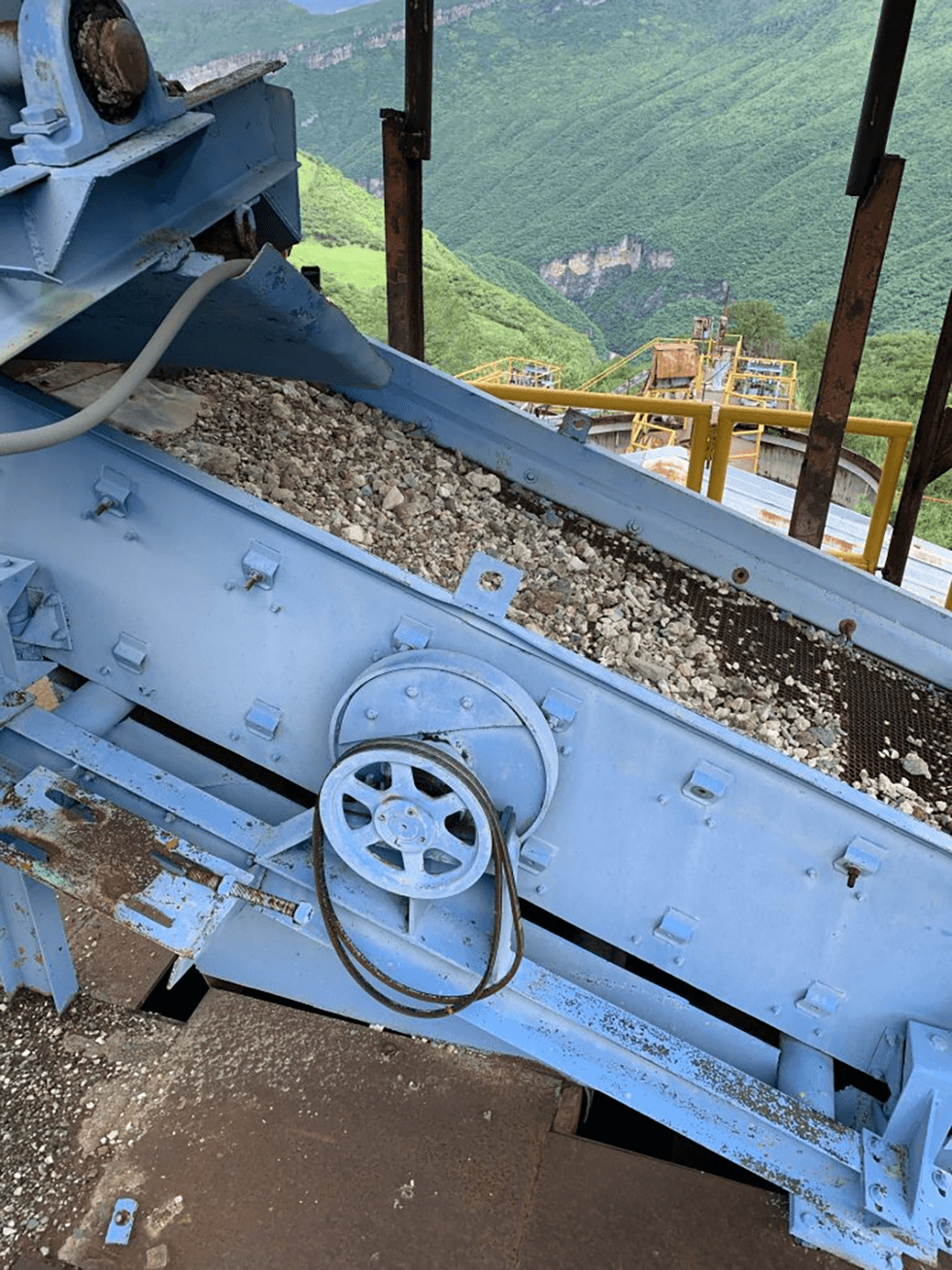

El Potrero is a high-grade, past-producing gold-silver project located in the prolific Sierra Madre Belt in Mexico, within 35 km of four operating mines, including Fresnillo’s 4,000 tpd Ciénega Mine. The project comprises two concession blocks totaling 1,074 hectares, which include the historic mines and a 100 tpd on-site processing plant.

Recent Developments (as of July 2025):

- Over 600 rock samples have been collected from underground and surface sources for geochemical analysis.

- Channel sampling at the Pinos Cuates mine returned assays of up to 85.1 g/t gold and 520 g/t silver over 0.5 m, and composite intervals of 50.3 g/t gold and 269 g/t silver over 1.7 m.

- Geological interpretation highlights a significant quartz-feldspar porphyry dyke as a structural control on gold-silver mineralization.

- The Dos de Mayo vein system has been mapped over 1.6 km with trench and underground samples showing high-grade mineralization, including 13.2 g/t gold and 2,280 g/t silver from surface grab samples.

- Work is underway to design an underground and surface drill program to define continuity and guide future mine development.

- A site inspection of the 100 tpd plant confirmed that the base infrastructure is sound. Refurbishment of key equipment (crusher, mill, Merrill Crowe circuit) is being planned.

- Permitting efforts are progressing efficiently, aided by the site's historical disturbance. Baseline studies and formal permitting proposals are underway.

Pinnacle can earn an initial 50 percent interest upon production and increase its ownership of El Potrero to 100 percent subject to a 2 percent NSR, primarily through cash flow-funded payments, offering a low-dilution path to full ownership.

Argosy Gold Mine

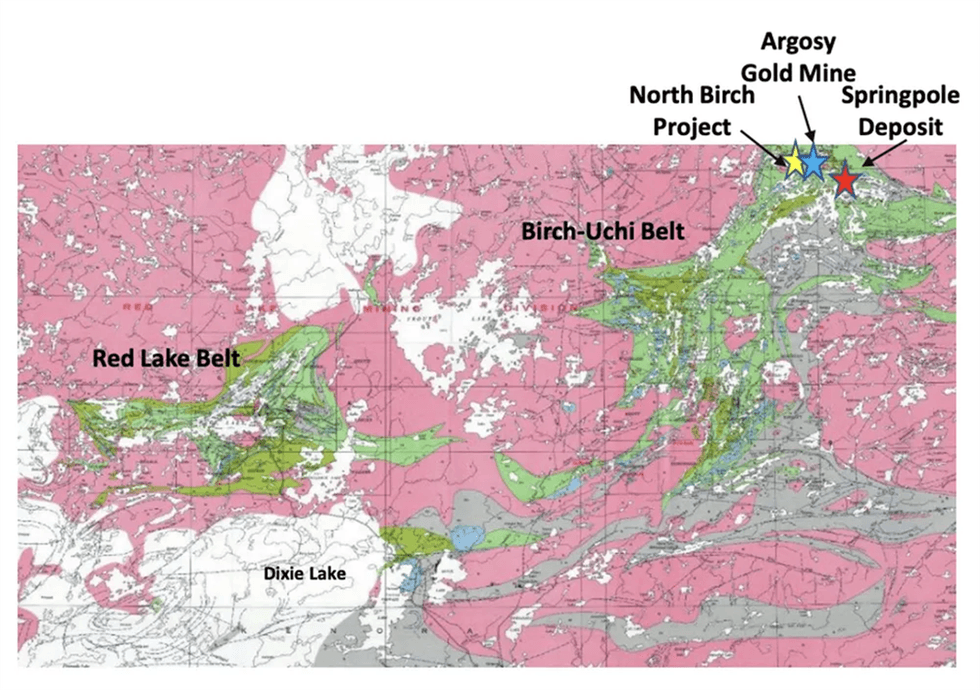

Located within the Birch-Uchi Greenstone Belt in Ontario’s Red Lake District, and approximately 10 km from First Mining’s Springpole deposit, the Argosy gold mine produced 101,875 ounces at 12.7 g/t gold from 1931 to 1952. Pinnacle owns 100 percent of the project, subject to a 2.5 percent NSR.

Exploration Highlights:

- Past drilling intersected high-grade mineralization, including:

- 14.67 g/t gold over 1.7 m (No. 3 Vein)

- 12.02 g/t gold over 1.29 m (No. 8 Vein)

- 11.75 g/t gold over 1.55 m (No. 2 Vein)

- The project offers strong depth potential, with 2002–2004 drilling intersecting multiple new veins and gold mineralization extending to 400 m vertical depth.

North Birch Gold Project

Located 4 km from the Argosy Mine, North Birch is a 3,850-hectare grassroots project with major upside. The property lies in an underexplored section of the Birch-Uchi Belt and covers a folded and sheared iron formation, interpreted as analogous to Newmont’s Musselwhite Mine.

Exploration Work:

- LiDAR surveys and IP geophysics have revealed 8+ km of structural breaks with multiple drill targets.

- 2022 drilling intersected anomalous gold and copper mineralization within structurally deformed and altered iron formations, confirming the favorable structural setting

Management Team

Robert Archer - President, CEO and Director

Robert Archer has more than 40 years’ experience in the mining industry, working throughout the Americas. After spending more than 15 years with major mining companies, Archer held several senior management positions in the junior mining sector and co-founded Great Panther Mining, a mid-tier precious metals producer, where he served as president and CEO from 2004 to 2017 and director until 2020. He joined Pinnacle as a director in March 2018 followed by his appointment as CEO in January 2019 and president in October 2021. Archer is a professional geologist and holds an Honours BSc from Laurentian University in Sudbury, Ontario.

David Cross - CFO

David Cross is a CPA and CGA with over 21 years’ experience in the junior sector with a focus on finance and corporate governance. He is currently a partner of Cross Davis and Company LLP Chartered Professional Accountant, which specializes in accounting and management services for private and publicly listed companies within the mining industry, and has recently been appointed CFO of Ashburton Ventures.

Colin Jones - Independent Director

Colin Jones is principal consultant for Orimco Resource Investment Advisors in Perth, Australia. He has almost 40 years’ experience as a mining, exploration and consulting geologist in a number of different geological environments on all continents. He has managed large exploration and due diligence projects, and has undertaken numerous bankable technical audits, technical valuations, independent expert reports and due diligence studies worldwide, most of which were on behalf of major international resource financing institutions and banks. Jones holds a Bachelor of Science (Earth Sciences) degree from Massey University, NZ.

David Salari - Independent Director

David Salari has worldwide experience in the design, construction and operation of extractive metallurgical plants. He is an engineer with more than 35 years of experience in the mining and mineral processing field. He is currently the president and CEO of DENM Engineering.

Ron Schmitz - Independent Director

Ron Schmitz is the principal and president of ASI Accounting Services, providing administrative, accounting and office services to public and private companies since July 1995. Schmitz has served as a director and/or chief financial officer of various public companies since 1997, and currently holds these positions with various public and private companies.

Carlos Castro Villalobos – Project Manager, El Potrero Gold

Carlos Castro Villalobos holds a degree in Mining Engineering and Mineral Processing (Ingeniero de Minas y Plantas de Beneficio) from the University of Guanajuato and brings over 45 years of experience in the mining industry. He has held senior roles with companies such as Peñoles, Luismin, Great Panther, and First Majestic, ranging from mine superintendent to general manager across multiple operations. Notably, while with Rochester Resources, he oversaw the construction of a 300-tonne-per-day processing plant completed in just seven months—experience that will be particularly valuable at El Potrero.

Jorge Ortega – Qualified Person

Jorge Ortega, P.Geo., is a qualified person as defined under National Instrument 43-101 and the author of the NI 43-101 Technical Report for the Potrero Project. He has reviewed and approved the technical information contained in this news release.